The Daily Show” host Jon Stewart criticized Donald Trump’s civil real estate case earlier this week, pointing out that overvaluing properties is not a victimless offense. However, Stewart himself has benefited from a similar inflation for his own home.

Stewart Discusses Donald Trump

On Monday night, the 61-year-old comedian discussed Trump’s $454 million appeal bond, criticizing the experts who have framed the former president’s New York civil case as not harming anyone individually and directly.

The host of “The Daily Show” played a clip of CNN’s Laura Coates interviewing “Shark Tank” mega star Kevin O’Leary. O’Leary remarked that the ruling doesn’t sit well with the real estate industry, which was now concerned about potentially becoming the next target.

O’Leary’s Comment

Coates countered O’Leary by emphasizing that Trump has been found to be liable for falsifying business records, committing insurance fraud, issuing false financial statements, and engaging in conspiracy. All these are directly related to his asset inflation.

O’Leary tersely replied saying, “Everything that you just listed off is done by every real estate developer everywhere on Earth in every city. This has never been prosecuted.”

Stewart Questions O’Leary

In response to the clip, Stewart raised the question, “How is he not this mad about overvaluations in the real world?”

Stewart added, “Because they are not victimless crimes.”

Stewart’s Arguments

To further illustrate his point, Stewart presented the arguments, “First, the banks got paid back at lower interest rates, although, to be honest, who gives a s—. But, second, money isn’t infinite. A loan that goes to the liar doesn’t go to someone who’s giving a more honest evaluation, so the system becomes incentivized for corruption.

Stewart added, “So the system becomes incentivized for corruption.”

Fraudulent Behavior

Stewart also presented the argument that declaring a higher market value for a property and then paying taxes based on a much lower assessed value amounts to fraudulent behavior.

Stewart said, “The attorney general of New York knew that Trump’s property values were inflated because when it came time to pay taxes, Trump undervalued the very same properties. It was all part of a very specific real estate practice known as lying.”

Stewart’s Own Case Of Overvaluation

Right after Stewart made his inflammatory remarks, internet investigators swiftly got to work digging Stewart’s property history.

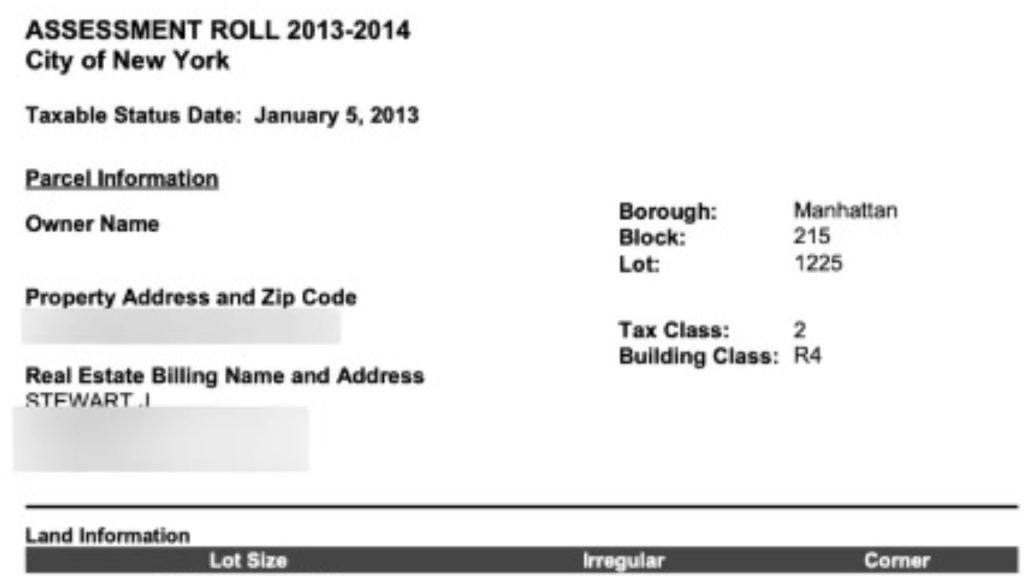

Documents reveal that New York City penthouse was sold for 829% more than what was its actual assessed value. The Post confirmed these records. Back in 2014, the comedian sold his 6,280-square-foot duplex in Tribeca to financier Parag Pande for a whopping $17.5 million.

The Actual Value of The Penthouse

The asking price for the property at the time it was listed for sale is not available in the records.

However, according to assessor records from 2013-2014 obtained by The Post revealed that the estimated value of the property was somewhere around $1.882 million which is obviously staggeringly low compared to the price at which it was sold.

Stewart Was Himself Found To Be Doing The Same Thing He Was Criticizing Trump For

The actual value based on assessor valuation was found to be even lower at $847,174.

