As the April 15 tax filing deadline approaches, the Internal Revenue Service (IRS) is ramping up its efforts to ensure that all taxpayers, especially high-wealth individuals, pay their fair share. Commissioner Danny Werfel has issued a strong warning to those who attempt to avoid their tax obligations, emphasizing the agency’s commitment to cracking down on tax evasion.

IRS Targets High-Income Individuals with New Initiatives

The IRS has recently implemented major new initiatives aimed at identifying and pursuing high-income individuals who fail to pay their full tax obligations. Commissioner Werfel, in an interview with The Associated Press, highlighted the agency’s focus on those who improperly deduct personal flights on corporate jets and those who don’t file their taxes at all.

Werfel emphasized that the IRS’s crackdown on corporate jet misuse “sets the tone for the American people” that everyone must pay what they owe. He also noted that many corporations are “sloppy with their bookkeeping” when it comes to private jet travel, making it a prime target for the agency’s scrutiny.

Artificial Intelligence and Technology Aid in Tax Enforcement

In September, the IRS announced its plan to pursue high-wealth tax dodgers using cutting-edge technology, including artificial intelligence. These measures are already having an impact, according to Werfel, with large corporate filers and others taking notice of the increased scrutiny.

The agency’s use of advanced technology is expected to result in improved compliance and increased revenue. Werfel hinted at the expansion of the IRS’s crackdown with new initiatives set to be introduced in the coming months, further strengthening the agency’s ability to identify and address tax evasion.

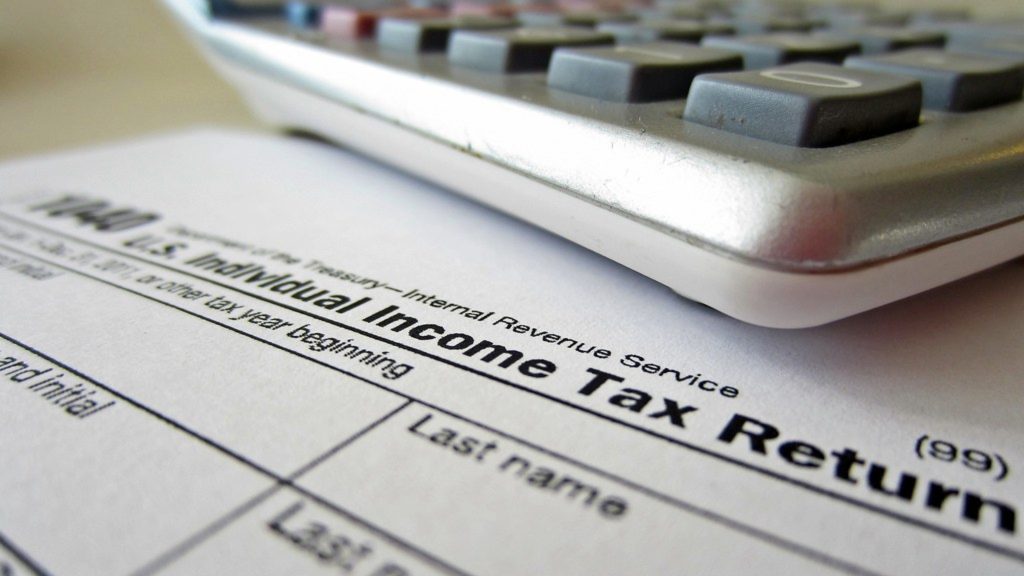

Taxpayers Advised to Avoid Common Filing Errors

With the tax filing deadline just weeks away, the IRS is reminding taxpayers to be vigilant in avoiding typical errors on their returns. The agency encourages the use of electronic filing methods, such as IRS Free File or alternative e-file service providers, to minimize mistakes and streamline the process.

Taxpayers are advised to gather all necessary documents, double-check their filing status, names, birthdates, and other details, report all taxable income, and remember to sign and date their returns. By following these guidelines, individuals can ensure a smooth and accurate filing process.

File Extension and Late Filing Penalties

For those who require more time to file their taxes, the IRS offers the option to request a six-month extension until October 15. By doing so, taxpayers can avoid late filing penalties, which can add up quickly and create additional financial burdens.

It is important to note that an extension to file does not grant an extension to pay any taxes owed. Taxpayers should estimate their tax liability and pay any outstanding balance by the April 15 deadline to avoid interest and penalties on unpaid amounts.

IRS Pilots Free Direct File Program in 12 States

To make tax filing more accessible and affordable, the IRS is piloting a new and free program called Direct File. This system allows taxpayers with simple W-2s and who claim a standard deduction to file their federal income taxes directly with the IRS, without the need for private commercial software.

