Many fast food restaurant workers throughout California will receive a higher wage effective April 1 due to the increase of the minimum wage to $20 an hour. The change will affect employees of chains that have more than 60 nationwide locations.

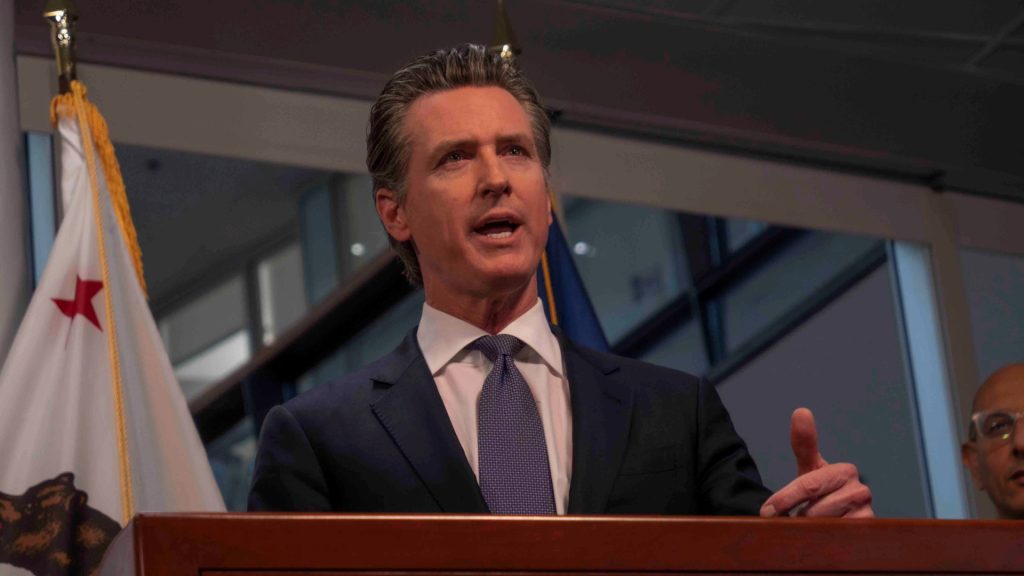

Governor-Signed AB 1228 Includes One-Time Boost, Inflationary Adjustments

Assembly Bill (AB) 1228, which was signed by California Governor Gavin Newsom in September, is the reason for the minimum wage increase that will go into effect April 1. The law prohibits any different local minimum wage from being used for all covered restaurants.

According to the law, the fast food council also has the right to increase the minimum wage annually up to a maximum 3.5% starting in 2025. The increase is reportedly subject to an annual cap that is associated with the Consumer Price Index.

AB 1228 Versus The Original AB 257 (FAST Act)

Newsom originally signed the Food Accountability & Standard Recovery (FAST) Act, which was also referred to as “Assembly Bill 257,” last year. The FAST Act attempted to boost the minimum wage in California to $22 an hour and establish a new state commission responsible for regulating industry work conditions.

Key industry players challenged the legislation, which led to the proposal of new legislation and a reached compromise. AB 1228 repealed the FAST Act when it was signed into law and replaced all other related provisions.

Fast Food Council Can Recommend Health And Safety Regulations

The new law will help the Fast Food Council to recommend new regulations related to safety and health working conditions, protected leave options, and security. There are also provisions related to discrimination and harassment.

Included within the negotiations for the new law was the requirement that franchise corporations cannot be held liable for the workplace violations conducted by individual franchisees. In addition, the Council cannot regulate vacation, paid sick leave, or predictable scheduling options that apply to franchisees.

Quick-Service And Fast-Casual Operators Covered By New Law

The new law impacts fast-casual operators (such as Chipotle) in addition to quick-service restaurants (such as Burger King and McDonald’s.) However, the bill excludes bakeries and restaurants that operated by and located inside of grocery stores.

The wording of AB 1228 specifically focuses on restaurants that are primarily engaged in the provision of food and beverages “for immediate consumption” either on or off the premises. These covered restaurants typically have patrons select menu items in advance of consumption with limited table service, if any.

Analyst Predicts ‘Majority’ Of Covered Restaurants To Raise Prices

William Blair Analyst Sharon Zackfia shared her predictions related to AB 1228 during an interview with Business Insider. Zackfia expects that the “vast, vast majority” of the restaurants covered by this new law will “raise prices in California.”

Jefferies Analyst Andy Barish had a similar response, adding that “unfortunately the consumer’s going to have to bear it.” Other analysts project that menu prices could increase between the mid-single to low-double digits.

