Former President Donald Trump recently criticized President Joe Biden over rising prices, claiming that inflation has soared to “over 50%” in the past few years. However, economic data suggests that Trump’s claims are exaggerated. In this article, we’ll explore the true impact of inflation since Biden took office in 2021 and how it compares to wage growth.

Trump’s False Claims About Inflation

In a recent appearance on CNBC’s “Squawk Box,” Donald Trump claimed that people are “going through hell” due to rising prices, with energy and food costs “through the roof.” He falsely stated that cumulative inflation had increased by as much as “over 50%” in the past few years. However, economic data shows that Trump is overstating the rise in inflation.

While inflation has indeed hit Americans hard in recent years, cumulative inflation has risen by 18% since 2021, when Biden took office. This figure is based on consumer price index data, which measures the cost of everyday items that Americans typically purchase.

Understanding Cumulative Inflation

The most common benchmark for inflation is the year-over-year rate, which currently stands at 3.1%, as measured by the CPI index. This rate has been steadily decreasing from its peak of 9.1% in June 2022, the highest since November 1981. However, the year-over-year rate can sometimes obscure the true impact of rising inflation over an extended period.

Cumulative inflation, on the other hand, measures the total increase in the price of goods and services over a specific period. Looking at cumulative inflation since January 2021, when Biden took office, the rate of CPI price growth is 18%. This translates to a yearly average of 6%, which is still well above the Federal Reserve’s target of 2%.

Signs of Improvement in Inflation

Despite the surge in prices over the past few years, there are indications that the worst of inflation may be behind us. One promising sign is that wage growth has outpaced inflation since May 2023. If this trend continues, the total gap between household buying power and inflation is expected to close in late 2024, according to Bankrate.

Based on these estimates, cumulative wage gains since January 2021 will be around 20%. Recent data supports this trend, with the wage growth rate increasing by 5% in January 2024, as measured by the Atlanta Fed’s Wage Growth Tracker, a three-month moving average of nominal wage growth for individuals. Before the pandemic, the rate of wage growth was closer to 3.5%.

Consumer Optimism on the Rise

The recent surge in consumer optimism since December, as measured by the University of Michigan Surveys of Consumers, may be attributed to more raises and slowing inflation. While still 20 percentage points lower than it was in 2019, the 29% increase in consumer optimism is a positive sign for the economy.

Wage gains vary widely by industry, but economists from the U.S. Department of the Treasury note that middle-income and lower-income households have been the most affected so far. As wage growth continues to outpace inflation, more Americans may feel relief from the financial pressures they’ve experienced in recent years.

Inflation’s Impact on Everyday Americans

While cumulative inflation has risen by 18% since Biden took office, the impact on individual households can vary greatly depending on their spending habits and income levels. Lower-income families, who often spend a larger portion of their budget on necessities like food and energy, may feel the effects of inflation more acutely.

On the other hand, higher-income households with more discretionary spending may be better equipped to absorb the increased costs of goods and services. As wage growth continues to outpace inflation, more Americans across the income spectrum may start to see their purchasing power improve.

The Federal Reserve’s Role in Combating Inflation

The Federal Reserve plays a crucial role in managing inflation by setting monetary policy and adjusting interest rates. In response to the high inflation rates experienced in recent years, the Fed has been gradually raising interest rates to slow down economic growth and curb rising prices.

However, Federal Reserve Chair Jerome Powell has cautioned that progress against inflation is “not assured,” highlighting the need for continued vigilance and policy adjustments. As the Fed navigates the delicate balance between controlling inflation and maintaining economic stability, Americans will be watching closely to see how their financial situations are impacted.

Comparing Inflation Across Presidential Administrations

While Trump has been critical of Biden’s handling of inflation, it’s important to note that inflation rates can be influenced by a variety of factors, many of which are beyond the direct control of the president. Economic policies, global events, and supply chain disruptions can all contribute to rising prices.

Looking at historical data, inflation rates have fluctuated under both Democratic and Republican administrations. It’s crucial to consider the broader economic context and long-term trends when evaluating the impact of inflation on the average American’s wallet.

The Pandemic’s Role in Driving Inflation

The COVID-19 pandemic has had a significant impact on the global economy, contributing to supply chain disruptions, labor shortages, and shifts in consumer behavior. These factors have played a role in driving up prices for goods and services, exacerbating inflationary pressures.

As the world continues to navigate the economic fallout from the pandemic, inflation will likely remain a concern for policymakers and consumers alike. Adapting to the new economic reality will require a coordinated effort from governments, businesses, and individuals.

