In Florida, an alarming trend is emerging as skyrocketing home insurance premiums force an increasing number of residents to abandon traditional housing and take up residence in their cars, vans, and campers.

This drastic shift highlights the deepening affordability crisis in the housing sector, with insurance rates climbing to levels beyond the reach of ordinary homeowners.

Rising Costs Force Long-Time Florida Homeowners into Vehicle Living

NBC2 News reported in early March that numerous long-time homeowners in Florida are now living out of their cars, unable to afford their homes due to rising mortgage rates, inflation, and escalating insurance costs.

These financial pressures have left many without any option but to turn to vehicle living as a last resort.

Insurance Inequality as Florida Homeowners Face Steep Costs Double the National Average

According to Insurance.com, homeowners in Florida are paying approximately $4,419 for insurance on a $300,000 home, significantly higher than the national average of $2,601, putting additional strain on their monthly finances

This disparity in insurance costs is intensifying financial pressures for many residents.

Financial Strain Overwhelms Florida Homeowners as Insurance and Mortgage Rates Skyrocket

Homeowners in Florida face a daunting $368.25 minimum monthly insurance payment, and with bills piling up, including mortgage interest rates soaring to 6-7% this year, many can no longer afford their payments.

This financial burden, compounded by rising utility costs, has pushed numerous residents to their financial limits.

Ann Rose, a Long-Time Floridian, Forced to Embrace Vehicle Living Amid Soaring Costs

In an interview with NBC2 News, Floridian Ann Rose shared that she now relies solely on her car insurance, having been priced out of her home by soaring expenses.

Faced with no alternative, Ann Rose, a long-time resident, has made the difficult decision to transition to living out of her car.

Tightening Eligibility Criteria Leads to Housing Crisis Amid Surging Insurance Prices

As insurance prices surge, prospective buyers face more stringent eligibility criteria.

While some struggle with skyrocketing costs, others cannot qualify for insurance altogether, forcing them to abandon their dreams of homeownership entirely.

Policy Changes and High Deductibles Drive Retirees Away from Florida’s Once-Popular Retirement Haven

Once hailed as a secure and affordable retirement destination, Florida is now witnessing an exodus of seniors due to recent policy shifts and the imposition of a staggering $1,000 hurricane deductible for tropical storm damage.

Faced with these challenges, many retirees are reluctantly leaving the state in search of more financially viable alternatives.

Climate Crisis Amplifies Insurance Risks for Coastal Homes in Florida

With scientific projections suggesting Florida could be submerged by 2100 and the southern portion rendered uninhabitable, insurance rates for coastal properties have soared due to escalating weather fluctuations, rising tides, and unstable terrain.

Homes nearest to the coast are bearing the brunt of these price hikes, reflecting the escalating risks associated with climate change.

Florida Homeowners Navigate Risks Amidst Uncertain Future Prospects

Residents in hurricane-prone regions grapple with the realization that their homes may not attract future buyers due to the associated risks.

Coupled with the inability to afford insurance premiums, many individuals acknowledge the significant financial jeopardy they face by remaining in the Sunshine State.

Florida’s Home Insurance Crisis as Fraud and Litigation Driving Costs

The surging prevalence of fraud and litigation in Florida adds to the escalating expenses of home insurance.

According to the Florida governor’s Office, the state is responsible for 79% of all homeowner insurance lawsuits nationwide, despite representing only 6% of the U.S. population.

Insurance Lenders Struggle Amid Home Safety Concerns and Legal Battles

Due to difficulties in finding safe homes to insure and the proliferation of lawsuits filed by homeowners, insurance lenders frequently face closure

Those businesses remaining in the state are compelled to raise their rates, placing the average homeowner in a challenging predicament.

Florida’s Affordability Crisis Deepens as Residents Living in Cars Demand Creative Solutions

Residents opting to remain in Florida have resorted to significant cost-cutting measures, including living out of their vehicles.

Insurers and lawmakers must collaborate on resolving the cost of living crisis, ensuring Florida remains affordable for the average family amidst these challenges.

