Joe Biden’s State of the Union address had several positive points in it. One was the mention of a $400 monthly tax credit for first-time homeowners. Unfortunately, not everyone is on board with this plan, and the president has faced a massive pushback in his implementation. Let’s find out why.

Addressing The High Cost of Home Ownership

Most Americans have decided that it’s too expensive to own a home. Because of the lack of supply, the cost of houses on the open market is among the highest in many states.

The Biden administration wants to address this by offering a credit of $10,000 for first-time homeowners, spread out over two years, with each month offering a $400 grant.

The Administration Is Hoping to Drop House Costs

This measure is only the latest in a series of positive moves by the administration to increase the supply of houses around the country. They’ve committed to building more homes throughout the US.

Additionally, the administration intends to help renovate existing homes, allowing Americans a safe and secure place to call home. Biden contends that all Americans deserve their own home.

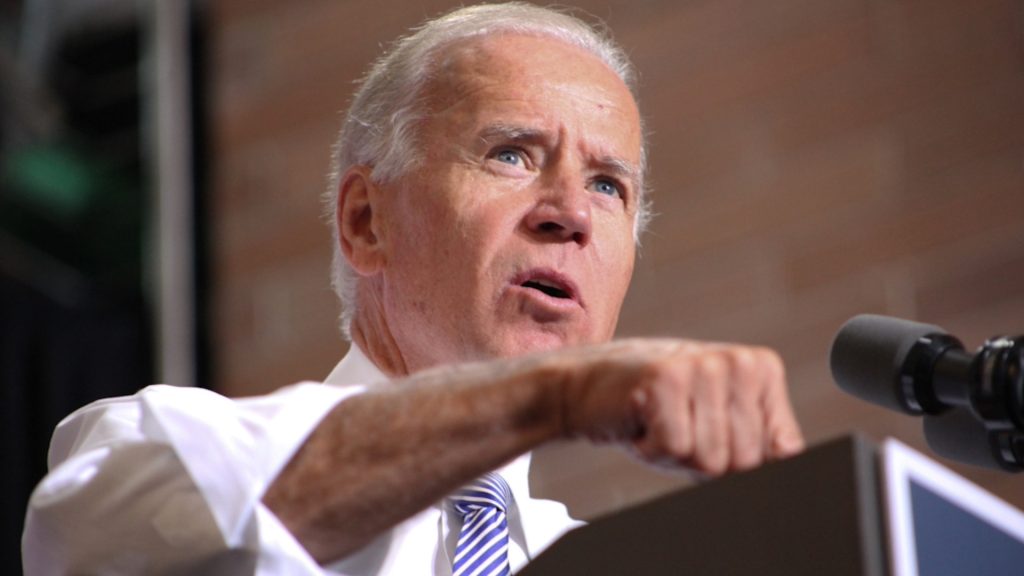

The President’s Announcement

The implementation of the tax credits came from a tweet from the White House, in which the president said it was going into effect. Not many were surprised by the announcement.

However, many internet commentators came out in force to highlight that the Biden administration wasn’t doing enough to address the rising costs of housing facing the citizenry.

Double The Mortgage Costs Under Trump

One commentator pointed out that rash spending has ballooned the mortgage rate. They stated that the mortgage rate under Biden was double that of what it was under Trump.

They further noted that Americans had seen their wages drop by 4%. Inflation has increased prices by 18%, meaning Americans aren’t even keeping up with the cost of living anymore.

Potential For Runaway Inflation

Another internet user noted that if inflation were looking bad at this point, it would be even worse when this particular economic measure went into effect. The shadow it casts is long.

With more “free money” being pumped into the economy through this $400-a-month credit, it’s likely that the value of money will drop, making things more expensive overall.

Aimed At The Wrong Crowd

Several X users noted that anyone who could afford a home in this economic climate didn’t have any need for a $400 per month tax credit write-off. They might be right in their estimation.

Almost one-third of home buyers in 2023 were first-time owners. Most of the people buying homes were buying their second or third residential property, making the grant useless to them.

Buying Votes Through Tax Credits?

More X comments examined whether the Democrats were buying votes through their tax credits. Some quipped that the Democrats didn’t have enough money to buy everyone’s vote.