AB 610 Added Eight Exemptions From ‘Fast Food Restaurant’ Definition

Assembly Member Chris Holden introduced Assembly Bill 610 on January 29, which added eight exemptions to consider from the standard “fast food restaurant” definition. These exemptions included restaurants and similar establishments located in airports, hotels, event centers, and theme parks.

Museums (public or private) and gambling establishments were also included within the exemption. These exemptions expanded the list that originally excluded bakeries from new law coverage.

McDonalds CEO Believes Impact Will ‘Hit All’ Competitors

McDonald’s CEO Chris Kempczinski did not hold back from discussing the new law with investors in October. According to Kempczinski, the new law presented McDonald’s with the chance to “gain share” since “this is an impact that’s going to hit all of [their] competitors.”

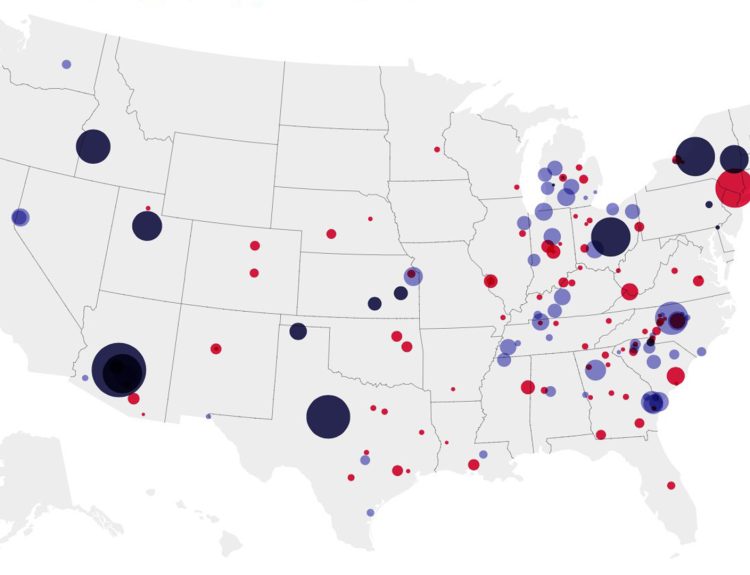

Kempczinski also expressed his belief that McDonald’s was in a “better position” to “weather” the new law in comparison to their competitors. One report shows that, as of April 2022, McDonald’s controlled nearly 44% of the fast food market share in the United States.

Size Will Matter With Varying Impact On Restaurants

There clearly will not be one uniform price increase that impacts all covered restaurants the same. Smaller chains or even the covered restaurants that operate exclusively in California may experience higher increases in their menu item pricing.

This is simply because they do not have the number of restaurants outside of California that their bigger competitors have to efficiently absorb the financial blow delivered by this new law.

Why Suburban Chains May Feel Impact More Than Urban Locations

Studies have shown that most of the fast food chains located in urban areas mostly already pay considerably high pay rates to their employees. Therefore, the increase to $20 an hour will not affect them as much as the locations in suburban cities that stuck with the previously enforced minimum wage of only $16 per hour.

This includes the suburban restaurants who likely will feel the impact of this new law more than their competitors.

The Ripple Effect Of Possible Pay Raises For Other Employees

Increasing the minimum hourly wage for covered restaurant workers will undoubtedly create a ripple effect that has a lasting impact on other industries throughout the state. For instance, supervisory workers within the covered restaurants will likely receive raises to retain higher pay rates than their lowest-paid employees.

In addition, other industries will need to consider increasing their own pay rates to remain competitive in the job market. Quite a few people will likely change their career paths based on the enactment of this new law alone.

People Could Dine Out Less And Cook At Home Instead, Analyst Claims

Jon Tower, a Citi analyst, was quoted as saying that there is a “good chance” that the new law “translates into weaker footfall.” This essentially means that fast food restaurants will experience a decline in foot traffic – especially after the wage increase affects menu option prices.

Tower believes that it would strongly encourage customers to cook at home instead of going out to eat. Andy Barish indicated that it is still “really tough to tell where consumers are going to trade.”

Analyst Projects That Digital Order Kiosks Will Spread ‘Even More Quickly‘

Zackfia projects that digital order kiosks will start to be used even more now than ever before as a result of the new law. Restaurants were already using this technology to reduce labor costs and increase order accuracy.

Zackfia believes that this technology will be used even more and expand throughout the state.

Value Menus Will Likely Receive More Promotions By Covered Restaurants

Value menu items will more than likely receive a major spotlight by covered restaurants, especially after the inevitable menu price increases become effective.

Multiple analysts predict that these value menus will be used to attract new customers and retain existing customers.