The commercial real estate market is facing an uncertain future according to a new prediction from Donald Trump’s personal attorney. With properties sitting vacant and rents falling across the country, it seems the boom times of the last decade could be coming to an abrupt end.

This attorney cites insider knowledge of Trump’s own real estate empire as evidence for the coming downturn. Their dire forecast calls into question the stability of a massive asset class and its ability to provide returns. With trillions in commercial real estate loans outstanding, the implications of this prediction extend far beyond just property owners.

Attorney Predicts Commercial Real Estate Market Collapse

According to Chris Kise, an attorney for Donald Trump, the commercial real estate market in the U.S. is on the brink of collapse. Kise predicts widespread defaults and distressed properties over the next year and a half, especially in major cities.

Unlike Trump, Kise notes, most commercial real estate developers carry high debt loads, leaving them vulnerable should property values decline or interest rates rise. In contrast, Trump’s real estate company is in a strong position to weather a downturn, according to Kise.

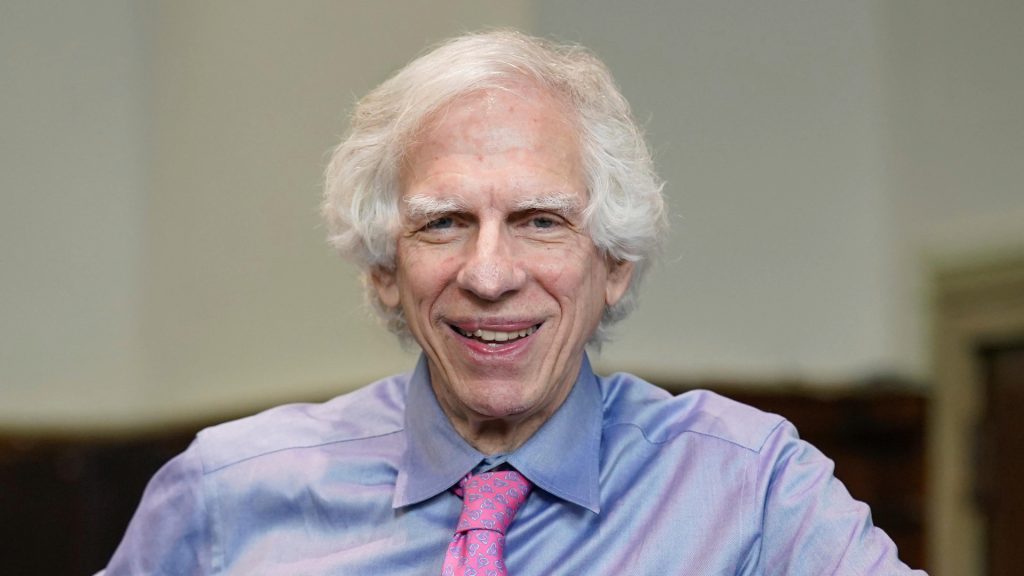

Appeal Possible to Overturn Engoron’s Ruling

Legal experts indicate Trump may succeed in appealing the $355 million penalty imposed by Judge Arthur Engoron. According to attorney Colleen Kerwick, Engoron failed to prove all the elements of fraud, as there was no clear victim.

The “preponderance of evidence” standard Engoron cited is lower than the “clear and convincing evidence” typically required in civil fraud cases. Syracuse University law professor Greg Germain agrees the case for victim reliance on Trump’s financial statements seems weak. If the appeal is successful, Trump’s real estate business would avoid the 3-year ban on serving as an officer of New York corporations included in Engoron’s ruling.

Debt Loads and Interest Rates

According to Newsweek, $929 billion of outstanding commercial mortgages will mature in 2024, representing 20 percent of total debt in the sector. If interest rates remain high and property values do not improve, default rates could reach or surpass those seen during the Great Recession, according to Columbia Business School professor Tomasz Piskorski.

High debt loads combined with rising interest rates place significant financial pressure on commercial property owners and increase the likelihood of default. The recent $355 million penalty against former President Donald Trump in a civil fraud case brought by the New York Attorney General could undermine confidence in the commercial real estate market.

Economic Conditions

The commercial real estate market is closely tied to overall economic conditions. A downturn in the economy, decline in business investment or consumer spending, or rise in unemployment could reduce demand for commercial space and place downward pressure on rents and property values.

While current economic indicators remain relatively stable, the potential impacts of rising inflation, supply chain issues, or geopolitical events like the war in Ukraine introduce risks that could spill over into commercial real estate.

Impact on Office Space and Retail Sectors

The imminent collapse of the commercial real estate market will have a devastating impact on the office space sector. According to extracts from Newsweek, roughly $929 billion of outstanding commercial mortgages are set to mature in 2024, representing 20% of total debt.

If interest rates remain high and property values do not improve, default rates could match or exceed those seen during the Great Recession. The retail sector is also poised to suffer from a commercial real estate downturn. Brick-and-mortar retailers already face immense pressure from e-commerce competitors and changing consumer preferences.

Regions Most at Risk for Commercial Real Estate Decline

Major cities with high costs of living and doing business, such as New York and San Francisco, are particularly vulnerable to commercial real estate distress. Suburban office markets are also at risk. These areas experienced overbuilding in the years leading up to the Great Recession of 2008.

While the markets recovered, many offices were left vacant. With more companies embracing remote work, the demand for suburban office space has declined. As leases come up for renewal, building owners may face challenges finding new tenants. This could lead to a drop in property values and issues repaying loans.

Strategies for Weathering the Commercial Real Estate Storm

According to Trump’s attorney, Chris Kise, Trump’s ability to withstand market turmoil is due to his lack of debt relative to the value of his assets. Developers should aim to minimize debt and ensure their balance sheets demonstrate a healthy ratio of assets to liabilities. Highly leveraged properties will struggle the most in a market downturn as interest rates rise and property values decline.

If faced with legal judgments that could significantly impact business operations, pursuing appeals may be prudent. For example, Trump plans to appeal the $355 million penalty imposed by Judge Engoron, arguing the judgment was too harsh given the lack of identifiable victims.

Diversify Holdings To Brace Your Investment

Commercial real estate companies would benefit from diversifying their portfolios across property types, locations, and risk profiles. A diversified portfolio is less susceptible to downturns impacting any single sector or region.

As interest rates rise and certain property values decline, other types of commercial real estate may remain stable or even appreciate in value. Geographic diversification also mitigates location-specific risks like natural disasters, economic shifts, or oversupply issues.

Opportunities Amidst Commercial Real Estate Turmoil

The impending turmoil in the commercial real estate market could present lucrative opportunities for investors and developers. According to legal experts and analysts, a collapse in the commercial property sector is likely within the next 12 to 18 months.

While New York authorities aim to penalize Trump, Kise argued that Trump is one of the few developers capable of weathering an impending market collapse. With many overleveraged properties at risk of defaulting, the market turmoil could provide an opening for debt-free developers and investors to acquire distressed assets at a discount.

What the Commercial Real Estate Collapse Means for Investors

A collapse in the commercial real estate market could have major implications for investors. According to legal experts, if interest rates remain high and property values do not improve, default rates could reach or surpass those seen during the Great Recession.

One expert foresees default rates even higher than those in the Great Recession if the commercial real estate market worsens. This could significantly impact investors who have funds tied up in the commercial real estate. Property owners may default on loans, leaving lenders with distressed assets and investors with devalued holdings.