The former president, Donald Trump, is causing a stir in the real estate market. This happened after the end of his trial. Judge Engoron required him to pay over $450 million in fines and interest. However, the decision has some nasty drawbacks.

Significant investors in America are leaving New York after the Judge’s verdict. They complain that the ruling is unfair. It also shows how easily other investors can be accused of fraud, too.

Real Estate Firms Are Leaving New York

It’s normal for Investors to track cases relating to their business. This helps ensure they align with the law and avoid legal issues. That’s why many were invested in Trump’s case, and the verdict didn’t please many.

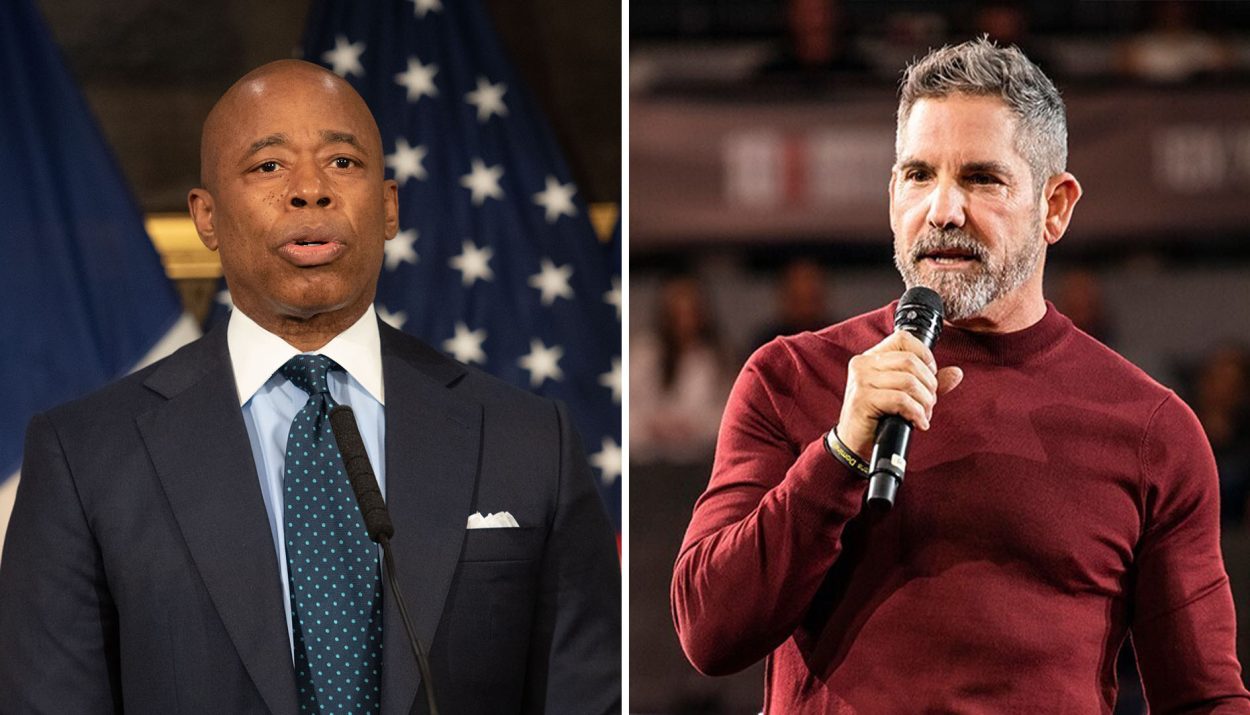

These businesses feared the case was unfair and lacked technicality. It also shows how easily they could be victims of such ‘poor justice’. So, major real estate investors are pulling out of New York. One of these investors is Cardone Capital’s, Grant Cardone.

Grant Cardone Leaves New York

Cardone explains that his firm planned to set up shop in multiple states. These include California, Chicago, and New York. However, the recent verdict on Donald Trump’s case scared him from moving forward with NYC.

The entrepreneur explained how he waited 40 years to invest in New York City. He was confident 2024 was the perfect year, but sadly, the verdict told him otherwise. Once he received the news, he called his team to retreat from NYC.

Grant Cardone Announces On X

Grant Cardone announced on X for his firm to pull out of New York immediately. His tweet: “Dear Cardone Capital team. Immediately discontinue ALL underwriting on New York City real estate. The risks outweigh the opportunities at this time.”

For context, Grant Cardone is an American Private Equity Fund manager ($4BAUM) and founder of 10X Studios. He’s also famous for heading Cardone Ventures and 10X Health System.

