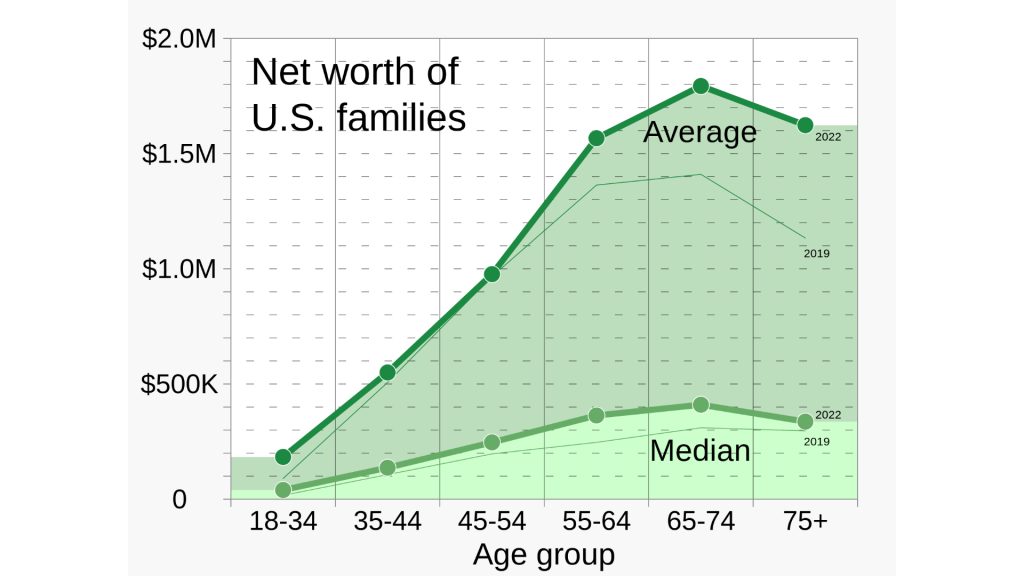

What does a typical financial trajectory across adulthood look like? Analyzing average and median net worth by different age groups reveals fascinating patterns. Most Americans see their financial foundation strengthen year after year into middle age before retirement years see some backsliding. But averages don’t tell every story. Read on to learn what impacts your net worth at each stage of life and how to set realistic wealth goals.

Defining Net Worth and Why It Matters

Your net worth measures your financial health at any given time. It represents your economic power relative to debt obligations. Net worth sums the total value of what you own (assets like savings, investments, real estate) and then subtracts what you owe others (liabilities like loans, mortgages, and credit card balances).

Tracking net worth over time serves as a check-in on financial growth through different life stages. Comparing your progress to national net worth averages helps gauge if you’re on track. Luckily, there are steps to take if you find your net worth lacking at any age.

Average vs. Median Net Worth in the U.S.

The average American household nets nearly $750,000 in net worth. But this figure disguises deep wealth inequality. Half of all American households share just 2% of national net worth. To standardize, the median shows the middle net worth amount. The median American household claims just $121,700 in net worth.

This means while average net worth pulls upward, most Americans never come close to this level of wealth. Checking both average and median net worth by age offers a clearer picture of typical financial trajectories.

Net Worth Typically Low in Your 20s

Young Americans aged 18-24 average $28,707 in net worth. But the median is further behind at $8,216. Those 25-29 average $49,388 and median just $7,512. Such low medians demonstrate most young people owe more than they own.

Many start adulthood by taking on costly student loans before their careers build income and assets. Paying down debts and establishing savings have to wait. This leaves most not yet on track to build wealth.

Thirties See Net Worth Gradually Improve

Thirties reveal modest net worth growth overall, but also wide variations. Ages 30-34 average $122,700 net worth and $35,112 median. Ages 35-39 average $274,112 and median $55,519. So while averages rise nicely, median net worth still lags far behind for many.

Debts like student loans and auto loans linger for some thirty-somethings. But others begin buying homes and climbing their career ladders at this age. This divergence will continue widening.

Forties Bring Major Net Worth Surge

By their early forties, Americans reach an average of $623,694 net worth and a median of $127,345. Ages 45-49 average $761,500 and median $164,197. This decade sees the most rapid wealth acceleration for typical households.

Peak income years drive net worth higher. Careers plateau at senior levels, bringing maximum salaries and bonuses. Many finish paying off student loans by 40 too. Now extra disposable income can redirect to building assets. The forties present a critical window for wealth creation before aging brings financial challenges. Compounding even modest investment portfolio gains for 5+ years creates substantial value.

Fifties Hit Peak Average Net Worth

Average net worth peaks in Americans’ fifties, aligning with peak earning years. Ages 50-54 average $897,663 net worth and $171,360 median net worth. Ages 55-59 average $1.16 million while the median reaches $193,549.

Debt finally falls for many fifty-somethings, especially once mortgages pay off. But health care costs often rise before Medicare kicks in at 65. Early retirement also slows net worth gains for some.

Sixties See High Net Worth Persist

While net worth gains begin slowing, the sixties still see strong financial health. Ages 60-64 average $1.18 million net worth and $228,833 median. Ages 65-69 average $1.25 million and $271,805 median.

New Social Security income and Medicare coverage support net worth resilience for many entering their golden years. But longer modern life expectancy means making retirement savings last.

Net Worth Slips Modestly After 70

The seventies see average net worth slide slightly, but many maintain decent savings here. Ages 70-74 average $1.17 million net worth and a median of $258,531. Ages 75-79 average $945,000 and median $272,976.

Fixed retirement income cannot build further wealth. Medical costs may accelerate while the needs for paid caretaking, home modifications, or relocations rise for older seniors.

Net Worth Rebounds Over 80 Somehow

Surprisingly, average net worth rebounds over $900,000 for those aged 80+. However, median net worth remains far lower at $235,193 after 80.

