It’s a true moment of financial freedom for homeowners when that last mortgage payment gets made. With the keys to your home fully in hand, you’ve unlocked an asset that can strengthen your finances, particularly in retirement.

While your home’s value may fluctuate, owning it free and clear gives you options. You can sell and downsize, eliminating housing costs. Or you can stay put and invest the money once spent on a mortgage. Homeownership becomes a pillar of stability for Americans fortunate enough to retire mortgage-free.

More Americans Own Their Homes Outright

According to a Bloomberg analysis of U.S. Census Bureau data, the percentage of Americans who own their homes outright jumped 5 percentage points between 2012 and 2022 to nearly 40%.

If homeowners own their properties outright with no mortgage or liens, their homes represent 100% equity. Should they choose to sell, the full price goes directly into their pockets.

Investment Generation from Homes Are Not Like Other Traditional Assets

Homes typically don’t generate investment returns like traditional assets. To become mortgage-free, homeowners likely spent years making payments where the bulk went to interest for the lender.

For example, putting $100,000 down on a $500,000 home with a 15-year mortgage at 2.5% means paying the bank about $80,000 in interest, not including taxes, insurance, and maintenance.

The Financial Benefits of a Mortgage-Free Home

When homeowners pay off their mortgages, they unlock significant financial benefits. Homeowners can cut the money once earmarked for the mortgage and invest it in retirement.

Again, using the $2,500 monthly example, over five years, that’s $150,000 that could be invested. Assuming a 7% return, that $150,000 could grow to $160,500.

Fully Paid Homes Are Built-In Equity

For homeowners nearing or in retirement, their fully paid-off home represents 100% equity. The value of the home, should they sell, is all theirs. Home prices have likely appreciated substantially over the years, making the home valuable.

Once retired, many homeowners look to downsize to a smaller home that better suits their needs. Without a mortgage, the proceeds from selling their current home are all available to put towards a new, smaller place.

Your Home’s Value Over Time

Once the mortgage is paid off, a homeowner sits on an asset that should gain value over the long run. According to historical data from the Federal Housing Finance Agency, home prices in the U.S. have risen steadily over the last several decades.

Assuming you bought your home at some point in the early 2000s or before the housing crisis, there’s a good chance it’s worth significantly more today. The increase could be substantial if you live in an area with strong housing demand and low inventory.

Home Appreciation Varies Based on Location

Properties in desirable neighborhoods with strong school districts and job opportunities tend to gain the most value over time. Homes in small towns or rural areas may gain little value or even lose some.

The only way to know how much your house has appreciated is to check recent sales of comparable properties in your immediate area.

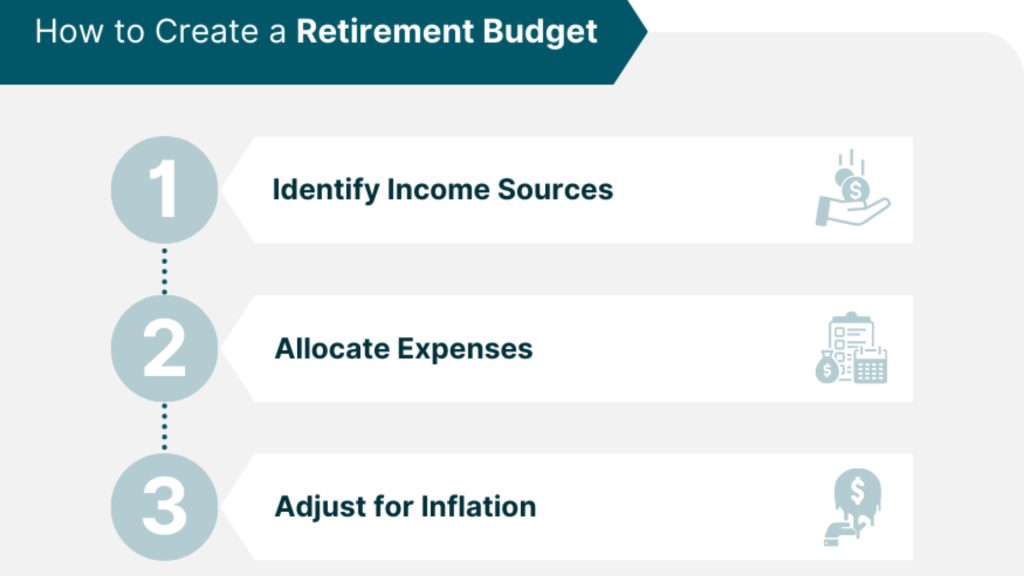

How a Paid-Off Home Impacts Your Retirement Budget

Once homeowners finally pay off their mortgage, their financial situation improves dramatically. Without a monthly house payment, people have more flexibility and stability in their budget.

Eliminating a mortgage payment provides homeowners with extra monthly cash flow that can be put toward other expenses. For example, a $2,500 monthly mortgage payment amounts to $30,000 per year.