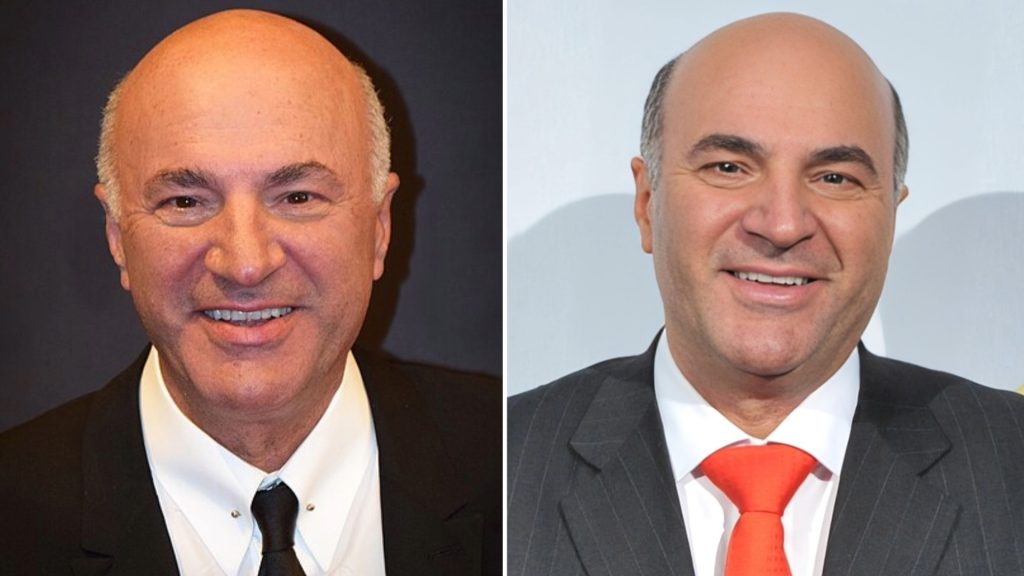

Kevin O’Leary Also Condemned New York

Cardone’s announcement on X went viral quickly. At the same time, many people agreed with his concerns. Even Shark Tank’s Kevin O’Leary commented on the situation. He called New York a “Loser state”, saying that he would never invest there.

O’Leary further emphasized his worry. He points out that Trump’s case shows what could happen to any investor. The rules are flimsy, as he was convicted for using standard industry practices.

Investors Can’t Invest If They Can’t Predict The Cash Flow

Some people online are confused. “Why did Trump’s case cause this much imbalance?” Grant Cardone explains that investors look at multiple factors before investing their money. The ruling and other factors in New York make the state too unpredictable for investment.

It’s worth noting that Cardone’s firm invests in over 14,000 clients who depend on him for cash flow. Since NYC has too many social and legal issues, he can’t predict the cash flow. If he can’t predict the cash flow, it’s too risky to invest.

‘Investors Have Nothing To Worry About” – Gov. Kathy Hochul

Real estate businesses pulling out of New York spells nothing but doom. Property prices will rise, making housing more challenging to secure. So, Gov. Kathy Hochul (D-NY) tries to manage the issue by telling investors they have nothing to worry about.

She explains that the ruling was fair for Donald Trump. He defrauded several banks to get money. So, as long as investors abide by the law and operate the businesses correctly, they have nothing to fear.

Kevin O’Leary Claps Back At Gov. Kathy Hochul

Kevin O’Leary quickly caught wind of Gov. Hochul’s comments and disagreed. He claps back, saying that there are no victims that lost money. The judge made an arbitrary decision that made it hard to put faith in NYC’s legal system.

This comment is based on a common criticism of Judge Engoron’s verdict. People have realized that the statute against Trump should only apply if there’s a victim. Therefore, Judge Engoron possibly made a faulty verdict.

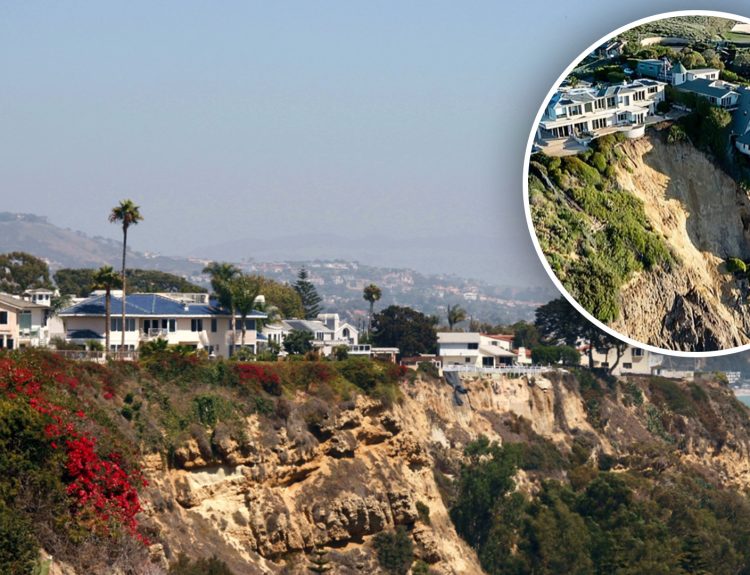

Investors Are Moving To Florida Instead

Real estate firms need a place with favorable laws and conditions to trade assets for their clients properly. One of these places is Florida, and investors are moving their resources there now.

As expected, Cardone is one investor who has moved to Florida. His tweet on X advises his team to “focus on Texas and Florida”. Why? Cardone explains that the risk of doing business in New York outweighs the benefits. So, they’re out!

Cardone Explains Why New York Is Risky

People think these fleeing investors are shady. They don’t want to be discovered by the government. But there’s a deeper reason. Cardone explains that the laws surrounding fraud are unreliable.

He explains that property loans are secured based on the property’s perceived values. Brokers will check the property and give varying opinions on the value. This will also differ from what the property owner believes the building is worth.

Cardone Explains His Point Further

Cardone expands, saying the bank will only take one or two property appraisals. These selected ones will differ from his conclusion. Ultimately, the bank’s value won’t be the same as what he puts on paper as his professional opinion.

Cardone notes that most investors buy properties for cash flow and not to sell immediately. The same applies to Trump, whose assets are to generate cash flow over months. In this case, sellers will always push the property’s value up. It’s based on the future worth, not fraud.

Investors May Have Good Reasons To Be Worried

Investors are wary of New York since it’s now easy for anyone to be accused of fraud. According to Cardone, standard procedures in real estate are now seen as fraudulent. So, it makes sense to pull out quickly.

Cardone and O’Leary condemn New York, saying no one will put big money in the city again. But what do you think? Are their fears valid, or are they merely overreacting?