Currently, Direct File is available in 12 states: Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming. Commissioner Werfel reported that over 50,000 people have already started using the system, with users praising its speed, ease of use, and cost-free nature.

Taxpayer Responsibilities and the Importance of Compliance

As the IRS continues to crack down on tax evasion and promote accurate filing, taxpayers must understand their responsibilities and the importance of compliance. Failing to pay one’s fair share of taxes not only puts individuals at risk of facing penalties and legal consequences but also undermines the integrity of the tax system as a whole.

By working together with the IRS and adhering to tax laws, taxpayers can contribute to a more equitable and efficient tax system. This, in turn, helps to fund vital government services and programs that benefit society as a whole.

The Role of Tax Professionals in Ensuring Compliance

As the tax code becomes increasingly complex, many individuals and businesses turn to tax professionals for guidance and assistance in filing their returns. These experts play a critical role in ensuring compliance and helping taxpayers navigate the ever-changing landscape of tax laws and regulations.

Tax professionals must stay up-to-date with the latest changes in tax law and be vigilant in identifying potential red flags or areas of non-compliance. By working closely with their clients and maintaining high ethical standards, tax professionals can help to promote a culture of compliance and transparency.

The Impact of Tax Evasion on the Economy

Tax evasion not only affects the individuals involved but also has far-reaching consequences for the economy as a whole. When high-wealth individuals and corporations fail to pay their fair share of taxes, it places a greater burden on honest taxpayers and can lead to reduced funding for essential government services.

Moreover, tax evasion can create an uneven playing field, giving those who cheat the system an unfair advantage over those who play by the rules. This can distort market competition and hinder economic growth in the long run.

The Importance of Transparency and Accountability

To combat tax evasion and promote compliance, it is essential to foster a culture of transparency and accountability. This requires the cooperation of taxpayers, tax professionals, and government agencies like the IRS.

Taxpayers must be honest in reporting their income and deductions, while tax professionals must uphold the highest ethical standards in their practice. The IRS, in turn, must continue to leverage technology and data analytics to identify and pursue those who attempt to evade their tax obligations.

The International Fight Against Tax Evasion

Tax evasion is not just a domestic issue but a global problem that requires international cooperation and coordination. Governments around the world have been working together to combat tax evasion and promote transparency through initiatives such as the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA).

These efforts aim to increase the automatic exchange of financial information between countries, making it more difficult for individuals and corporations to hide assets and income offshore. As the international community continues to collaborate in the fight against tax evasion, it becomes increasingly important for taxpayers to comply with their obligations and avoid the risks associated with non-compliance.

The Consequences of Non-Compliance

Failing to comply with tax laws can result in severe consequences, including hefty fines, interest charges, and even criminal prosecution. The IRS has a wide range of enforcement tools at its disposal, and it is not afraid to use them against those who violate tax laws.

In addition to the financial and legal repercussions, tax evasion can also damage an individual’s or a company’s reputation, leading to a loss of trust among customers, investors, and the general public. The long-term costs of non-compliance often far outweigh any short-term gains.

The Benefits of a Fair and Equitable Tax System

A fair and equitable tax system is essential for the functioning of a healthy society and economy. When everyone pays their fair share, it helps to ensure that the government has the resources it needs to provide essential services, such as education, healthcare, and infrastructure.

Moreover, a fair tax system promotes social cohesion and reduces inequality, as it ensures that the burden of funding public goods and services is shared proportionally among all members of society. By working together to promote compliance and combat tax evasion, we can help to build a more just and prosperous future for all.

The Role of Education and Outreach in Promoting Compliance

Education and outreach play a crucial role in promoting tax compliance and helping taxpayers understand their rights and responsibilities. The IRS and other organizations offer a wide range of resources, including workshops, webinars, and online tools, to help taxpayers navigate the complex world of tax laws and regulations.

By investing in education and outreach efforts, the IRS can help to foster a culture of compliance and empower taxpayers to make informed decisions about their tax obligations. This, in turn, can lead to higher levels of voluntary compliance and a more efficient tax system overall.

The Future of Tax Compliance in a Changing World

As the world becomes increasingly interconnected and digitized, the challenges of tax compliance and enforcement are likely to evolve. New technologies, such as blockchain and artificial intelligence, may offer opportunities to streamline tax processes and improve transparency, but they may also create new avenues for tax evasion and fraud.

To stay ahead of these challenges, the IRS and other tax authorities must continue to adapt and innovate, leveraging new tools and strategies to detect and deter non-compliance. By working together with taxpayers, tax professionals, and the international community, we can help to build a more resilient and equitable tax system that serves the needs of all.