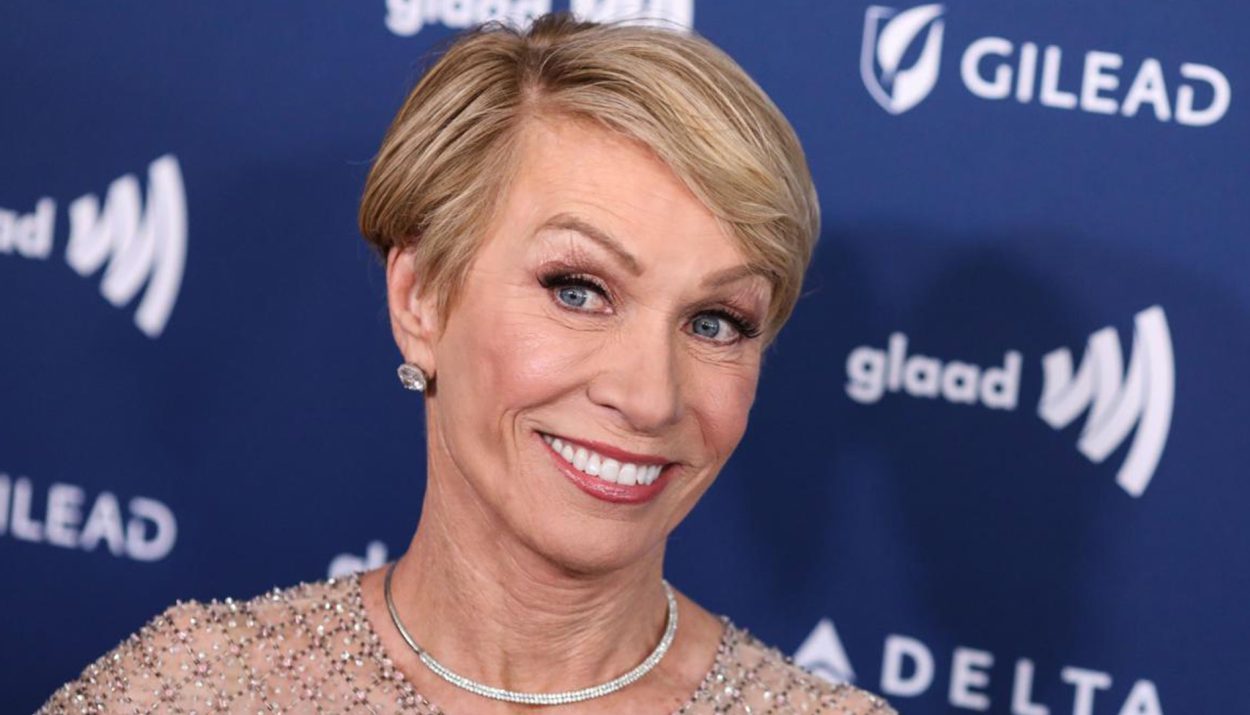

Barbara Corcoran, the savvy “Shark Tank” investor, has a bold forecast for the housing market. She believes a magic number will trigger a buying frenzy, sending prices soaring. Discover what this critical threshold is and how you can prepare for the potential surge in demand and prices. Buckle up, because Corcoran’s insights might just change your homebuying strategy.

Anxious Americans Await Lower Mortgage Rates

Many potential homebuyers are currently on the sidelines, eagerly waiting for mortgage rates to drop from their current level above 7%. However, Barbara Corcoran cautions that holding out for lower financing costs might not yield the benefits buyers expect. She predicts that if rates fall by just one more percentage point, it could ignite a buying frenzy.

Corcoran explains, “If rates go down just another percentage point — that’s what I’m hoping for by year-end — prices are going to go through the roof because everyone will come out and buy. Everybody’s going to charge the market.”

The Magic Number That Could Trigger a Buying Frenzy

According to Corcoran, there’s a specific mortgage rate that could entice hesitant buyers to flood the market, driving up demand and causing home prices to escalate further. This magic number, she believes, is just one percentage point lower than the current rates.

The median home sale price currently stands at around $374,500, a 4.6% increase from last year, according to Redfin data. Corcoran warns, “If you wait for interest rates to come down by another point, I don’t think you’ll gain — I think you’ll wind up paying more.”