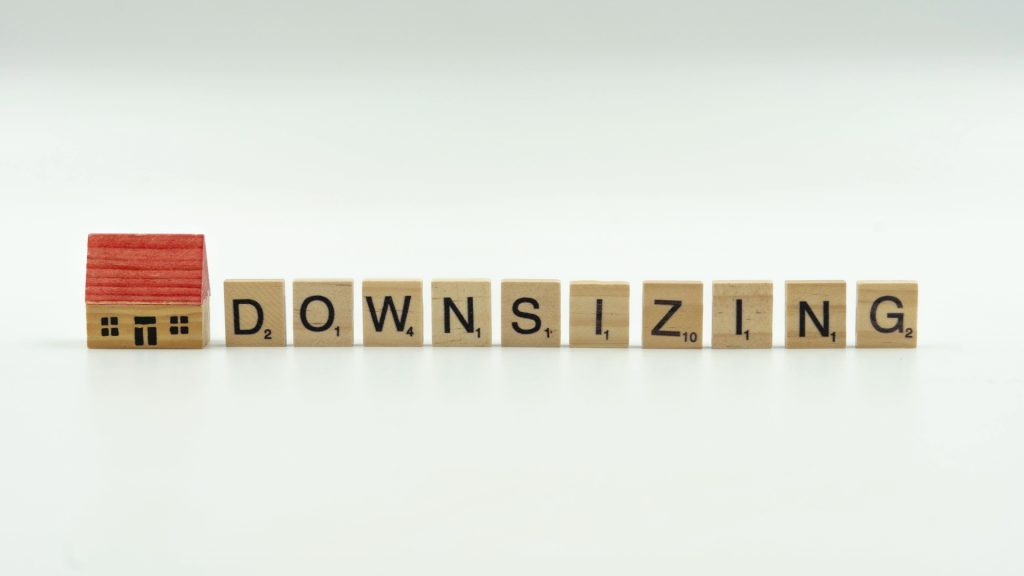

With Your Mortgage Paid, You Can Option to Downsize

Once the mortgage is paid off, homeowners can downsize to a smaller, more manageable home.

The equity in the current house can be used to purchase a new, lower-cost property outright without taking on a new mortgage. Downsizing allows one to declutter and live with fewer responsibilities while enjoying retirement.

Investment Opportunities After Clearing Mortgage

With a paid-off home, retirees have more opportunities to invest their money for additional income and growth. The money that used to go toward the monthly mortgage payment can now be invested in the stock market, certificates of deposits, or other interest-bearing accounts.

Even modest investment returns can provide a boost to retirement savings over time. A paid-off house is a valuable asset that contributes to a comfortable retirement.

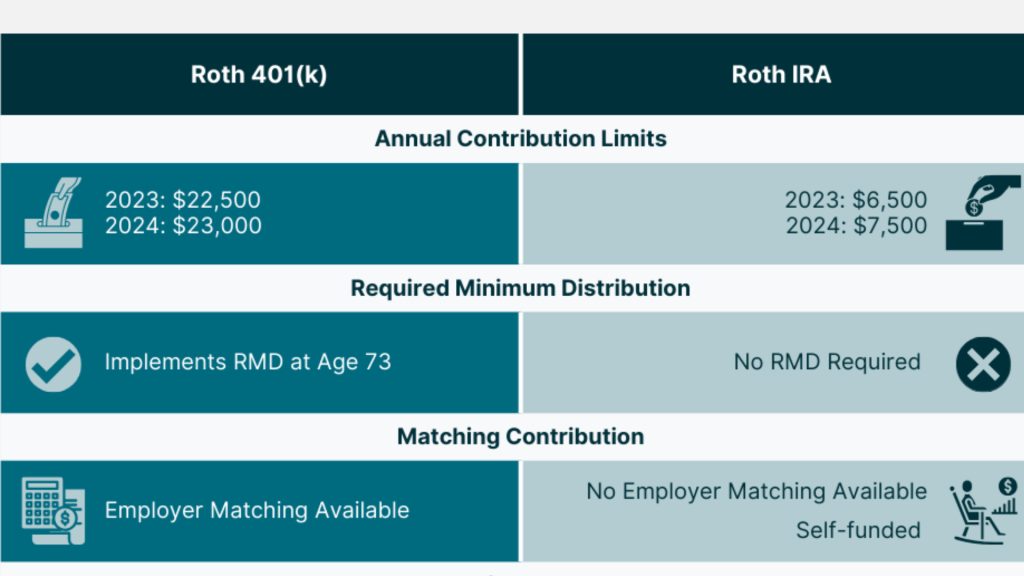

Funding Retirement Accounts After Mortgage is Paid Off

Once high-interest debts have been eliminated, homeowners can focus on retirement savings. Contributing more money to retirement accounts such as 401(k)s, IRAs, and Roth IRAs allows savings to grow tax-advantaged over time through compounding returns.

For those over age 50, catch-up contributions allow savers to put away even more money. Retirement accounts should be a top priority for anyone wanting to maintain their standard of living in retirement.

