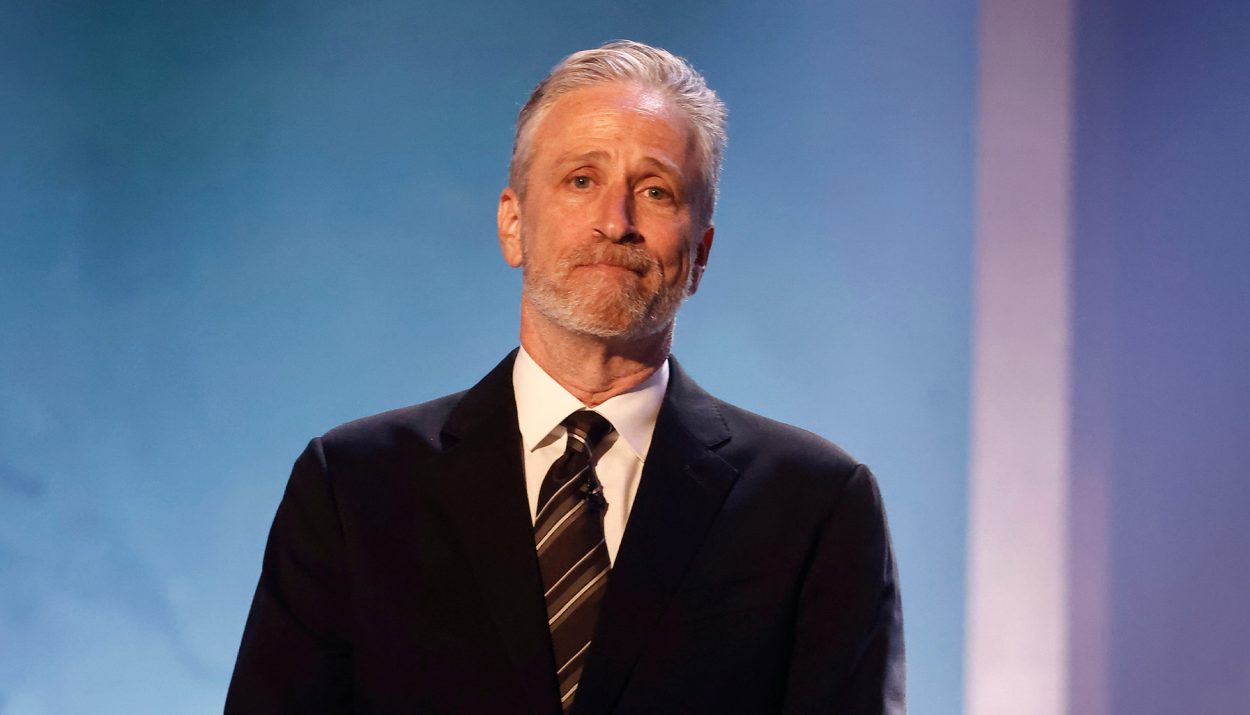

When it comes to the civil fraud case surrounding former President Donald Trump and allegations of asset overvaluation, public figures have expressed a range of opinions. “The Daily Show” host Jon Stewart recently criticized “Shark Tank” star Kevin O’Leary for downplaying the case’s impact.

Stewart challenged O’Leary’s view that no victims were involved, arguing that banks and taxpayers suffered from Trump’s practices. In response, some online voices pointed to Stewart’s own experience selling a New York City penthouse for over 800% more than its estimated market value years ago.

Stewart Slams Trump Over Alleged Asset Overvaluation

Jon Stewart recently called out former President Donald Trump over allegations of inflating the value of assets, deeming such acts “not victimless crimes.”

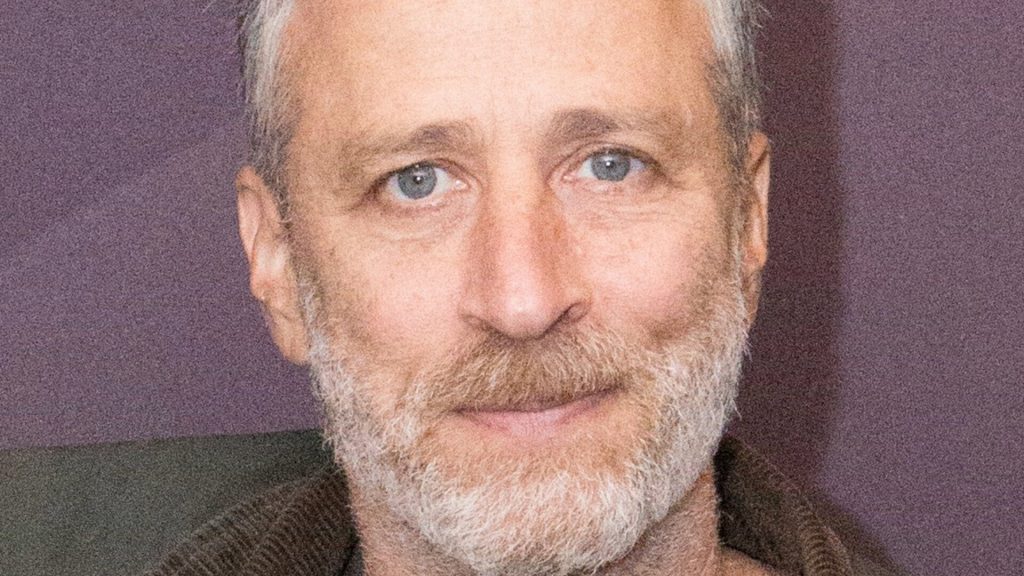

However, some critics quickly pointed out that Stewart himself sold a New York City penthouse in 2014 for nearly 829% above its estimated market value.