History of Surging Home Insurance Rates in Florida Amid Hurricanes and Legislation Spurs Urgent Calls for Solutions

For decades, Florida’s home insurance rates have experienced substantial increases as a result of frequent hurricanes and flooding,

Historical fluctuations in legislation and market demands, often resulting in sharp premium hikes, highlight the importance of understanding these trends for evaluating the current crisis and forecasting future changes.

Floridians Embrace Alternative Insurance Models Amid Rising Costs and Overheads

In response to escalating costs, Floridians are increasingly embracing alternative insurance models like peer-to-peer insurance and microinsurance, offering flexible, community-oriented solutions that can be more affordable and personalized (via NAIC).

These models present innovative strategies for risk mitigation, eliminating traditional insurers’ overhead costs.

Experts Call for Urgent Support as Financial Instability and Vehicle Living Aggravate Mental Health Struggles

The strain of financial instability and the dramatic shift to living in vehicles profoundly impact mental health, with experts noting rises in anxiety and depression among displaced homeowners.

Persistent uncertainty worsens these conditions, emphasizing the critical need for mental health support in affected communities.

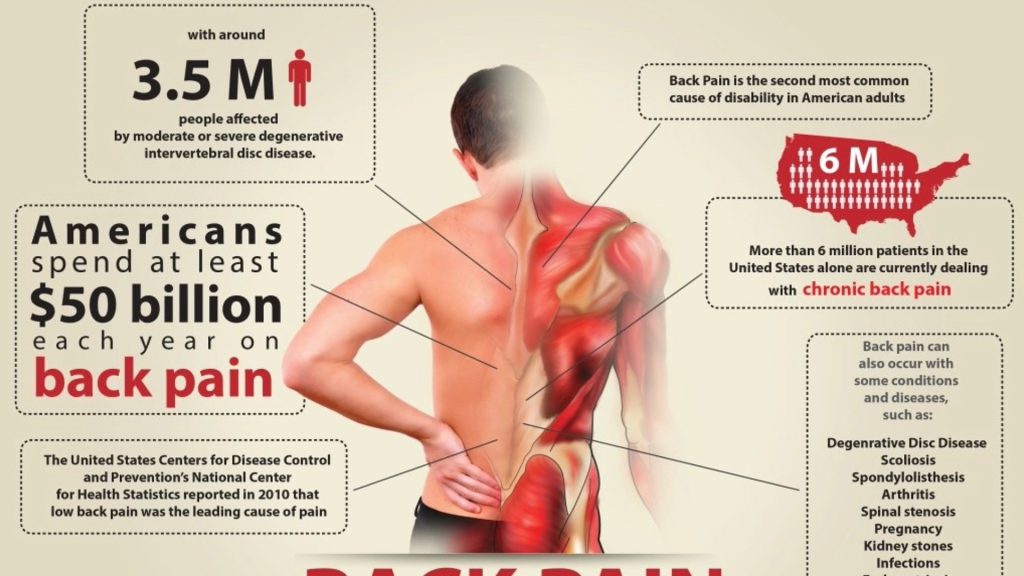

The Harsh Reality of Car Living and Urgent Health Interventions Needed for Affected Individuals

Living out of a car can result in severe physical health issues, such as chronic back pain, poor sleep quality, and limited access to sanitation facilities.

Health experts caution that these conditions may lead to enduring health complications, stressing the need for urgent interventions to offer relief and assistance to those compelled into such living conditions.

High Insurance Costs Impact Family Dynamics and Children’s Well-being

According to the CDC, the burden of high insurance costs often fractures family dynamics, causing strained relationships and instability. Children experience disruptions in their education and social interactions, enduring prolonged uncertainty that can impact their development and prospects.

This prolonged situation can have profound and lasting effects on their emotional well-being, academic performance, and future opportunities. Therefore, urgent interventions are needed to alleviate the financial burden on families and provide support systems to ensure the holistic well-being of children growing up in these circumstances.

