As wildfires ravage the state and insurance companies flee, thousands of California homeowners are finding themselves without coverage. Persistent profitability issues driven by inflation, increased claims costs, and competitive pressures led American National to exit these homeowners insurance markets.

The company joins a growing list of insurers like State Farm, Allstate, and Farmers Insurance that have tightened rules or paused issuing new policies in California, which already faced availability issues.

Withdrawal of Major Insurers

American National Group recently announced plans to stop offering homeowners insurance in California, affecting roughly 36,475 policyholders.

The company cited “significant and persistent profitability issues” in the state’s homeowners insurance market, driven by increasing costs, more frequent claims, and competitive pressures. American National is exiting eight other states as well.

Rising Costs and Risks

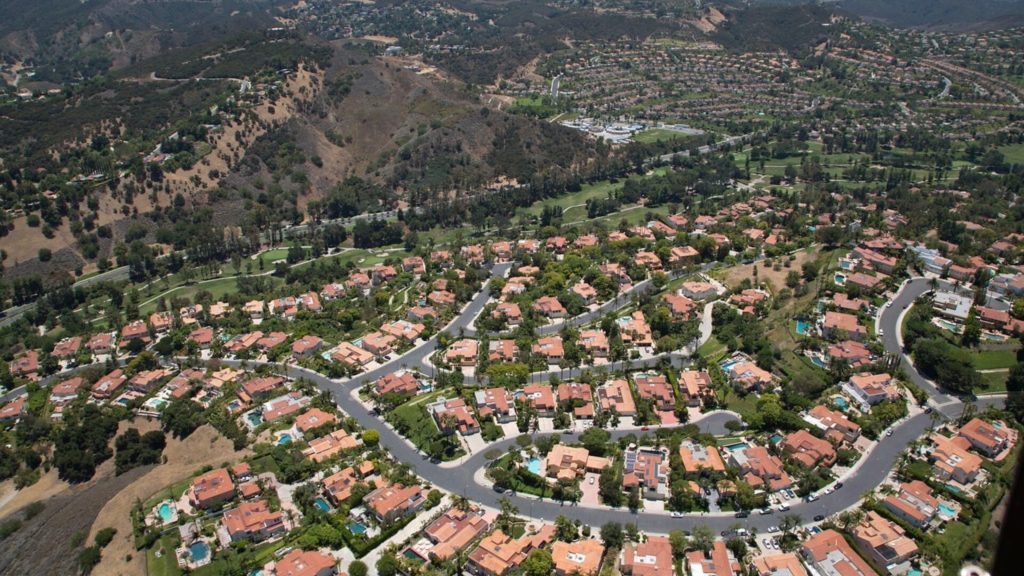

The insurance exodus highlights the challenges of insuring homes in California’s high-risk, high-cost market. Homeowners face surging insurance premiums, coverage restrictions, and policy cancellations as insurers struggle with billions of dollars in wildfire claims.

According to Joe Cronin, president of International Citizens Insurance, “The insurance market in California is notoriously complex due to the high risk of blazes and a state statute that demands additional processes for rate increases exceeding 7 percent.”

Persistent Weather Events and Costly Claims

American National stated that multiple years of increased frequency and severity of weather events, such as wildfires, have led to a lack of profitability in their home insurance line of business. The costs to pay out claims related to these catastrophic events have compounded over time.

California, in particular, has already experienced 137 wildfires so far this year, resulting in loss of homes and land. Weather events like these have made insuring homes in California, an increasingly unprofitable endeavor for companies.

Inflation and Market Pressures

In addition to weather events, American National noted that inflationary pressures have increased the costs of claims payments, further reducing profits. They also face competitive market conditions in California that limit their ability to increase premiums.

Insurance companies in California must go through an approval process for rate increases over 7%, which can be a lengthy and uncertain process. These economic factors, combined with the risks from natural disasters, have made the California home insurance market difficult for companies to navigate profitably.

Impacts on Homeowners and Housing Market

The departure of American National Group from California’s insurance market will leave thousands of homeowners in need of new coverage. This could delay home purchases for prospective buyers or prevent some from buying altogether due to affordability issues.

While American National Group is leaving several states, the situation in California highlights the challenges insurance companies face in providing affordable, comprehensive coverage to homeowners in areas prone to natural disasters.

State Farm, Allstate Also Tightening Rules or Pausing New Policies

As the frequency and severity of catastrophic weather events increase in California, major insurers are finding the state’s market increasingly unprofitable.

Some companies have elected to exit the California homeowners insurance market altogether, while others have tightened underwriting guidelines or paused the issuance of new policies.

Homebuyers Face Affordability Challenges

As options for homeowners insurance dwindle and premiums climb in California, prospective homebuyers may face significant barriers to affordability and homeownership.

“Prospective buyers trying to enter the market now are already facing higher home values on top of higher interest rates,” said Alan Chang, founder and president of a title and escrow company. “This is a perfect storm against home affordability.”

137 Wildfires Already Burning in California This Year

California is battling its fair share of wildfires this season. As of July, there have already been 137 wildfires across the state, according to the California Department of Forestry and Fire Protection.

The high frequency of fires is alarming and threatens the homes and properties of many California residents. The dry, hot weather combined with seasonal strong winds have created hazardous fire conditions in California.

It’s Too Expensive To Insure Homes

As insurers continue to pull out of the California market due to high wildfire risks and increasing claim costs, home insurance premiums are skyrocketing, making it difficult for many homeowners to afford coverage.

With fewer options and stiff competition for remaining policies, insurance costs are pricing some homeowners out of the market.

Limited Insurance Options Leaving Homeowners Anxious

As American National Group ceases to offer homeowners insurance in California, thousands of policyholders are left scrambling to find coverage elsewhere.

According to company statements, the decision was prompted by years of substantial losses in the state’s homeowners insurance market. The rising costs of wildfire damage claims and rebuilding fees have cut into profits, leading the company to pull out of the California market.

How CA Homebuyers Should Factor Insurance Into Decisions

Industry experts recommend that prospective homebuyers thoroughly research insurance rates and options prior to home shopping.

By planning and making insurance a priority, homebuyers in California’s high-risk areas can overcome this additional obstacle and achieve homeownership despite the challenging conditions.

Coverage Pushing Homeowners Away

Homebuyers in California should carefully consider home insurance costs before purchasing a property. As major insurance companies increasingly withdraw from the California market due to unprofitability, coverage is becoming more expensive and difficult to obtain.

Obtaining insurance may require shopping among multiple providers to find an affordable policy. Some buyers may be forced to accept higher deductibles or less coverage to lower premiums.

A Need for Government Intervention

The mass exodus of insurers like American National from California due to wildfires and other factors leaves thousands of homeowners in a dire situation.

The state may need to reform regulations to entice insurers back while assisting vulnerable homeowners. But the core driver is climate change, evident in the worsening wildfires.