California may be the land of dreams, but for the ultra-rich who have invested in luxury real estate, their dreams of selling their homes for a profit are quickly becoming Californian nightmares. So what’s causing this real estate disaster? And why is the government getting the bulk of the blame?

Real Estate Recovery Post-Pandemic

Like almost all other industries, Covid brought the luxury real estate industry to a halt. There were no more viewings and a significant reduction in sales. In fact, a 43.5% sales drop was reported between the second quarter of 2019 and 2020.

But as the shutdown ended, the industry crawled back to life. Though sales numbers didn’t quite get back to pre-pandemic times, the Californian luxury real estate industry still boasted pretty impressive post-pandemic sales. That was, until April 2023 when the government enacted something industry professionals had been dreading for months.

The 5 Million Dollar Tax

On April 1st, 2023, Los Angeles County enacted ‘Measure ULA’, otherwise known as the ‘Mansion Tax’. Similar to mansion taxes in other states like New York and Hawaii, this tax would come into effect for any property sold for an amount above 5 million dollars.

For sales above $5 million, sellers are now expected to pay an additional 4% ‘mansion tax’, while sales above $10 million, attract a 5.5% ‘mansion tax’. This tax measure was overwhelmingly voted in by California residents to increase revenue for homelessness prevention and other housing projects.

Political Promises Are Never What They Seem

Leading up to the vote for Measure ULA, pro-tax campaigns promised that the measure would generate anywhere from $875 million to $923 million annually. But as with many political promises, things were not quite as they appeared.

By mid-March, a Los Angeles city officer reported that the revenue from the mansion tax was projected downwards to around $672 million annually. This new figure took into account market reactions to the new tax and higher interest rates that were not considered in the initial projections.

The Last Minute Sales Rush

As state officials were preparing for the inflow of mansion tax, the real estate industry was in a rush to beat the tax launch. Leading up to April 1st, there was a significant increase in luxury home sales as sellers rushed to avoid the tax with over $1.3 billion in sales being made in the last week of March 2023.

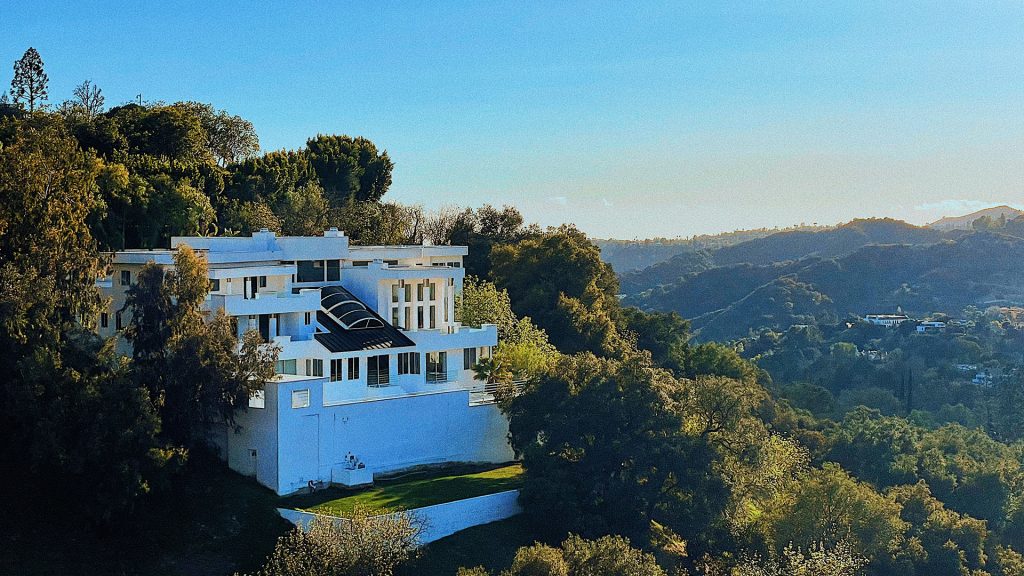

Even household names got in on the action. Mark Walberg closed the sale of his 30,500 square-foot mega mansion in February 2023. The sale closed at $55 million, $32.5 million less than he originally wanted. Brad Pitt sold his home in the Hollywood Hills for $39 million just days before the mansion tax came into effect. And then April 1st arrived.

The Sales Freeze

After April 1st, luxury real estate saw property sales with a price tag above $5 million plummet. In fact, according to CoStar Data, less than half a dozen commercial properties above $5 million were sold in the first few weeks of the tax

The ‘mansion tax’ was even addressed on the Netflix California-based reality show, Selling Sunset, with celebrity real estate agent, Nicole Young stating, ‘Those (tax percentages) are huge numbers and I think it’s a massive detriment to the real estate market as a whole’, and veteran Mary Fitzgerald stating ‘This is going to be a nightmare for us. We’re just screwed!’

They Couldn’t Have Picked A Worse Time

The enactment of the ‘mansion tax’ came against a backdrop of an already struggling real estate industry and a struggling economy. The increased cost of borrowing has not only deterred buyers from taking on large mortgages, but has caused hesitancy from sellers who don’t want to give up their low interest rate mortgages.

At the same time, house prices have been on the rise, further pushing buyers away. Many believe city officials did not properly consider this economic environment when pushing for the luxury market destroying tax.

Sellers Argue Their Case in Court And On The Street

In response, some sellers in turn have chosen to take their properties off the market and hold out for buyer appetite to return. There are also some who are holding out in hopes that the mansion tax will soon be a thing of the past if one of two things happen.

There is a lawsuit currently in court which, if successful, could see the tax ended and the city of Los Angeles giving the collected money back to the taxpayers. There is also The Taxpayer Protection and Government Accountability Act that could end the mansion tax if passed in the November 2024 ballot.

Making Real Estate Lemonade Out Of Lemons

While sellers hold out to see if the mansion tax will survive, some sellers have decided to take their properties off the market and rent them out instead. Many luxury homeowners do not live in these properties but rather use them as second homes, vacation homes, or investment properties.

This has made the renting of these properties a pretty painless experience. This uptick in luxury rentals has been recognized by Bloomberg and other leading real estate agencies and more and more luxury homes in the price range of $150,000 and above per month, are becoming available.

The Only Way Is Up! Right?

Despite the hits that the luxury real estate market has suffered. All hope is not lost. As The Institute for Luxury Home Marketing (ILHM) asserts, those able to purchase homes with high price tags will always do so, regardless of market hits. Likewise, those with luxury homes to sell will continue to do so.

But patience is key. Industry experts continue to predict continued growth in the market, especially in the state of prime properties; California. Wealthy families are increasing in number, international buyers are increasingly interested in investing in Californian real estate, and there is a strong track record of resilience in the luxury real estate market.

Sometimes, when going through a slump, the best thing you can do is sit back and let it play out.