In a glimmer of hope for aspiring homebuyers, Moody’s Ratings has forecasted a decline in mortgage rates over the next few years. Despite the current rates remaining higher than the pandemic-era lows, this news brings a sigh of relief to those who have been squeezed out of the market by soaring home prices and elevated borrowing costs.

Freddie Mac Reports Record High Mortgage Rates for 2023

Just a week ago, Freddie Mac announced that the average rate for a 30-year-fixed mortgage, the most popular among U.S. borrowers, had reached a staggering 7.1 percent. This marks the highest point for mortgage rates in 2023, further compounding the challenges faced by potential homebuyers in an already competitive market.

However, Moody’s Ratings offers a ray of hope, predicting that mortgage rates will gradually decrease in the coming years. While the decline may not be as swift as homebuyers would like, the financial research company estimates that rates could reach around 6 percent or slightly lower by the end of 2025.

Federal Reserve’s Rate Hikes Impact Mortgage Lending

The Federal Reserve’s aggressive rate-hiking campaign, aimed at combating rising inflation, has had a direct impact on mortgage rates. Although the central bank does not directly set mortgage rates, any increase in interest rates influences the cost of new mortgage lending.

Despite expectations that the Federal Reserve would lower interest rates this year, the latest data on the cost of living shows that inflation remains higher than anticipated at 3.48 percent in March. This persistence of elevated inflation has prevented the central bank from easing its monetary policy thus far.

High Mortgage Rates Lead to a Drop in Demand and Price Correction

The steep rise in mortgage rates has made homeownership unaffordable for many Americans, resulting in a significant drop in demand during the late summer of 2022. However, the subsequent price correction was relatively modest, as the supply of homes remained limited.

In the spring of 2023, home prices began to climb once again across the country, driven by the persistent shortage of available properties. This historic undersupply of homes can be attributed to the nation’s under-building following the housing bubble burst and the financial crisis of 2007-2008.

Homeowners Reluctant to Sell Due to Low Fixed-Rate Mortgages

Moody’s report highlights another factor contributing to the limited supply of homes on the market: many U.S. homeowners are holding onto their low fixed-rate mortgages. These favorable rates, secured in the past, have made homeowners reluctant to sell their properties and give up their advantageous financing.

“Many U.S. homeowners have low fixed-rate mortgages that they are reticent to give up, which is constraining existing property listings and sales,” Moody’s stated in the report. This trend has further exacerbated the already tight housing inventory, making it challenging for buyers to find suitable homes.

Growing Demand for New Constructions and Mortgage Interest Rate Buydowns

As existing homeowners hold onto their properties, the demand for new constructions and mortgage interest rate buydowns has surged. Moody’s experts anticipate that this increased demand will help to stabilize home prices, preventing a significant decline in the coming months.

Despite the challenges posed by limited inventory and elevated mortgage rates, Moody’s predicts that home prices will only experience a moderate 5 percent decline this year, following a 6.6 percent drop in 2023. This forecast offers a glimmer of hope for homebuyers who have been eagerly waiting for more favorable market conditions.

The Pandemic’s Impact on the Housing Market

The housing market experienced a remarkable boom during the pandemic years, fueled by record-low mortgage rates and a surge in demand for more living space. As remote work became the norm, many Americans sought larger homes and relocated to suburban areas.

However, this increased demand, coupled with the limited supply of homes, led to a rapid escalation in home prices. The fierce competition among buyers resulted in bidding wars and homes selling well above their asking prices, making it challenging for many aspiring homeowners to enter the market.

The Role of Inflation in Mortgage Rate Fluctuations

Inflation plays a crucial role in determining the direction of mortgage rates. When inflation rises, it erodes the purchasing power of money, and central banks often respond by raising interest rates to curb spending and stabilize prices.

The Federal Reserve’s rate hikes, aimed at combating inflation, have had a ripple effect on the housing market. As the cost of borrowing increases, it becomes more expensive for homebuyers to secure mortgages, leading to a slowdown in demand and a potential cooling of home prices.