What explains seniors averaging nearly $1 million net worth during retirement’s last phase? Much stems from affluent households with substantial assets lasting into ripe old age. Poorer seniors simply don’t live as long.

The Rich Distort Overall Averages

Behind lofty overall average net worth lies America’s wealth inequality. The richest 10% of citizens claim 70% of all household wealth. The top 50% own nearly all of it at 98% despite being half the population.

These concentrations of extreme wealth push overall average net worth upward. Thus checking median net worth offers a needed perspective on economic class divides most confront while chasing financial security.

Education Level Impacts Net Worth

Education proves crucial for building wealth over time. Median net worth among college graduates runs over 4 times higher than high school-only adults by middle age. Homeownership rates and retirement savings balances all typically rise with education as well.

Advanced degrees bring higher average incomes with better workplace benefits. This enables faster debt repayment and asset accumulation accelerating net worth over decades.

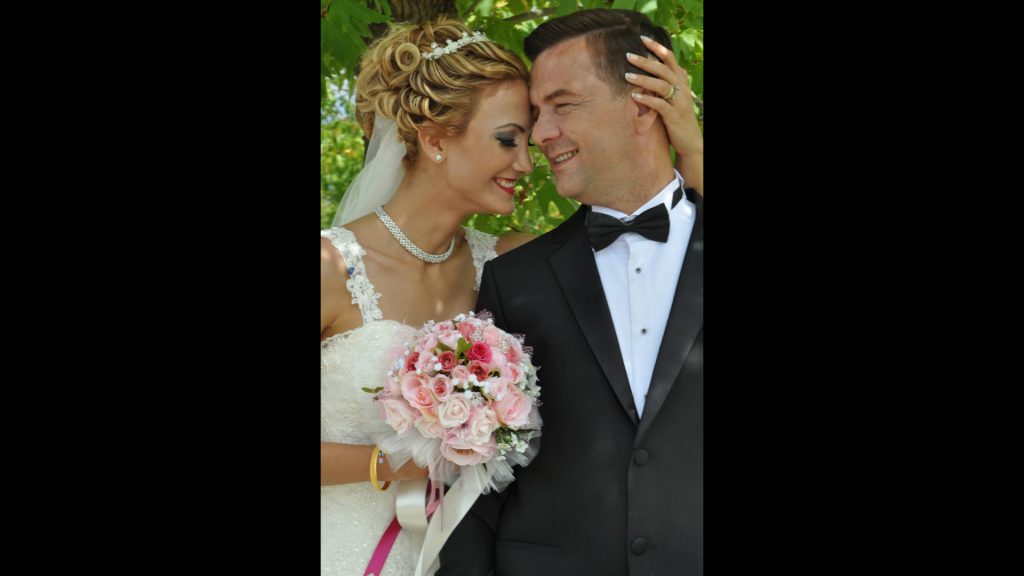

Marriage Provides Net Worth Boost

Get ready for some solid financial teamwork. Married couples build nearly double the median net worth of single adults in almost every age bracket. Shared benefits range from income pooling to investment portfolio diversification.

Coordinating financial plans, accountability, and emotional support propels couples’ combined savings capacity well above what most singles achieve overall.

Homeownership Builds Net Worth

Owning real estate remains Americans’ number one builder of net worth across every age group. Mortgage payments build equity over time. Appreciation then lifts the property values boosting owners’ overall assets.

Homeowners aged 45-54 average over 13 times higher median net worth than renters of identical ages. Even buying starter homes early starts compounding sizable wealth benefits over decades.

Race Impacts Economic Opportunity

Historical discrimination in housing access, education quality, job opportunities, and wages contributes greatly to the racial wealth gap seen across age groups. Median white families hold well over 10 times more wealth than black families of similar ages.

Targeted programs look to increase minorities’ access to homeownership, education grants, and career networking. Much work remains before equity can emerge.

Income Disparity Also Skews Net Worth

While average net worth amounts seem comfortable for many American households, median figures reveal far lower earnings for most workers. The top 10% highest paid workers earn well over 9 times more income than middle-class workers at their peak ages of 35 to 44.

Such skewed incomes verify why the middle class struggles to build assets. Too little disposable income reaches potential savings and investments after covering steep living costs.

Do An In-Depth Comparison

Wondering how your current net worth truly stacks up? Compare it to the average and median net worth for citizens your precise age. See if you fall behind, match, or outpace most people.

Analyze the specific assets you hold against national data on 401(k) balances, home values, savings accounts, and investment portfolios at your stage of life. Include all debts too like mortgages, credit cards, and student loans.

This helps gauge where you excel, lag, or match others on wealth building. Revisit this full analysis every 1-2 years while actively working to grow assets faster and reduce debts. This keeps your exact financial trajectory on pace.

Celebrate Net Worth Milestones

Utilize net worth targets by age to set milestones for your wealth-building journey. Celebrating each little win builds momentum to stay on track meeting bigger goals.

Useful benchmarks include hitting $100,000 net worth by 40, $500,000 by 60, and $1 million upon full retirement. Tweak such goals as needed year to year but push yourself to capture each milestone.

Throwing a little party or treating yourself keeps wealth-building rewarding. This positive reinforcement incentivizes sticking to long-term financial plans achieving future security step-by-step.

Key Takeaways

Typical net worth does rise over most working-age Americans’ lifetimes before slowing by retirement. However, individuals’ actual trajectories vary widely by location, education, career, windfalls, and expenses. Regularly calculating your net worth by age offers insight into your unique financial standing. Compare it to national medians and averages to see if you’re on track or need to implement debt reduction and wealth-accelerating strategies in any life stage.

What net worth by age goal can you set for your situation one year from now? Outpace peers and national medians to secure your financial future.