Contrasting Insurance Markets in Florida and California Amid Climate Disasters

Insurance markets in Florida and California are experiencing divergent trajectories in reaction to climate-related catastrophes. While California grapples with insurers withdrawing due to wildfire risks, affecting a substantial number of policies, the California Department of Insurance downplays these departures as relatively insignificant, despite the concerning trend, exemplified by State Farm’s intention to reduce 72,000 policies, underscoring a looming crisis.

Conversely, Florida confronts its own set of challenges stemming from hurricanes and flooding, yet the state’s approach and insurer tactics diverge significantly, resulting in distinct consequences for homeowners.

Texas Home Insurance Rates Surge 22% in 2023 Amid Climate Impacts, Contrasting with Florida Challenges

In 2023, Texas witnessed a 22% surge in home insurance rates, doubling the national average, attributed to a rise in billion-dollar disasters and increasing rebuilding costs driven by inflation and climate change, as reported by the Texas Tribune

This significant hike underscores Texas’s proactive yet expensive strategy in addressing the impacts of climate change, contrasting with the ongoing challenges faced by Florida.

Experts Warn that Florida’s Insurance Market Faces Ongoing Price Increases

Experts predict that without substantial intervention, Florida’s insurance market will witness ongoing price increases due to climate change and a rise in hurricane frequency, as reported by Insurance Business Magazine.

These factors are anticipated to render insurance increasingly unaffordable for residents, potentially worsening displacement.

Florida Legislation Aims to Tackle Soaring Insurance Costs with Oversight and Subsidies

Recent Florida legislation seeks to address skyrocketing insurance costs by strengthening state oversight and offering subsidies to lower-income homeowners.

These measures aim to deliver immediate relief while fostering long-term solutions to safeguard the sustainability of the insurance market, marking a significant step towards addressing affordability challenges and ensuring equitable access to coverage for all Floridians.

How New York and Washington Interventions Offer Hope for Florida’s Insurance Market Crisis

Case studies from states like New York and Washington provide compelling evidence of successful interventions in the insurance market, such as implementing capped rate increases and establishing government-backed insurance pools. These innovative approaches have effectively mitigated rising costs and increased accessibility to insurance coverage for residents

By examining and adopting similar strategies, Florida could potentially alleviate its current crisis and ensure greater affordability and stability in its insurance market, offering hope for homeowners grappling with escalating premiums and limited options.

Florida Faces Urgent Call for Unified Action Against Soaring Home Insurance Costs

The pressing challenge of high home insurance costs in Florida calls for urgent action to implement innovative and sustainable solutions.

Insurers, lawmakers, and communities must come together and engage in collaborative efforts to develop comprehensive strategies that address immediate needs and ensure the insurance market’s long-term stability. Preserving Florida’s affordability and livability for all its residents amid rising insurance expenses requires a unified and cooperative approach.

Stakeholder Collaboration Key as Florida Pursues Innovative Insurance Solutions for Market Stability

By rallying insurance companies, government bodies, community leaders, and homeowners together, Florida aims to pioneer inventive solutions for market stabilization.

These collaborative initiatives may extend to the enhancement of building codes to withstand extreme weather, the establishment of government-backed insurance pools, and the implementation of incentive programs encouraging homeowners to fortify their properties against natural disasters. Such comprehensive efforts promise to not only bolster the resilience of Florida’s insurance landscape but also safeguard the diverse population from the risk of displacement and homelessness.

Florida’s Strategic Roadmap for Championing Insurance Affordability and Community Resilience

As these collaborative efforts advance, stakeholders are actively addressing immediate challenges of insurance affordability while laying the groundwork for enduring stability and resilience.

By fostering partnerships and implementing innovative solutions, Florida endeavors not only to alleviate the burden of high insurance costs but also to safeguard the well-being and security of all its residents. This comprehensive approach aims to prevent the escalation of homelessness, promote inclusive prosperity, and foster a thriving community for generations to come.