With electric vehicles exploding in popularity over the past decade, the demand for lithium, a key component in EV batteries, has skyrocketed. Mining companies rushed to increase production, but the oversupply has led to a market crash, sending shockwaves through the industry.

The optimism surrounding the electric vehicle industry in early 2023 has faded as sales of EVs have slowed and interest from consumers has declined. Major automakers have had to adjust their production schedules and delay factory expansions in response.

2022 Marked a Surge, But It All Changed in 2023

According to industry experts, the demand for EVs surged in 2022 but dropped by nearly 50 percent by the end of 2023. As a result, the prices of lithium and nickel, essential materials for lithium-ion batteries in EVs, have plunged over 90 percent.

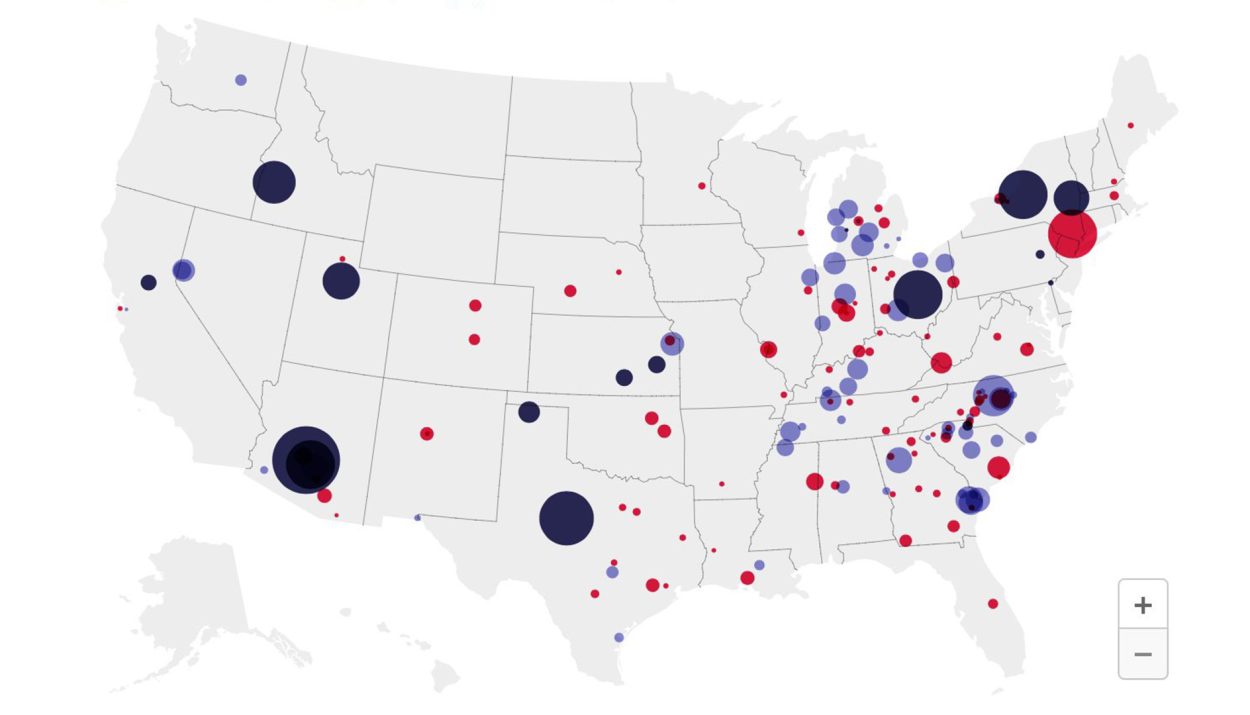

In light of slowing sales, Ford eliminated 1,400 jobs at its lithium-ion battery plant in Michigan. General Motors also laid off all workers at its Detroit factory, though the company intends to rehire them in 2025 if the market improves. Executives acknowledge the EV market will not grow steadily.

What Caused the Sudden Shift?

The lithium industry’s rapid expansion and subsequent contraction can be attributed to overoptimistic forecasts of electric vehicle adoption in the United States. When major automakers like GM and Ford announced aggressive electrification targets and plans to build dedicated EV platforms, lithium producers anticipated a surge in demand and invested heavily in new mines and processing facilities.