An $17.5 Million Penthouse

According to city records, Stewart’s Tribeca penthouse had an estimated market value of $1.88 million in 2013-2014.

Yet, Stewart sold the property for $17.5 million – more than eight times the estimated value. The significant difference led some to claim Stewart had also overvalued his assets.

Real Estate Complexities

The real estate market is complex, and many factors impact a property’s selling price. An estimated market value represents what assessors believe a property could reasonably sell for under normal market conditions.

The final selling price depends on the motivations and means of both the buyer and seller at the time of the transaction.

Critics Point to Stewart’s Own NYC Penthouse Sale

According to critics, Jon Stewart’s criticisms of Trump’s practices ring hollow when considering Stewart’s own experiences with property valuation.

Some saw this as evidence of overvaluation. Political commentator Tim Pool, for instance, asked whether Stewart committed fraud by selling his penthouse at such an inflated price. “Did @jonstewart commit fraud when he sold his penthouse for $17.5M?” Pool tweeted. “NY listed its market value at $1.8M and AV at around 800k. Who did he defraud?? I am SHOCKED.”

Some Argue Critics Are Holding Stewart To Unfair Double Standards

Public figures like Stewart face extra scrutiny in all areas of their lives. However, minor issues from years past should not invalidate their current stances or suggestions.

Critics combing through old news stories to find “gotcha” moments risk creating false equivalences and distraction from real issues.

Market Dynamics and Appraisal Challenges

The large difference between the estimated value and sale price doesn’t necessarily mean Stewart overvalued his property. Real estate values depend on market dynamics at the time of sale.

Source: Housing

Property appraisals also have limitations and don’t always accurately reflect a home’s market value. Appraisals consider attributes like square footage, amenities, and recent sales of comparable properties.

Victims Of The Sale

There is no evidence the sale created any victims. The buyer willingly paid the asking price for the property.

While the city’s tax assessment may have been lower, there were likely no lost tax revenues since the assessment would have increased to reflect the new, higher property value.

Assessor Estimates Don’t Dictate Sale Prices

As the saying goes, a property is worth what someone is willing to pay for it. This maxim is important to keep in mind when considering the criticism leveled at Jon Stewart regarding the 2014 sale of his Tribeca penthouse.

According to the New York City tax assessor, the penthouse had an estimated market value of $1.88 million at the time. However, Stewart was able to find a buyer willing to pay $17.5 million for the property—a figure that led some critics to claim Stewart had “overvalued” the home by a whopping 829%.

Variables Like Location Can Boost Property Values

Location plays a significant role in determining a property’s value. Properties in desirable neighborhoods or areas experiencing growth often sell at a premium.

When Stewart listed his Tribeca penthouse, the downtown Manhattan neighborhood was an up-and-coming area attracting interest from buyers.

Stewart Penthouse Features Attarct High-end Buyers

A property like Stewart’s, with distinctive features that set it apart, may attract particular interest from high-end buyers.

According to reports, the 3,000-square-foot penthouse boasted three bedrooms, four bathrooms, and a landscaped rooftop terrace with an outdoor kitchen.

Critics Miss Important Nuance

While critics were quick to accuse Stewart of hypocrisy and fraud, the nuances of real estate valuation and sales show the issue is more complex.

The massive difference between Stewart’s penthouse’s estimated value and sale price, on its own, doesn’t prove he deliberately overvalued or defrauded anyone.

Buyers Dictate Final Sale Prices

In the end, a property is worth what a willing, able buyer will pay. Stewart did not determine the $17.5 million sale price—the buyer did.

While the price may have seemed high compared to outdated estimates, for that particular buyer, the unique features and prestige of the penthouse merited the multi-million dollar premium.

Lack of Further Context

The information available about Stewart’s real estate transactions is limited, preventing a full understanding of the situation.

The details of the property itself, its amenities and updates, and additional terms of the sale haven’t been disclosed. Stewart himself hasn’t provided public comment clarifying the details of the deal.

When Higher Sale Prices Don’t Equal Overvaluation

A higher sale price for a property doesn’t necessarily mean the seller overvalued the asset. In the real estate market, the final selling price depends on a variety of factors, including current market conditions and the motivations of the buyer and seller.

Though critics may allege hypocrisy, real estate valuations involve nuance. Assessing fraud requires a careful analysis of intent and actions.