Experts Predict Mortgage Rate Drops

Several experts anticipate that mortgage rates will indeed drop later this year. The Mortgage Bankers Association forecasts rates will end at 6.1% by the end of 2024, while Fannie Mae expects them to dip to 5.9% during the fourth quarter.

These predictions are based on the expectation that the Federal Reserve will introduce cuts to the federal funds rate, which would have a ripple effect on home loan rates. However, even with lower financing costs and increased supply, home price appreciation may continue to outpace income growth.

The Supply and Demand Dilemma

Analysts at Wells Fargo point out that while lower mortgage rates and a boost in housing supply could help turn around the slump in home sales, the recovery will be limited by the fact that home price growth continues to surpass income growth.

The analysts state, “This dynamic, which is unlikely to change materially, ultimately stands to exert upward pressure on home prices and keep homeownership costs elevated.” In other words, even with lower rates, affordability challenges may persist.

Corcoran’s Advice: Act Sooner Rather Than Later

Given her predictions, Barbara Corcoran encourages Americans to consider buying sooner rather than later to avoid the potential surge in demand and prices when mortgage rates eventually fall. She believes that waiting for lower rates might not yield the savings buyers hope for.

In an interview on ABC News, Corcoran advised, “Find yourself a great broker who knows how to hustle because there’s always a deal to be had — no exceptions to that rule.” She also recommends getting pre-approved for a mortgage to demonstrate to sellers that you’re a serious buyer.

The Refinancing Strategy

For those who have the means to purchase a home now, Corcoran suggests a strategy of buying at current rates and refinancing when mortgage rates drop in the future. This approach allows buyers to secure a property before the anticipated surge in demand and prices.

However, it’s important to note that this strategy involves some risk, as there’s no guarantee that mortgage rates will fall as expected. Additionally, not everyone has the financial resources to buy a home at the current rates.

Alternative Real Estate Investment Options

For those who can’t afford to buy a home right now or are hesitant to take on the risk of higher rates, there are still ways to invest in real estate. One option is to invest in shares of vacation homes or rental properties, allowing you to benefit from the potential appreciation without the full cost of ownership.

Another avenue to consider is investing in commercial real estate by purchasing shares in institutional-quality properties leased by well-known national brands. This approach provides exposure to the real estate market without the need to buy an entire property directly.

The Emotional Aspect of Homebuying

While financial considerations are crucial, Corcoran also acknowledges the emotional aspect of homebuying. For many people, a home is more than just an investment; it’s a place to build memories and create a sense of stability.

She encourages buyers to think about their long-term goals and what they truly want in a home. It’s important to find a balance between the financial realities and the emotional desires when making such a significant purchase.

The Role of Location in Home Values

When considering a home purchase, location plays a significant role in determining the property’s value and appreciation potential. Corcoran advises buyers to research the local market, looking at factors such as school districts, crime rates, and nearby amenities.

She also suggests considering up-and-coming areas that may offer more affordable prices now but have the potential for significant growth in the future. Working with a local real estate agent can provide valuable insights into the best locations to invest in.

The Impact of Remote Work on Housing Preferences

The rise of remote work has changed the way many people think about their living arrangements. With the ability to work from anywhere, some buyers are opting for larger homes in more affordable areas, trading longer commutes for more space and amenities.

Corcoran notes that this trend could impact the demand for certain types of properties and locations. Buyers should consider their work situation and lifestyle preferences when choosing a home.

The Potential for a Market Correction

While Corcoran predicts that lower mortgage rates could lead to a surge in demand and prices, she also acknowledges the possibility of a market correction in the future. Economic factors such as inflation, job market changes, and shifts in consumer confidence could all impact the housing market.

She advises buyers to be aware of these potential risks and to make decisions based on their financial situations and long-term goals. It’s important to have a plan in place for various market scenarios.

The Value of Professional Advice

Navigating the complex world of real estate can be challenging, especially in a rapidly changing market. Corcoran emphasizes the importance of seeking professional advice from experienced real estate agents, mortgage brokers, and financial advisors.

These experts can provide valuable guidance on market trends, financing options, and investment strategies. They can also help buyers make informed decisions based on their unique circumstances and goals.