Florida’s housing market has been having its share of ups and downs lately, but new information shows an even worse side to this drama. The price of condos in Florida has sunk into a downward spiral over the last few weeks as more and more buyers seem to be avoiding these housing options. Let’s see what’s causing these woes.

A High Amount of Motivated Sellers

Recent exploration into the Florida housing market has shown that it has the highest amount of motivated sellers anywhere in the US. These sellers would accept lower prices for their properties.

Yet, at the state level, there still seems to be an increase in housing prices overall. The median sale price for a home in Florida is around $404,100 as of January 2024.

Florida’s Underperforming Market Raises Doubts

While the house price in Florida is healthy, it suggests that the price correction that went on through 2022 and most of 2023 seemed to end in this part of the country.

Unfortunately, it’s still uncertain why Florida’s market is showing these signs of distress. Compared to the housing market in the rest of the country, Florida’s is underperforming.

Fewer People Buying Houses, Despite A Lot of Sellers

In most cases, the law of supply and demand states that as more people list their houses on the market, the price drops to meet the demand. People would pay less if there were more of a commodity available.

Yet, even though there are so many motivated sellers, there aren’t nearly enough buyers to make up that need. There are several reasons why this might be happening in Florida.

Condo Prices Elsewhere Are Much Higher

Florida is known as one of the places in the US that is great for retirees. Up until recently, buying a condo and retiring to Florida has been a dream for many people.

Unfortunately, the price of a condo in Florida is still much higher than elsewhere. What’s causing this massive difference in price compared to similar housing in other states?

Individual Home Prices Are Dropping

While condo prices are through the roof, the price of individual stand-alone housing units seems to be dropping rapidly. This could be explained by the amount of motivated sellers on the market.

In Jacksonville, home prices have dropped around 6.5% over the last year, with homes in Miami showing a drop of around 2.5% compared with the same time the previous year.

Insurance Crisis to Blame

Most people who know what’s happening in Florida have already spotted the problem. The cost of homeowners’ insurance has skyrocketed, with most homeowners paying much higher premiums.

In some areas of Florida, homeowners’ insurance costs have increased by over 100%. While the state has taken measures to try to deal with this, the current situation is terrible for many.

Condo Association Fees Suggest Why Many People Are Abandoning Them

The problem for condo owners isn’t insurance so much as it is the fees associated with living in those places. These have also gone up significantly over the last year.

Part of the reason for the increase in fees is because these condos are taking their upkeep seriously. To avoid tower collapses, these condos have a vast maintenance fund that residents are required to pay into.

Florida Not Exempt From Housing Crisis

Despite the amount of houses on the market, the prices are still high. Supply outstrips demand, and while these sellers will accept less, they’ll still get a pretty penny for their homes.

Many of them have been painted into a corner to sell because they can’t afford the insurance for their homes. Recent reports put the cost of insurance on a house at around $6,000 a year.

High Prices Remain for Condos As Well

Despite so many people leaving condo life behind, the price of acquiring one is still relatively expensive. Again, the supply of living space remains constant, so the prices remain high because of high demand.

The state has also seen a rise in mortgage rates alongside condo payments. However, this rise seems to be the most pronounced in the highest-value condos. Most buyers won’t have to deal with it.

Buyers Are Looking at Lower-Cost Properties

With the focus on finding affordable housing options, many buyers are avoiding condos because they’re simply too expensive. Single-family homes seem like a better option for them.

Even with the increased cost of homeowners’ insurance, it would be more cost-effective than a condo. At $6,000 a year, average insurance would work out to around $500 per month.

Prices Will Remain High in 2024

If you’re in Florida and looking for an affordable home because of the many sellers there, you will probably be disappointed this year as prices will likely remain high.

Real estate experts suggest that since there isn’t likely to be a significant amount of extra available housing here, low affordability and lean supply will dictate the market prices in 2024.

Moody’s Sees Sideways Market Movement

According to Moody’s, the housing market prices are likely to move sideways in 2024, suggesting a stagnating market. The movement will continue over the next few years.

Economists believe this sideways movement will give the economy some time to stabilize and find the balance between median income and median housing prices.

Faster Job Creation Means Rising Demand

Among the US states, Florida has the fastest job creation, which may mean that the demand for housing (and therefore the price) may recover faster than initially thought.

While more jobs usually translate to more housing, there’s a concern about how many people can afford the mortgage payments. High mortgage rates may be a limiting factor in housing purchases in the state.

When Will This End?

No one is certain what the future of the housing market in Florida will be. There’s likely to be an influx of new buyers coming in, even as so many people are looking to leave the state because of its massive homeowners’ insurance burden. The government is trying to help, but bureaucracy moves slowly.

For many homeowners, there’s no option. They can’t afford insurance, and with hurricanes becoming stronger and more intense, they can’t afford to keep their house uninsured. For now, many people may just consider selling, as it’s the safest financial decision.

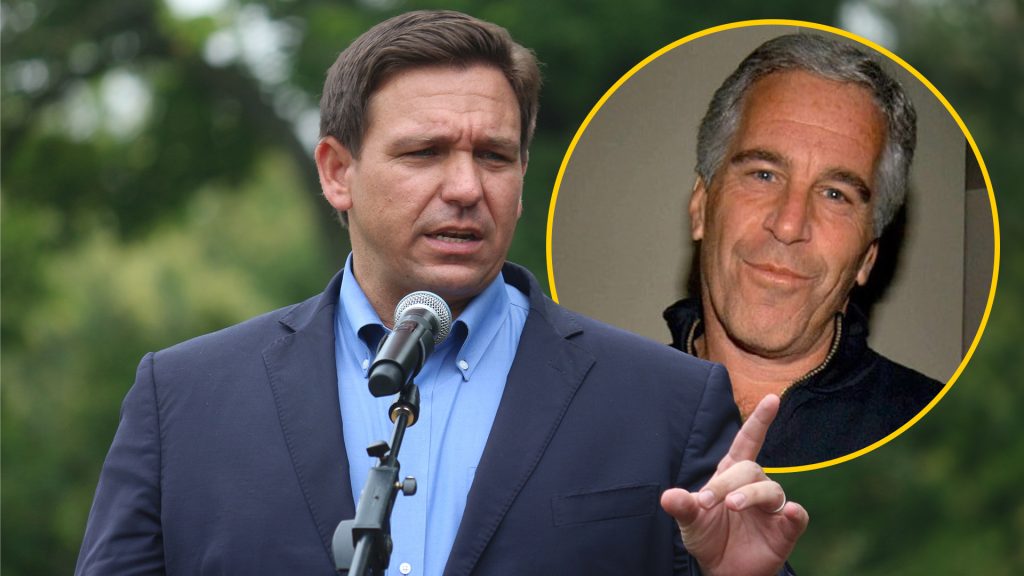

Desantis Signs Law Releasing Records Which Could Explain Epstein’s Light Charges in Florida

Desantis Signs Law Releasing Records Which Could Explain Epstein’s Light Charges in Florida

Major Investors Pull Out Of New York After Trump Legal Ruling

Major Investors Pull Out Of New York After Trump Legal Ruling