Options for Tapping Your Home Equity

Many homeowners consider selling their property once the mortgage is paid off and the kids have moved out. The equity built over years of payments now represents a sizable nest egg. Selling allows them to cash in on that equity and downsize to a smaller, more manageable home.

This option provides the largest lump sum to fund retirement or other life goals. However, selling costs include real estate agent commissions, closing, and moving expenses. There is also the emotional toll of leaving a long-time home behind.

Tap Into Your Equity Using Reverse Mortgage

For homeowners over 62, a reverse mortgage allows them to tap into their home equity without making monthly mortgage payments.

The loan doesn’t need to be repaid until the last borrower moves out or passes away. Interest is simply added to the balance each month.

Common Types of Reverse Mortgages

The most common type of reverse mortgage is a home equity conversion mortgage (HECM), which is insured by the FHA.

These typically have lower interest rates and fees compared to private reverse mortgages. The loan amount depends on the age of the youngest borrower, current interest rates, and the home’s appraised value.

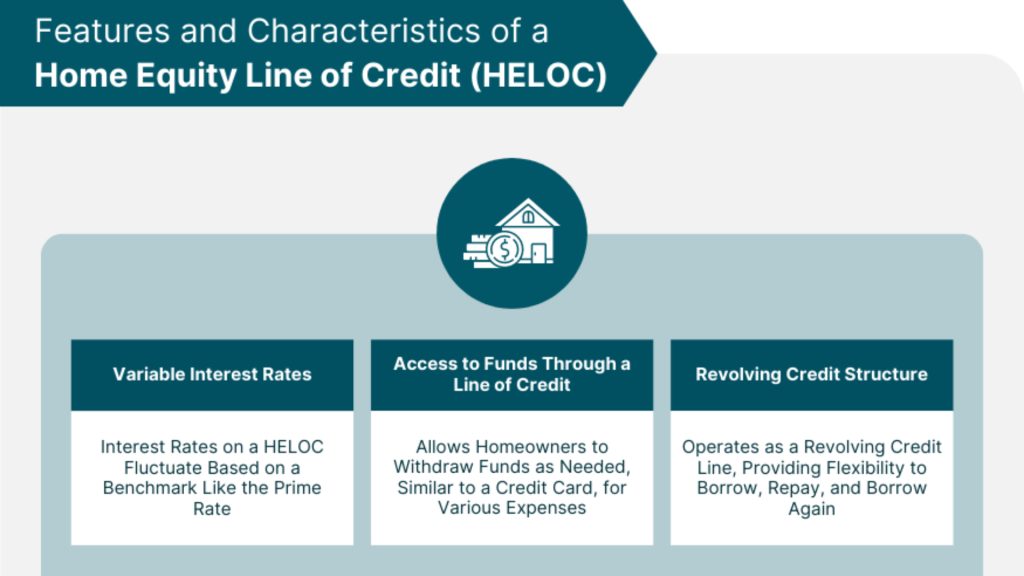

Home Equity Line of Credit (HELOC) For Younger Owners

For younger homeowners still making mortgage payments, a HELOC allows them to tap into their equity through a revolving line of credit.

It works like a credit card, where they can draw money as needed and make interest-only payments for a set period, usually 10 years. After that, the balance converts to a fixed-term loan with higher payments to pay it off.

Why Do Many Homeowners Opt For HELOs?

HELOCs typically have variable interest rates, so payments could increase substantially over time. They also come with application fees, appraisal fees, and closing costs, though not as high as a reverse mortgage. HELOCs provide flexibility and access to cash for major expenses.

But without a concrete repayment plan, it’s easy to end up owing more than the equity in your home. However, a HELOC can be a useful financial tool for savvy homeowners if used responsibly.

Making the Most of Your Mortgage-Free Asset

With the mortgage paid off, homeowners are no longer obligated to a lender and have full ownership of the property.

They can sell the house and move to a new location without accounting for an outstanding loan balance. The proceeds from the sale represent 100% of the equity. The funds could be used to purchase another home outright or provide income in retirement.

Generating Extra Income After Finishing Your Mortgage Payments

Homeowners may consider renting out spare rooms to generate extra income or move to a smaller home and rent out their previous fully-owned house.

The rental income provides cash flow without a mortgage payment. Over time, rent prices will likely increase, allowing for higher returns.

Unlocking The Doors To Financial Freedom

Having a mortgage-free house unlocks the door to financial freedom and stability. With the bank out of the picture, homeowners have full control and access to their largest asset.

They can leverage the equity to suit their needs and priorities in life after the mortgage. The options provide income, allow for relocation, and give peace of mind that housing costs are covered, no matter the future.

Utilizing Your Home as An Asset

So, if you’re lucky enough to have a paid-off house as you enter retirement, take time to appreciate just what an accomplishment it is.

Your home is now an asset to be leveraged, not a debt dragging you down. With the right planning, you can use its full value to secure your retirement years in ways that would otherwise be impossible.