Records also indicate that Stewart was paying relatively low property taxes calculated based on that assessed valuation price — precisely the very thing he criticized Trump for during his Monday monologue.

Stewart’s Hypocrisy

The Real Deal revealed that Pande, who bought the penthouse from Stewart, later resold it for just $13 million in 2021. By selling the penthouse for $13 million, Pande incurred a loss of around 26%.

However, Norm Miller, a real-estate economist and emeritus professor at the University of San Diego, explained to Newsweek that “assessed value does not equal market value and it’s typical to have a ratio of assessed value in the market value that varies by market.” Miller also added that it is possible for assessed values to lag when compared to market values.

Timothy Pool Calls Stewart A Hypocrite

Timothy Pool, a political commentator and podcast host recognized for his right-leaning views, accused Stewart of hypocrisy. Pool wrote on X, “Did @jonstewart commit fraud when he sold his penthouse for $17.5M? NY listed its market value at $1.8M an AV at around 800k. Who did he He defraud?? I am SHOCKED.”

A user responded to Pool’s post on X saying, “This is right in [Letitia James’] jurisdiction! I look forward to the grand jury indictment.”

The Same Citation Metric and Method

There are a lot of parallels between Stewart’s and Trump’s cases regarding property overvaluation.

The citation metric and method used for Stewart’s penthouse valuation by the New York assessor is exactly the same as what New York Attorney General Letitia James used for valuing Trump’s properties, which she later cited in her lawsuit against him for artificially inflating the assets.

Market Value Wasn’t Taken Into Consideration In Trump’s Case

In Trump’s case, the market value of his properties was not taken into consideration.

For instance, Trump’s Mar-a-Lago estate in Palm Beach was valued at only $18 million during the time despite its likely higher market value. The valuation by real estate brokers is at least 50 times higher than the assessed amount.

Trump’s New York Estate

Another example is Trump’s private 200-acre family estate in Westchester County, New York. This property was assessed to be somewhere between $30 million and $56 million which is far lower than its estimated market value.

According to some experts, in Trump’s case, part of the issue lies with the statute the New York Attorney General (AG) is using for the case. Massimo D’Angelo, a real-estate lawyer at Blank Rome, told Newsweek, “This was never the intent of the statute, which is designed to protect the public from harm, and it now gives the AG carte blanche to sue anyone for any alleged ill-gotten gains. Under the statute, it is to be shown that these types of overvaluations or alleged misrepresentations in property sizes or valuations like Stewart’s adversely impact the public. So, then the question becomes, are the public masses getting worse rates or inferior terms because of such indiscretions? This has not been shown, nor do I believe can it be.”

The Difference Between The Two Cases

It is clear that there isn’t much difference between what Stewart has been doing compared to Trump’s overvaluation and undervaluation of properties depending upon how they both stood to benefit from either of the two options.

The only difference seems to be the fact that in Trump’s case, a judge ruled that the former president had exaggerated the size of his properties to lenders, including the total square foot area of his iconic Trump Tower apartment.

Stewart Criticism Of O’Leary

While playing the O’Leary clip, Stewart said, “I’m surprised to hear he’s so chill about overvaluing something that he thinks is victimless, because when someone tries to do that to him.”

Stewart played a series of O’Leary’s clips from Shark Tank where the legendary investor was found sharply criticizing entrepreneurs for proposing what he considered “crazy” and “insane” startup valuations. Stewart’s intention was to highlight what looks like a double standard.

Not The First Time Stewart Has Targeted Trump

Stewart has been critical of Trump even before the former president entered the world of politics fully. Stewart’s angst against Trump dates back to his early days on “The Daily Show.” According to Stewart Trump’s recent “shenanigans cost the City of New York.”

May Not Be Accurate To Compare The Two Cases

According to some real estate experts, Stewart’s case is very different from what Trump has been accused of doing. Will Thomas, assistant professor of business law at the University of Michigan, told Newsweek, “The analogy here between Mr. Stewart’s property sale and the Trump Organization’s business model falls somewhere between non sequitur and nonsensical.”

Thomas added, “Discrepancies between tax assessment value and market value doesn’t figure into the analysis of wrongdoing, except insofar as it informs the calculation of the disgorgement penalty.”

Misunderstanding Of The Actual Issue

Thomas also explained that there seems to be some major misunderstanding when it comes to the two situations. Thomas said, “The confusion of these two situations stems, I suspect, from a misunderstanding about how disgorgement works. Disgorgement is unlike other types of legal damages, which are often used to pay compensation back to specific victims.”

Thomas added, “The point of disgorgement is to discourage wrongdoing by making the defendant pay back the maximum potential profits attributable to their misconduct, rather than just the actual net benefits that the defendant managed to pocket from specific victims.”