A lot of people love Los Angeles for its Hollywood Walk of Fame and Rodeo Drive. But, only a few understand the extent of its problems, especially homelessness. As of November 2023, only 3,500 unhoused people in LA have found a permanent place to live.

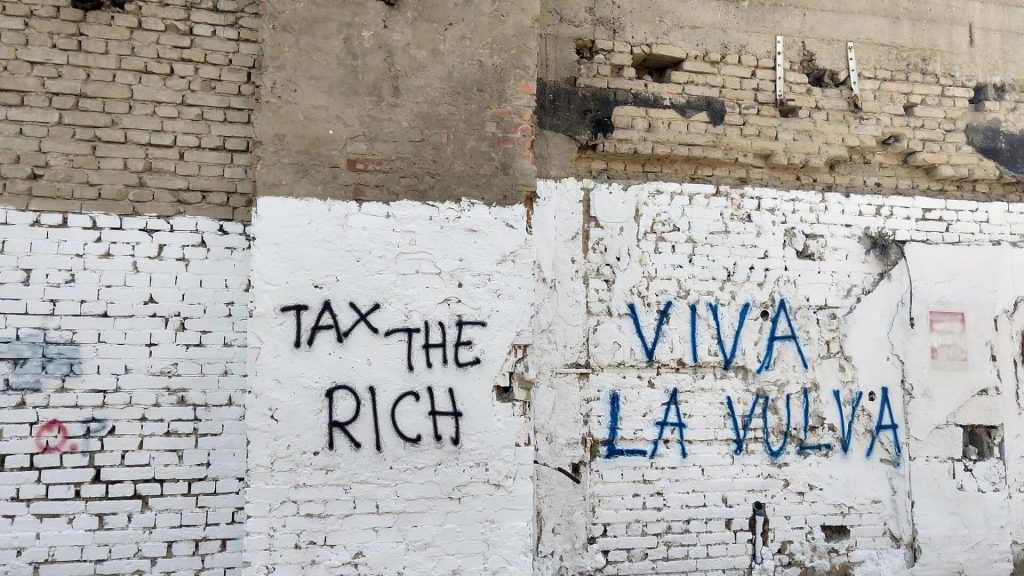

The Los Angeles government is aware of this situation and has spent time and resources coming up with a solution. What’s the answer? Tax the rich! Little did they know that this remedy would backfire on the state.

The Homeless Crisis In Los Angeles

As of June 2023, Los Angeles had a homeless population of 75,000, which grew by 9% from the previous year. What’s worse is that the Los Angeles Homeless Services Authority expected this number to rise by 4% because of the population increase.

During that time, only 3,500 of those homeless people found a home, which means thousands are living on the streets. Naturally, the people quickly turned to the government for an answer, resulting in a unique solution.

‘Tax The Rich’

After months of deliberation, the Los Angeles government came up with a solution to homelessness. They planned to tax the rich more and channel the excess funds into fighting the housing crisis.

The tax named “Mansion Tax” introduced a 4 percent tax on real estate listed between $5 million and $10 million. Also, any property above the range gets an increased tax of 5.5 percent. Did this work? The evidence showed otherwise.

People Weren’t Happy With The New Tax

Critics were quick to point out that the government failed to consider the reaction of property owners to the increased tax. Raising the price by 4% is a big deal for many, which led to many investors selling quickly.

For context, the tax increase means a property selling for $5.2 million will require the owner to pay $200,000 in tax. Many investors found the amount outrageous and the government’s way of exploiting their hard work.

Everyone Sold As Quickly As Possible

The New Mansion Tax had a little longer before getting implemented by the LA government. So, property owners in LA took the opportunity to cash out on their investments.

Sellers even went as far as adding bonuses to supercars like McLarens and Lamborghinis. Why? These property owners wanted to sell these multi-million-dollar buildings quickly.

Famous Celebrities Were Selling Too

Celebrities like Jim Carrey and Mark Wahlberg are two of many Los Angeles real estate owners who sold their properties. This also includes Jennifer Lopez, who sold her famous Bel Air place in February.

Everyone wants to cash out their prized investments before the new law hits. The result includes properties being sold at a crazy bonus amount. But how low do these real estate prices go?

Mansions Sold For Lower Than Expected

For example, celebrities like Mark Wahlberg from Ted put his 30,500 square-foot estate for sale. The price was an enticing $87.5 million, which many investors considered a steal. But the piece went even lower.

As the due date approached, Wahlberg sold his Beverly Park mansion for $55 million. This final price was a steep 37% drop from the original amount. But, Wahlberg’s accountant considered it better than paying the extra tax.

Real Estate Agents Worked Overtime

Imagine several millionaires quickly selling luxurious properties for cheap. Brokers had no choice but to seize the opportunity. One broker mentioned how they adapted from selling business buildings to handling bonus yachts and cars.

The broker said: “I’ve become not only a real estate agent, which I signed up for, but I’m now a yacht salesman, a car broker, and a wholesale furniture salesman.” They also commented on the rushed sale, saying people like Mark Wahlberg could have earned more if they waited a bit longer.

How The Mansion Tax Will Affect LA Real Estate

The government set the Mansion Tax to combat the homelessness problem. Sadly, it will do the reverse. Real estate agents predict sellers will do their best to avoid the tax. This includes either not selling or trading at the minimum range.

At the same time, it will stifle development. How? Millionaires will avoid Los Angeles for fear of the mansion tax. This avoidance means less work for local developers, killing the LA housing market.

‘Not All $5 Million Houses Are Mansions’

Another problem with the mansion tax is that people feel it’s unfair. The law targets homes sold between $5 million and above. These properties are considered luxury properties. However, LA brokers claim that the range is unrealistic.

One of the real estate brokers in LA commented that $5 million isn’t worth the “luxury title. Why? LA is a popular area with housing issues, especially after the pandemic. Therefore, many homes fall within this $5 million mark for average individuals.

The Tax Won’t Help The Homeless As Demand Will Creep Up

Brokers also express an extra problem with the mansion tax. Some homeowners who didn’t rush to sell will hold their homes longer. This lack of commerce in the real estate market will drive inflation.

Sadly, there’s a possibility that these homeowners will wait until demand is at its peak before selling. In this case, the money they made can compensate for the mansion tax, which defeats the purpose of the new tax.

Many Consider The Mansion Tax An LA Nightmare

The pandemic caused a lot of economic issues that put people out of a job and their homes. This has made housing expensive, but government interventions are yet to help individuals. Many tag the mansion tax as the worst initiative so far.

The new law drove away the very celebrities that made LA feel luxurious. At the same time, it didn’t fix the homelessness problem. Instead, homes are still unaffordable as people drive inflation by holding on to other properties.