Money is a tricky conversation to have, whether you’re fortunate enough to not worry about finances or unlucky enough to constantly be worried about finances. Everyone has an opinion on where people should earn their money, how they should save it, and the different things that they should do with it. The usage of debit cards versus credit cards is no different than any other monetary conversation, and three experts have weighed in about the benefits of both and neither.

First, Mark Cuban

Mark Cuban is a billionaire who is well-known for his status as the owner of the Dallas Mavericks and his role as the richest panel member on “Shark Tank.” He’s also the CEO of the company Cost Plus Drugs, which has aimed at making prescription medication more affordable for the average person.

Due to his billionaire status, Cuban could easily pay for every purchase he ever needed to make with cash, and wouldn’t notice the effect on his wealth. Due to his particular flexibility with money, his insights into how and where to spend money can be particularly influential.

Don’t Use Credit Cards, At All

And what does the billionaire say in the credit card versus debit card debate? Well, he says not to use credit cards. At all. Cuban believes that the exorbitant interest rates that credit card companies charge on outstanding balances negate any positives that they might offer as far as cash back or other rewards.

According to the Federal Reserves, the average interest rate on credit cards was over 21% as of November, 2023. With those rates, an outstanding balance could double in less than four years, which would drain cash flow that could otherwise be used to save or invest.

Interest Can Be Avoided, Through Paying Off the Card

Cuban does acknowledge that the downside of interest rates can be avoided if you pay off the balance of your credit card every month. Unfortunately, though, most Americans have neither the discipline or the budget to be able to pay off the entirety of their cards every month.

Because of this, Cuban urges people not to use credit cards at all. So many Americans are one or two paychecks away from financial ruin, and he believes that using credit cards can only compound that. One bad month could mean that you’re stuck with debt that compounds for the lifetime of the card, which is a risk that Cuban sees as too high to take.

Instead, Rely on Debit

Instead, Cuban endorses the use of debit cards for all financial transitions, but only if the card and bank that issues it don’t have any fees. He also suggests taking out a personal loan before using a credit card if you’re really strapped for cash.

His reasoning behind this suggestion is that personal loans often have a lower interest rate than credit cards, as well as a finite lifetime. Making payments on personal loans helps build your credit, making your financial future more stable in the long term.

Second, Tori Dunlap

Tori Dunlap is the owner and creator of “Her First $100k,” which is a multimillion-dollar business that is aimed at helping women improve their finances. She is a New York Times bestselling author, and the owner of a successful financial podcast.

The fact that Dunlap is a woman commenting on finances in a space that is often dominated by men is noteworthy enough. But she also has a rather stunning opinion in the debit card versus credit card debate. She exclusively uses credit cards, and doesn’t have a debit card.

Simple Reasons for Credit

The reasoning behind exclusively using credit cards, in Dunlap’s words, are simple. She is a financial expert, and well knows the slippery slope that can come from relying too much on credit cards. Over reliance on credit cards can lead to financial difficulty, but it doesn’t have to.

Instead, Dunlap argues that those who are financially responsible with their credit cards can take advantage of many of the benefits that these cards offer. If you pay of your balance every month, credit cards can offer many perks, including rewards, a boosted credit score, and protection against unauthorized purchases.

Discipline is Required for Credit

Now, Dunlap doesn’t say these things to encourage people to go and apply for five different credit cards right now. Using credit thoughtfully takes discipline and thought, and she stresses that nobody should rack up credit card debt simply to get points on the card.

But, she also says that spending money is an unfortunate part of life. We all have to buy groceries and put gas in our car, and if you’re going to pay for these things anyway, why shouldn’t you take advantage of the rewards that can come from using a credit card?

A Boosted Credit Score

One of the biggest perks that comes from responsible credit card usage is the fact that it boosts your credit score over time. A high credit score can lead to significantly better purchasing power when making major financial investments such as a house or a car, and using a credit card responsibly can only help with that.

Lastly, Dunlap likes the fact that, by federal law, no credit card company can hold any individual person responsible for more than $50 of unauthorized charges. Most companies will go a step further in protecting their customers from fraud, making credit a safer investment than cash or debit in terms of fraud protection.