However, electric vehicle sales have failed to meet optimistic forecasts. Hybrid vehicles accounted for more sales than fully electric vehicles in 2023. Consumer interest in EVs has declined relative to early projections due to their high upfront costs and range anxiety.

Sudden Shift in Demand

The lithium industry’s fortunes shifted rapidly. Lithium demand and prices surged in 2022 but declined precipitously the following year. The abrupt change in demand left producers with excess capacity and forced them to cut costs through layoffs and suspended operations.

The performance of Albemarle, one of the largest lithium producers in the US, is illustrative. Albemarle had planned to invest in a new lithium plant to supply materials for 2.4 million EVs annually. However, Albemarle had to pause spending on the plant and lay off 300 employees in the face of softening lithium prices and demand.

Plummeting Lithium Prices

Analysts argue that expectations for rapid growth in the EV market were unrealistic. Gabe Daoud, a sustainable energy analyst, said, “A lot of the initial targets put out by GM or Ford a couple of years ago have proven too optimistic and probably too aggressive. Everybody expected the entire car fleet to change overnight and go electric, but that’s impossible and impractical.”

Companies made bold promises to open new production plants, even when forced to slow expansion and cut jobs. For example, Piedmont Lithium announced plans to hire 400 new employees just as it was laying off over a quarter of its existing workforce.

The Ripple Effect on Battery Suppliers

The slowing demand for EVs has dealt a blow to lithium and nickel producers supplying electric vehicle batteries. With fewer EVs being sold, these suppliers have excess inventory and falling profits. As a result, companies like Albemarle have been forced to cut costs through layoffs and pausing expansion plans. Albemarle laid off 300 employees, about 4% of its workforce, and halted spending on a new lithium plant.

South Carolina. Other suppliers like Piedmont Lithium have also announced workforce reductions despite ambitious hiring plans announced just last year. Major automakers have had to adjust their EV strategies in response to slowing demand.

Government Support May Be Needed

The slowing EV market shows that government support and incentives may still be needed to spur the adoption of electric vehicles. Strict emissions standards and tax rebates for EV purchases have helped drive growth. However, demand has not kept pace with the ambitious targets set by companies and policymakers.

While consumers cite high costs and lack of charging infrastructure as barriers, government policies could help address these issues and accelerate the transition to EVs. Additional subsidies and investments in charging networks may be required to revive momentum in the EV industry and support suppliers and automakers in the long term.

Falling Commodity Prices

The slowed growth in the electric vehicle market has led to a plunge in lithium and nickel prices, key materials used to produce lithium-ion batteries. The price of lithium has dropped 90 percent since January 2021. Major lithium producers like Albemarle have been forced to suspend expansion projects and lay off hundreds of workers.

Albemarle had planned to open a lithium plant in South Carolina that would have produced enough lithium for 2.4 million electric vehicles per year. However, the company’s CEO, Kent Masters, said, “Where prices are today, the economics aren’t there for those projects.”

What This Means for EV Adoption Rates

The slowing demand for electric vehicles is impacting the lithium and nickel industries that supply materials for EV batteries. With sales of EVs declining, major producers like Albemarle have been forced to cut costs through layoffs and by pausing expansion of production facilities. This has significant implications for the adoption of EVs going forward.

According to forecasts from the Center for Automotive Research, EV sales were expected to reach 10 percent of total vehicle sales in the U.S. in 2024, up from 7 percent the previous year. However, as interest in EVs has waned, automakers are hesitating to invest further in developing and producing new models.

The Outlook Going Forward

The lithium industry faces significant challenges in the coming years. With demand for electric vehicles slowing and interest in hybrid models rising, lithium producers have had to scale back expansion plans and cut costs. Major companies like Albemarle have had to pause spending on new production facilities and lay off hundreds of workers.

Although some optimists believe EV sales will rebound and reach 10% of total vehicle sales in the U.S. by 2024, the future remains uncertain. Automakers are reluctant to ramp up EV production if consumer interest does not keep pace. General Motors and Ford have already slowed down the construction of their EV rollout and battery plants.

What Consumers Need to Know

As the demand for electric vehicles declines, consumers should understand how these market forces may impact them. Companies that produce lithium-ion batteries and the raw materials for these batteries have slowed expansion and hiring.

According to industry experts, the reduced demand means companies will likely offer more incentives and discounts to attract customers to electric vehicles. While this may benefit consumers in the short term, in the long run, it could slow progress in improving technology and reducing costs if investments in research and development also decrease.