The state of California is facing a mass exodus as many of its wealthiest residents are packing up and running for the hills. Let’s take a look into why the state has been experiencing such a huge decline in its population.

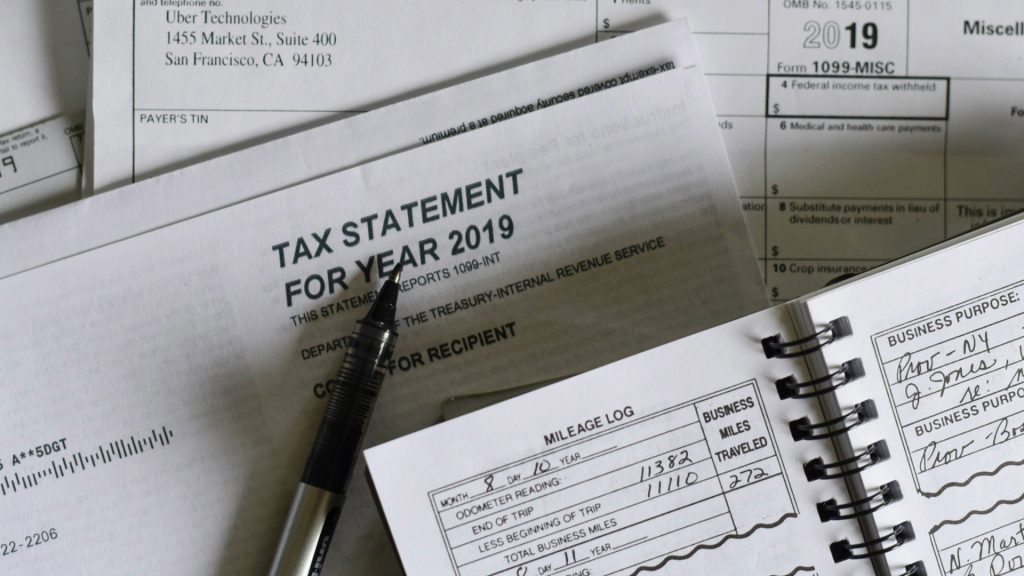

The Top 1% Contributes To 40% Of The Total Personal Income Tax Revenue

Unfortunately the wealthiest occupants of California are assuming a massive portion of the state’s tax bill. With 1% of the states richest contributing to a staggering 40% of all personal income tax receipts.

The loss of this income will lead to government programs and services being done away with.

Saying Bye To The Golden State

Recent statistics derived from the U.S. Census Bureau have shown that people are fleeing the state by the thousands, most of which were high earners.

Adding to the ongoing decline in population in the state of California.

Substantial Decline Of Over 27,300 High-Income Tax Returns

Even Though the migration of the wealthy part of the population isn’t new news, it has significantly increased recently.

Between 2020 and 2021 the state lost over 27,300 high-income tax returns according to IRS statistics. Leading to the conclusion of the large-scale departure of the wealthiest taxpayers in California.

The State Has Lost Close To 75,400 Residents Over the Past Year

In the last year alone California has seen a decrease in its population of around 75,400, most of which were considered to be among the rich. This has created a huge shift in the state’s demographic.

The extreme decline has raised concerns for the possible implications on the state’s long-term financial and economic stability.

What Is Causing This Decline In Population and Revenue?

The state of California relies very heavily on the financial support from high-income taxpayers to pay for essential services such as healthcare and education. The decline in the wealthy population has created a significant imbalance, putting these services in jeopardy.

It is a difficult issue to address because of the population decline and significant loss in revenue.

An Astonishing $68 Billion Deficit Projected

The bottom line is that the state of California’s financial situation isn’t looking good. If adequate actions aren’t made, analysts are predicting a staggering $68 billion deficit for the following year.

The decline in tax revenue, primarily from income taxes, which has seen a 25% drop in collections from the previous fiscal year, is directly correlated to the potential deficit.

Residents Seek Better Lives Elsewhere

The truth is the cost of living is significantly higher in California than it is in other states, if you combine this with a more competitive market and remote employment opportunities elsewhere, you end up with locals looking for greener pastures.

Residents of California are simply relocating in search of better opportunities, especially those that have higher incomes. After all they didn’t become rich by wasting it all on monetary living.

How To Stop The Budget Bleed

So the question is, how do policymakers stop the budget bleeding?

Some consider the option of drawing from the state’s financial reserves, exploring ways to bring high earners back to the state, and cutting expenses.

Cut Expenditure On Proposition 98

Proposition 98 is a program that ensures a specific level of financing for K-12 education in California. Policy makers have suggested spending less on this proposition as a way to address the current budget imbalance.

Cutting a program like this runs the risk of having significant effects on future job training programs and quality education.

The Benefit Of Working Remotely

The pandemic has created a new work environment that is predominantly remote, virtually enabling those that do work remotely to work from anywhere they want.

Because of this fact, many professionals are looking to live in places where they can enjoy a better quality of life with a much lower cost of living.

7 Other States That Saw A Population Decline Last Year

California isn’t alone in this decrease of population. There was a decline in populations in seven other states last year, clearly indicating a much larger demographic change in our country.

The state of California has $24 billion in reserves, which could be pivotal in addressing the state’s current fiscal imbalance. However, dipping into these reserves is a band-aid and doesn’t address the core concerns that are causing population reduction and revenue loss.

The High Tax Rate Is Causing High-Income Earners To Leave California

Some of the state’s higher earners are saying that California’s high tax rates are causing them to not want to live there.

People are seeking out tax relief in regions that are more tax-friendly, bringing into question whether or not California is still able to compete with other states that provide more tax-friendly conditions.

Rough Roads Ahead For California

California is facing some pretty difficult decision making if it wants to put an end to the decline of its population and get a hold on its financial issues.

To ensure the long-term prosperity of the state and to lure high-income earners back in, long term sustainable solutions are a necessity.