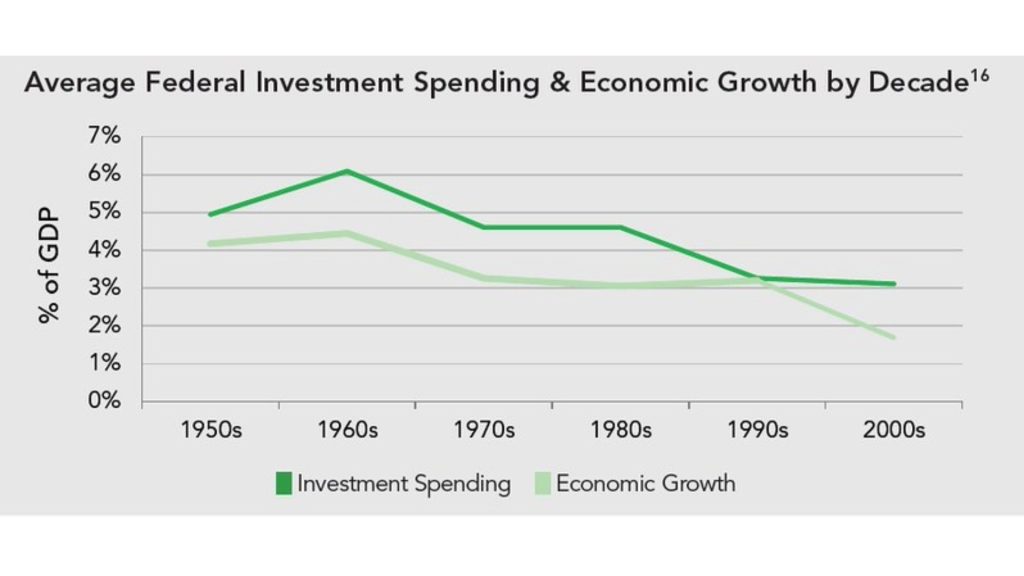

The Relationship Between Inflation and Economic Growth

While high inflation rates can be a cause for concern, it’s important to recognize that a certain level of inflation is often viewed as a sign of a healthy, growing economy. When an economy is expanding, businesses may raise prices to keep up with increased demand for goods and services.

However, when inflation rates exceed the Federal Reserve’s target of 2% for an extended period, it can erode the purchasing power of consumers and lead to economic instability. Finding the right balance between growth and price stability is a key challenge for policymakers.

The Importance of Financial Planning in an Inflationary Environment

As Americans navigate an economy with elevated inflation rates, personal financial planning becomes even more crucial. Strategies such as budgeting, saving, and investing can help individuals and families weather the impact of rising prices on their finances.

Seeking the advice of financial professionals, such as financial advisors or certified public accountants, can provide valuable guidance on how to adapt one’s financial plan to an inflationary environment. Building an emergency fund, diversifying investments, and considering inflation-protected securities are just a few examples of strategies that can help mitigate the effects of inflation on personal finances.

The Global Context of Inflation

Inflation is not unique to the United States; many countries around the world are grappling with rising prices in the wake of the pandemic and other global economic challenges. Comparing inflation rates and policy responses across different nations can provide valuable insights into the global economic landscape.

As the world becomes increasingly interconnected, the actions taken by major economies to address inflation can have far-reaching consequences. International cooperation and coordination will be essential in navigating the complex challenges posed by inflation in the coming years.

The Long-Term Outlook for Inflation

While the current inflationary environment has caused concern for many Americans, it’s important to consider the long-term outlook for prices and economic growth. As the world continues to recover from the pandemic and supply chains stabilize, many economists predict that inflation rates will gradually return to more manageable levels.

However, the path to price stability may not be smooth, and there may be periods of volatility along the way. Staying informed about economic trends, policy decisions, and personal finance strategies can help individuals and families navigate the uncertainties of an inflationary environment.

Balancing Inflation Concerns with Economic Optimism

While inflation has been a dominant economic concern in recent years, it’s important not to lose sight of the broader economic picture. Many indicators, such as low unemployment rates, rising wages, and strong consumer spending, suggest that the U.S. economy is on a path to recovery.

As policymakers work to address the challenges posed by inflation, Americans can take steps to protect their financial well-being while also remaining optimistic about the future. By staying informed, adaptable, and proactive, individuals and families can navigate the complexities of an ever-changing economic landscape.

The Bottom Line: Understanding Inflation in Context

Donald Trump’s recent claims about inflation rates since President Biden took office are exaggerated, according to economic data. While cumulative inflation has indeed risen by 18% since January 2021, this figure is far lower than the “over 50%” claimed by the former president.

As Americans continue to feel the impact of rising prices on their daily lives, it’s crucial to understand inflation in the context of broader economic trends, policy decisions, and personal financial strategies. By staying informed and adaptable, individuals and families can navigate the challenges posed by inflation while working towards long-term financial security and well-being.