Times are hard! Most states are implementing tax reductions to help reduce the hardship people are going through. But what they don’t know is that while they are reducing taxes, some other basic needs are getting crazy expensive.

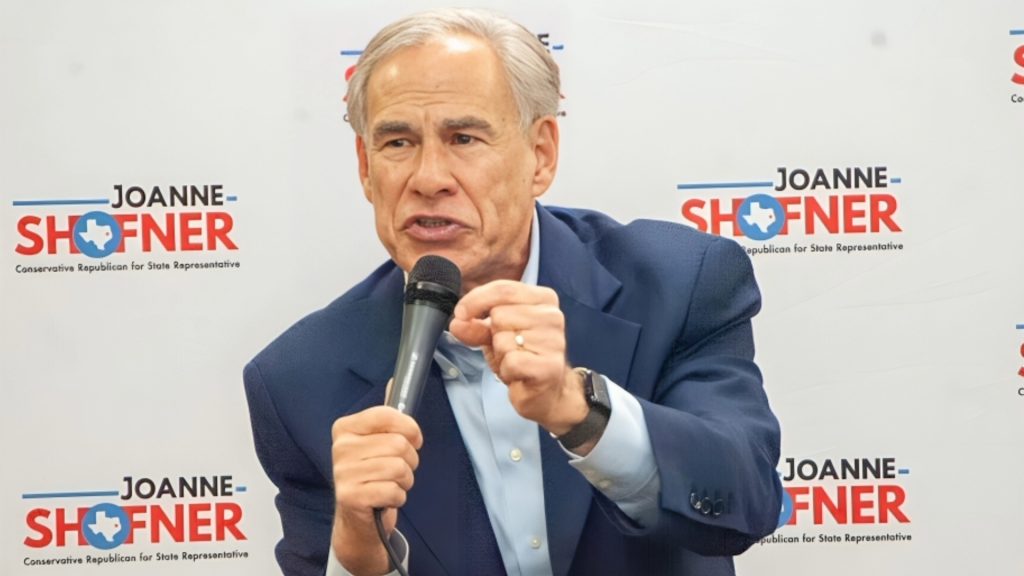

This is the fate of many Texans after their Republican governor Gregg Abbott signed a new tax relief package that was supposed to ease their financial troubles – instead, they’re now facing even higher property taxes. Stay focused as we take you through the full story.

Increase In Property Value: A Way To Counteract The Relief

Texas residents are struggling presently, almost all Texans have been complaining about how most of their appraisal districts have raised their property value. This is in a bid to counteract the relief measures implemented by the government.

Comparing the property value of the year 2022 to that of 2023, Texans have experienced a huge spike in their property tax and this has made things tough for them. All this is happening even after they get their tax relief package.

Gregg Abbott And His $18 Billion Property Tax Relief Package

The reason why Gregg passed this into law was to raise the homestead exemption from $40,000 to $100,000 per year. A homestead exemption is the money a homeowner is allowed to take from the value of their house before it then gets taxed.

This bill also affects residential and commercial properties as it puts an appraisal cap on them. The relief package also includes a public school tax compression, reducing the school district’s maintenance fees by 10.7 cents per $100 of each property valuation.

Abbott Signed The Bill Into Law In 2023

After complaints and backlash from Texas residents, about the tax relief not being enough to reduce their financial burden, Greg Abbott’s $18 billion property tax relief package still came into force.

The historic bill was signed into law in July 2023 and was backed by residents on the November 7 ballot. According to this legislation, local governments are to stop enforcing property taxes and the state government will step in as regards all lost revenue.

This Relief Came At A Very Wrong Time

While Governor Abbott thinks he has done something very significant for the people of Texas, filled with joy as he jubilates and celebrates this measure. The people of Texas are not happy about this package.

There’s nothing exciting about lowering the homestead exemption taxes at a time like this. This is a very wrong time in fact it is the worst period for it to happen, this is a period where Texans are being hit by the effects of higher inflation, increased cost of living, and choking bills.

Texas Residents Cry Out

Texas residents have been quiet for too long and have decided to speak up. Earlier, one of the residents called this whole relief package a bunch of smoke and mirrors. And surprisingly, Susan, a Texas resident agrees with her.

Susan believes that the taxes have really gone up in recent months and it has also taken a toll on her finances. She added that everything got tough because her country decided to raise all homes to the 10% limit.

Texans Can No Longer Afford Their Home

The state of affairs of Texas has found itself in a really sad situation. The effects it’s having on Texans are not a good one. Most Texas residents can no longer afford their homes thanks to the outrageous taxes that go way above their income.

And it is even tougher for people who bought their home at least 30 years ago. Even though they’ve paid off in full, there’s still a limitation on what they can do on their property all thanks to Texas’s outrageous property tax laws.

This Is How Property Taxes Work In Texas

The way property taxes work in Lone Star states is different from how it works in most US states. Over in Texas, they do not have what is called state-imposed property taxes.

In Texas, instead of state-imposed property tax, what they have is property tax collected by local tax units. Who now redirects it to the appropriate quarters like schools, streets, police, and other important ones.

A Totally Different Outcome

When the option to vote for a lower property tax was brought before the people of Texas they had something else in mind. However, what they got after voting was different from what they had in mind.

When the majority voted it was because they wanted the local street districts to lower their taxes, and whenever they needed extra funds the state could make up for any revenue lost.

Texas Resident W. Green Doesn’t Feel The Relief Package Is Negative

Green believes that the relief package was passed into law to help Texans and it’s not the legislation that is causing the present crisis.

According to Green, even with the higher property tax going on, most of these homeowners still pay less tax compared to those who own homes in states with income tax. He believes that the value of homes has generally risen and this is what has caused the ridiculous increase in property taxes.

Soon Only The Rich Will Be Able To Survive

A lot of people have had to sell their homes because it has become so difficult to keep up.

At the end of the day, only the rich who do not have to worry about money will be able to stay in places like this.

Greg Abbott’s Legislation Is Nothing Brought Nothing But Additional Torture To Texans

While Greg believes that he just made history with his largest property tax cut in Texas history, residents of Texas do not feel the same way.

This new legislation has affected them in every way, from property taxes to the extreme pressure from higher inflation and increased cost of living. Something needs to be done and it’s not a Tax Relief Package.