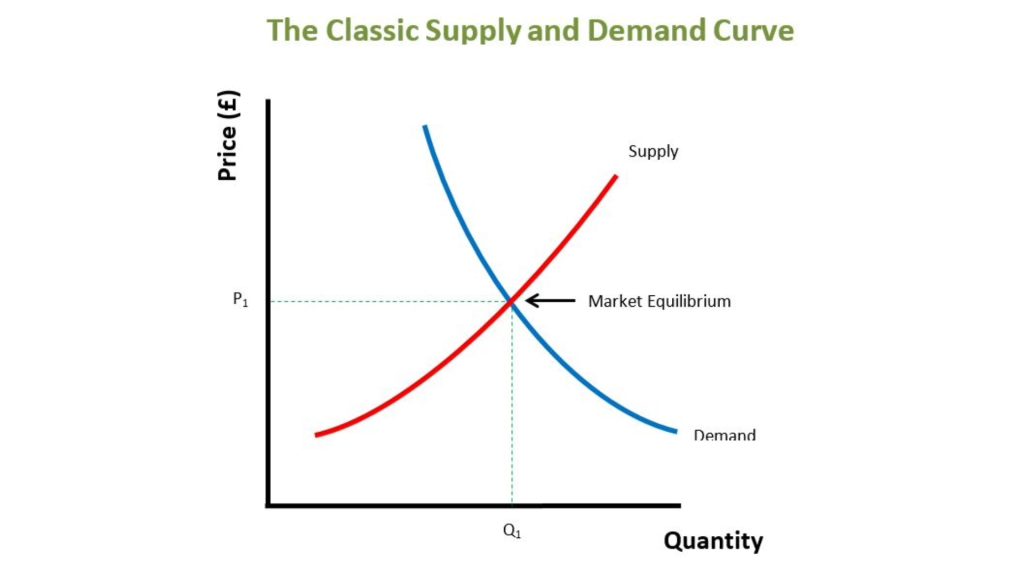

The Importance of Supply and Demand in the Housing Market

The housing market, like any other market, is governed by the fundamental principles of supply and demand. When the supply of homes is limited and demand is high, prices tend to rise, as buyers compete for the available properties.

Conversely, when supply outpaces demand, prices typically stabilize or decline. The current housing market has been characterized by a persistent shortage of homes, which has kept prices elevated despite the challenges posed by high mortgage rates.

The Psychological Impact of High Mortgage Rates on Homebuyers

High mortgage rates not only affect the affordability of homeownership but also have a psychological impact on potential buyers. When rates are elevated, many aspiring homeowners may feel discouraged and delay their purchase plans, waiting for more favorable conditions.

This psychological barrier can further contribute to a slowdown in the housing market, as fewer buyers actively seek out properties. However, the anticipation of declining mortgage rates in the coming years, as predicted by Moody’s Ratings, may provide a much-needed boost to homebuyer sentiment.

The Importance of Financial Planning and Budgeting for Homeownership

Regardless of the state of the housing market, aspiring homeowners must engage in careful financial planning and budgeting. Purchasing a home is a significant financial commitment that requires a stable income, a healthy credit score, and sufficient savings for a down payment and closing costs.

Potential buyers should assess their financial readiness and create a realistic budget that accounts for not only the monthly mortgage payments but also property taxes, insurance, maintenance, and potential repairs. By being financially prepared, homebuyers can navigate the challenges of the housing market more effectively.

The Benefits of Homeownership Despite Market Challenges

Despite the challenges posed by high mortgage rates and limited inventory, homeownership remains a cornerstone of the American Dream. Owning a home provides a sense of stability, security, and the opportunity to build long-term wealth through equity accumulation.

Moreover, homeownership offers tax benefits, such as the ability to deduct mortgage interest and property taxes from taxable income. These advantages, coupled with the potential for appreciation over time, make homeownership an attractive prospect for many Americans.

The Role of Government Programs and Initiatives in Supporting Homeownership

Various government programs and initiatives aim to support homeownership and make it more accessible to a wider range of individuals. These include first-time homebuyer programs, down payment assistance, and affordable housing initiatives.

These programs can provide much-needed support to aspiring homeowners, particularly those who may face challenges in saving for a down payment or qualifying for a mortgage. By leveraging these resources, potential buyers can overcome some of the barriers to homeownership and realize their dreams of owning a home.

The Importance of Working with Trusted Real Estate Professionals

Navigating the complexities of the housing market can be daunting, especially for first-time homebuyers. Working with trusted real estate professionals.

Such experienced real estate agents and mortgage brokers, can provide valuable guidance and support throughout the homebuying process.