“Bidenomics” is the Democrat’s messaging service that allows for a catch-all term to refer to the President’s economic policies. It was originally used as a derogatory statement by the conservatives to point to the damaging results of Biden economic policies, but the Democrats have run with it.

Economic Indicators as a Measure of Health

Economic indicators are generally a clear sign of both the nation’s economic health and its future. These are indicators such as unemployment rates, GDP, and rising or lowering wages. These different factors all paint a picture of the stability of an economy and of a nation.

Biden’s administration, when these numbers are looked at, has done surprisingly well considering he came in during the COVID-19 pandemic recovery. Unemployment has been at historic lows for months on end, and GDP is up month after month, and year after year.

Strengthening American Infrastructure

One of the key strategies of Bidenomics has relied on strengthening American infrastructure and industries. A happy side effect of these efforts has been lowering inflation, and allowing for the Fed to stop raising interest rates.

The goal of improving infrastructure is improving the nation’s economic foundation, and increasing America’s competitiveness on the global stage. Some of the investments that have been made towards this goal include investments in roads, bridges, and high-speed internet infrastructure.

Bringing Manufacturing Jobs Home

The administration has also been focusing on bringing manufacturing jobs back home, and fostering more jobs in the clean energy sector. Among other things, these efforts have been aimed at improving unemployment rates and providing well-paying jobs for the long-term stability of the United States economy.

These various investments have emphasized the importance of healthy competition across various sectors. Competition is good for the economy and it’s good for consumers, and Biden has made clear his administration’s determination to reverse the trend of growing monopolies in various sectors.

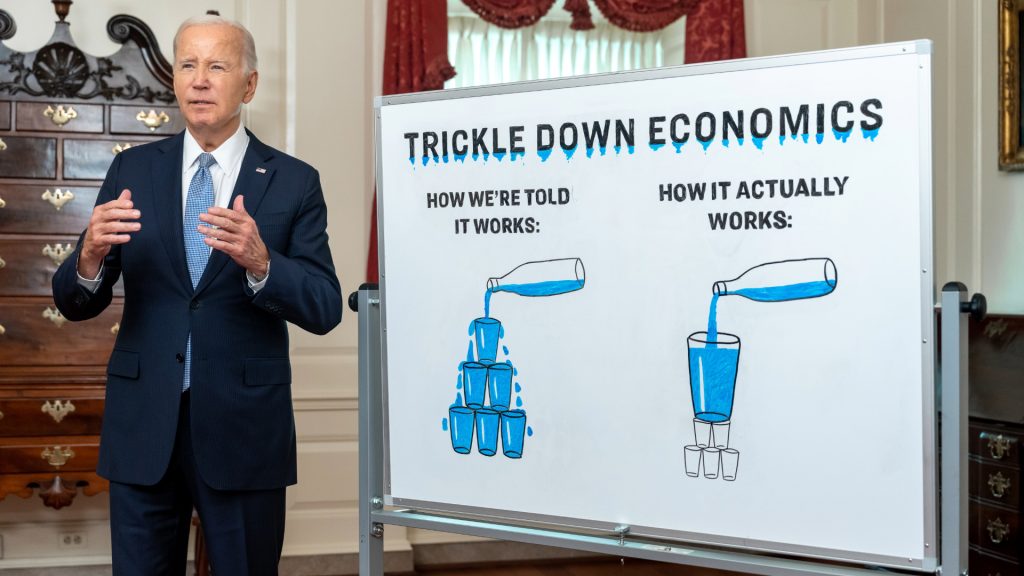

Numbers Are Up…But What Does That Mean?

The numbers behind all of these various factors are positive. Many measurable numbers are up, including GDP and average wages, and the wealth gap between the very richest Americans and the very poorest Americans has even shrunk for the first time in years.

Despite that, there are worrying signs that are predictors of a recession. The inversion of the yield curve, as measured by the Cleveland Fed, has traditionally signaled an impending economic downturn. The yield curve inversion has persisted for more than 470 days, raising concerns about America’s future economic challenges.

Consumer Debt is Rising

Likewise, the Federal Reserve Bank of New York has reported a massive increase in household debt. This increase has been seen across various sectors, including credit card balances, auto loans, and mortgages. This is a stunning indicator of how financially pressured American families are, despite the positive economic numbers.

There has also been a rise in delinquency rates across credit card balances, mortgages, and auto loans. This signals a growing financial distress among consumers. The trend is particularly noticeable among younger borrowers, and suggests a rising burden of debt that could have long-term consequences for the economy.

Savings At A Low

Inflationary pressures have also made their appearance in another significant way. Personal savings for Americans has hit incredibly low levels, which hints at how squeezed most American households are regarding the economy.

And average Americans are not the only ones feeling the squeeze. The federal debt has reached unprecedented levels in America, and the sustainability of many current fiscal policies is under scrutiny. American confidence in the fiscal responsibility of the government is being threatened, which could have catastrophic consequences.

Paying the National Debt

The responsibility of the government to the debt that’s been taking on is increasing, as well. Interest payments for the debt are consuming a significant portion of the federal budget every year, and more than once, the threat of defaulting on the nation’s debt has been brought up to point out the unsustainability of the issue.

These increasing interest payments have also limited the government’s ability to spend on essential services. The budget has increased year after year without an increase in revenue, and the more money that is spent that the government doesn’t have, the higher the burden of interest payments on both the government and the American people.

A Mixed Bag For Bidenomics

All together, Biden’s policies appear to be a mixed bag. On the face of it all, the numbers are great, and the administration has been making significant efforts towards making sure that Americans feel confident in the state of the economy.

Once you dig into the numbers a little bit, though, it becomes clear that things are not all as positive as the administration wants Americans to believe. The debt that both Americans as individuals and America as a country face are quickly growing out of control, and further spending allocations without a significant increase in revenue will do nothing to stem the tide of debt.

Solutions to the Issues

Multiple solutions have been proposed that would address some of the fiscal issues that have become more and more clear over the years. None of these solutions, including raising taxes and cutting social programs, are entirely perfect. They offer a solution to part of the problem, and raise issues in other ways.

Biden and his administration will have to face the issues in the economy sooner or later, though. There is measurable discontent growing in America regarding economic issues, and it’s shaping up to be a significant issue for voters ahead of the 2024 election. “Bidenomics” is a great slogan, as long as it has the policy and the support to back up its intention.