Student debt forgiveness is a huge issue for the Biden administration. Biden has tried to push through legislation to enable loan forgiveness for some students in keeping with his campaign promises. However, some states are not pleased and have filed lawsuits against him. Let’s see the triggering actions.

Republican States Want to Halt Loan Forgiveness

Two lawsuits from eighteen combined states have been filed to stop the Biden administration from advancing its legislation to allow college debt loan forgiveness.

The suits were filed by Republican lawmakers in Red states and named Biden and the Education Department as defendants. They challenge the Saving on a Valuable Education (SAVE) plan.

Canceling Debt Since December 2023

Since its implementation in December 2023, the SAVE plan has helped over 150,000 students recover from their student debt. Over seven million people are enrolled in the plan.

While this seems like a good idea for students who are suffering crippling amounts of debt, some lawmakers see it as a wealth redistribution scheme and foisting the debt onto individual states.

Repayment Plans Covered By Congress Act

A 1993 act by Congress allowed the Education Department to create loans to help repay student debts. These loans would service the debt directly as students repaid over time.

Many of these states argue that Congress’s act doesn’t cover new plans like SAVE and only refers to the establishment of a repayment plan. The loan repayment is a source of income for some states.

Transforming Loans Into Grants

A loan is defined as something a borrower needs to repay, usually with interest added on as an incentive for the lender. Loans for college fall under this category, but the SAVE plan changes them.

According to the lawsuit filed by Kansas Attorney General Kris Kobach, the SAVE plan changes these loans into grants and claims that the president has no appropriation from Congress to do so.

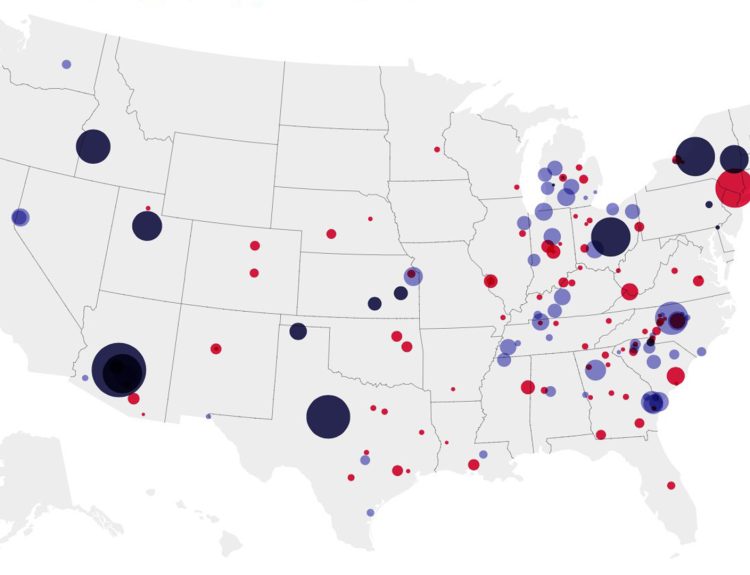

First Suit Backed By Many States

Several other states backed the first suit, including Utah, Texas, South Carolina, Nebraska, Montana, Louisiana, Iowa, Idaho, Alaska, and Alabama.

The Education Department has declined any comment on the case, but the Biden administration has stated that it will continue to seek relief for education loan holders.

Not The Only Lawsuit Involved

Missouri’s Attorney General Andrew Bailey filed the second lawsuit. Oklahoma, Ohio, North Dakota, Georgia, Florida, and Arkansas have signed on as part of this suit.

The second lawsuit makes a similar case to the first one but also states that the Missouri-based collection agency responsible for the loans, MOHELA, will face an imminent loss of revenue.

Moving the Debt To Unwilling Payers

Bailey argues that the president is taking actions that foist the payment for these loans onto the state, moving the burden of payment from the people who initially took these loans.

He states that this is the most recent example of the administration using decades-old legislation to justify making decisions on behalf of the taxpayer without their consent.

Debts Can’t Be Canceled, Only Redirected

Debt in the form of a loan usually involves a lender and a borrower. The borrower agrees to pay the amount on the loan, including an interest payment over time to make up the total amount.

Canceling a debt, like the Biden administration is trying to do, means writing the debt off, making it null and void. Yet the administration doesn’t own these debts. The individual states do.

Previous Debt Forgiveness Plans Were Trashed

This is the Biden administration’s second attempt to deliver on its promise of student debt forgiveness. Missouri was also instrumental in blocking the previous effort for loan forgiveness.

In June 2023, the Supreme Court struck down the Biden administration’s attempt as unconstitutional. The SAVE plan was adapted from the initial legislation.

An Obsessive Focus on College Education

Consistently, families have focused on sending their children to universities after high school to prepare them for the world of work. However, having a degree is no guarantee of employment.

Many university graduates can’t find jobs because the market is saturated with degrees. The result is that these people take out loans, hoping to land employment, only to be left in debt and unemployed.

Loan Forgiveness Targets The Interest

Some supporters of the SAVE plan and others like it say that loan forgiveness isn’t really forgiving the loan. They highlight that the administration is forgiving the interest.

This argument doesn’t make much difference. The state only offered the payment plans because it got income via interest from the loans. Losing that income could hobble the state.

Federal Government Can’t Repay the Loans Either

Some sources claim that the total loan amount taken from both private and public loan funding by students totals around $1.75 trillion. On average, a student owes around $28,950.

Based on the sheer amount of money needed to pay off these loans, the federal government can’t pay off the amount to the state on behalf of the students. So, the states will be left holding the bag.

Exorbitant College Fees Contribute

College fees have also been going up year after year. With so many students willing to take loans, colleges haven’t had a hard decision raising the cost of their tuition, making students borrow more.

Students end up owing a lot of money to public and private lenders. This wouldn’t be such an issue, except the universities aren’t interested in helping these students get jobs. For this reason, most students avoid college.

Unfair To Those Who Chose a Different Path

Removing debt payments will force the state to raise taxes to get the funding it expects from those debts. It redistributes the indebtedness to the taxpayers, who had no say in the matter and didn’t borrow the money in the first place.

Many of those who now have to foot the bill for others’ irresponsible financial behavior opted not to go to college and chose to take up a trade instead. It would be patently unfair to ask them now to pay for the tuition for someone else when they avoided making that bad decision in the first place.