Americans have seen a steady rise in the price of goods and services over the last few years. Although inflation has mostly gotten under control, it’s still a difficult time for many people.

Not Enough Homes For The People

Part of the reason the US is having such a housing crisis is that there isn’t enough available housing for those who want to buy it-and those who want to buy run into other problems.

Many people looking for a first-time home only have a limited downpayment. The housing market purchases are dominated by older people with a substantial financial buffer to outbid new owners.

Houses Being Sold in Places People Don’t Want to Buy

Another issue that frequently arises is the sale of houses in places where people don’t want to own property. Sellers in some areas are willing to accept anything to move out of those locales.

Florida, for example, is seeing a lot of motivated sellers. Many people can’t afford to live there because they can’t afford to pay for homeowners’ insurance within the state.

Other Governmental Efforts

The Biden administration is doing more than offering the $10,000 tax credit. For first-time, first-generation homeowners, the president is calling on Congress to offer $25,000 in downpayment support.

The president is also pushing Congress to give first-time middle-income homebuyers a $5,000 per year tax credit for owning their own home. These are small steps, but they could yield positive results.

Preoccupied With The Issue

Presidential aides have noted that Biden knows that Americans are suffering with the cost of owning a new home. He has quizzed several staff members about what Americans are dealing with.

Many of these measures are geared towards helping first-time buyers get started in the market. However, as with most measures, there’s always the law of unintended consequences to consider.

An Open Market With Bidders

Affordable homes seem to be the direction the Biden administration is going to help people get their hands on their first homes. It’s a brave measure that has worked in several other places.

Unfortunately, this could also drive the price of houses down further, opening up the market to predatory buyers trying to get as much property as possible. There’s always another side.

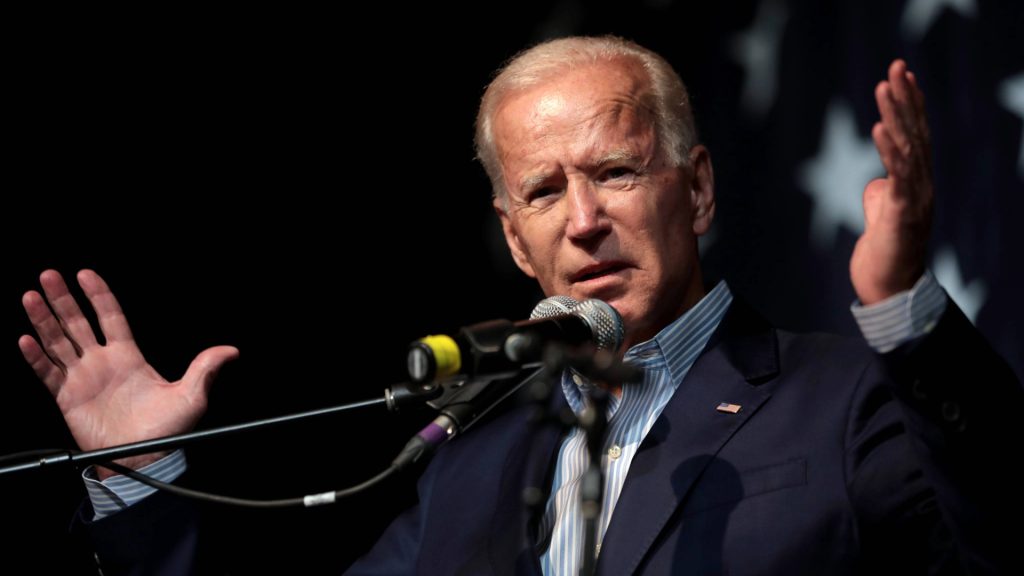

Housing Could Be a Debate Topic

With the elections coming, the state of the housing market may be a primary concern for voters. Biden’s overtures could give him a leg up on his competition. Still, there’s a lot to be seen.

Republicans have consistently held that the housing market needs less governmental control rather than more. Some economists believe they may be right and that too much meddling could worsen things.

Americans Want Homes

People all across the US are trying to afford their first home. While the Biden administration seems like it’s doing its best, many elements could affect the housing price, and the government can’t control all of them.

Aside from the availability of housing, the quality of that housing is also an essential concern. Mass construction may lead to lower-quality housing, which could cause more issues in the long run. It remains to be seen whether this is a positive development or not.