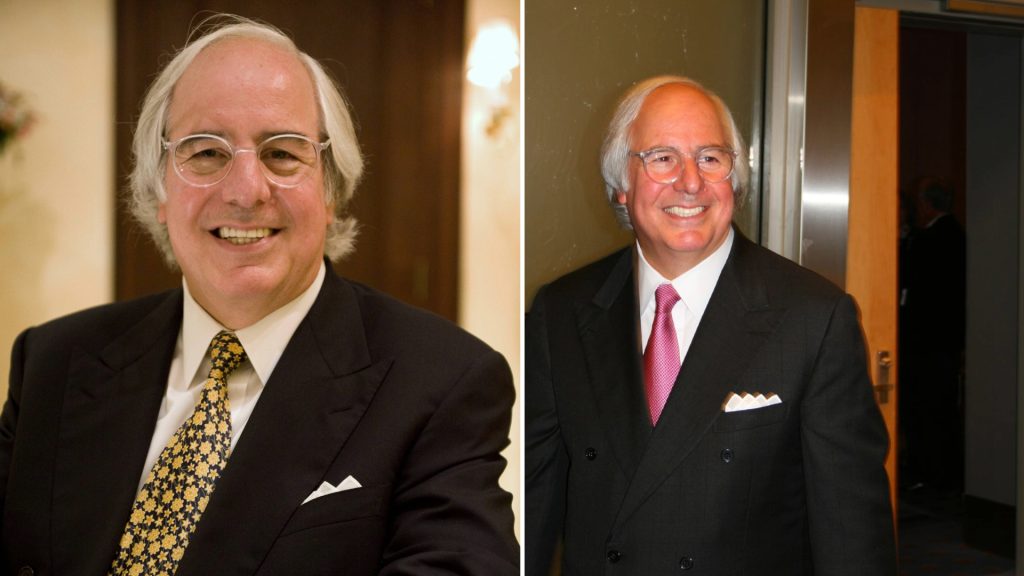

Third, Frank Abagnale

Frank Abagnale is a convicted felon and fraudster who committed frauds that mainly targeted individuals and small businesses. He is best known for his autobiography Catch Me If You Can, which inspired a film of the same name directed by Steven Spielberg.

A convicted fraudster might not be the first person you think of when it comes to considering ways to spend money responsibly, and in most cases, you’d be right. Abagnale has a unique perspective on the credit versus debit debate, though, making insight valuable.

Credit Over Debit, With a Twist

Like Tori Dunlap, Abagnale uses credit cards to make purchases almost exclusively. He states that he has never once used a debit card, and that he never allowed any of his three sons to have one either. However, he takes the argument for credit over debit one step further.

Rather than keeping his money in a savings account, Abagnale explains that he uses credit cards and spends the bank’s money while keeping his personal funds in a money market account. Money market accounts often have higher interest rates than personal savings accounts, meaning that Abagnale can accrue higher returns for his deposits.

Personal Benefit, Rather than Bank Benefit

By storing his money in this unique way, Abagnale is the one who benefits from the storage of his money, rather than the bank. He can purchase something with the balance on his credit card, and then can still enjoy earning interest on his personal money until he has to pay off the balance of the credit card.

This is a unique perspective, given that many people don’t know about money market accounts at all. They’re not a common topic in financial education, and the lay person might not understand the benefits of a money market account over a general savings account. As Abagnale states, though, they are, in general, far superior.

Safety from Fraud, as Well

Additionally, Abagnale agrees with Dunlap’s contention around the potential fraud of using cash and debit. By using credit cards, he protects himself from potentially losing his shirt, should someone get a hold of his number or pin and try to take his money.

By using cash and debit, Abagnale warns people that they are putting their own money at risk. Using a credit card reduces your personal liability as a consumer, which is why it’s the method he prefers to use when making purchases. After all, you’re only responsible for the purchases that you ultimately made and the bank cleared.

A Very Personal Decision, at the End of the Day

Using money responsibly is a very personal choice that requires thought and careful consideration. While there are many benefits and perks to using credit cards, the overall benefit of never spending any more money than you actually have in your debt account shouldn’t be overlooked either.

Ultimately, the decision is up to every individual person. Choosing credit will help with long term financial health, but opting for debit reduces the risk of getting into debt. There are pros and cons to both choices, and at the end of the day, it’s nobody’s business except your own.