A good deal of the discourse around a potential second term for presidential hopeful, and former president Donald Trump, has centered around the state of democracy and the ways that he could potentially damage it. However, even if democracy remains intact, another four years of Donald Trump could have far-reaching consequences for all American citizens, young and old.

Older Americans Are Right to be Concerned

Notably, there are several significant ways that a second Trump presidency could affect older Americans. With the conversations that are happening around the retirement age as well as the longevity of social security, it’s understandable that older Americans might be concerned about the outcome of a second Trump term.

Unfortunately for Trump, his history makes senior Americans’ concern understandable. While older white Americans were a significant portion of his voting bloc in 2016, his actions during the presidency and the far-reaching consequences of them might have affected his appeal with them in the future.

First, Taxes

One of the major legislative “wins” that Trump touted during his first presidency was a comprehensive tax reform package that was passed in 2017. This law, the Tax Cuts and Jobs act, made significant changes to tax law, and not necessarily for the better.

The act amended tax laws for the first time since 1986. Among other things, the act reduced tax rates for individuals and organizations, eliminated the alternative minimum tax for corporations, and doubled the estate tax exemption.

Expiring Benefits

The Congressional Budget Office projected that the tax reforms would add several trillion dollars to the national debt over the course of ten years if implemented, and as of this writing, some of that has come to fruition. More importantly, though, average citizens have seen significant impacts from this legislation.

Many of the tax cut provisions that were implemented in the bill are set to expire in 2025, and the benefits from them started to reduce, starting in 2021. This tax season, many Americans have seen a significant increase in the tax bill they had to pay, with some individuals having to pay a bill for the first time rather than receiving a return.

Retirees Affected by the Tax Changes

As far as older Americans, though, the TCJA has affected them in a unique way. The lowered individual income tax rates provided some retirees with a lower tax bill on their taxable retirement income, which offered some relief when the bill was first implemented.

Other retirees with significant investment income, on the other hand, were forced to reevaluate their tax planning strategies in order to optimize their after-tax income. This led to some individuals having to pay more than they might have expected, and a second Trump presidency could see even more significant changes made to the tax code.

Second, Social Welfare Programs

The second significant way that a second Trump presidency could affect retirees would be to make formal, legislative changes to government programs that benefit retirees. Specifically, changes to the Medicare and Social Security programs.

These programs have long been a topic of discussion in Congress, though for different reasons depending on who’s talking. The social security and Medicare programs come up as a topic every time the annual budget is discussed, and every time, there’s discourse that makes a good deal of Americans uneasy.

Social Security is Unsustainable in its Current Form

The fact of the matter is that the social security program in particular is not sustainable in its current form. Some dire estimates project that the program will run out of the funds that support it within the next fifteen years, and the tax cuts that were made by Trump’s tax reform did not help the matter.

Every year, when the annual budget comes up, as well, Republicans make big statements about cutting down the American deficit and reducing the amount of government spending in order to increase our GDP and liquidity as a country.

Republicans Making Big Statements

These statements are always followed with the assertion that public welfare programs like social security and Medicare are not on the table for budget cuts. Republicans are always certain to mention that they don’t want to take these benefits away from Americans who have paid into these programs for decades of their lives.

What they say and what they do are entirely different matters, though. The fact is that multiple Republican budget proposals over the last several years have offered increases to the defense budget, and slashes to social welfare programs including Medicare and social security. None of these cuts have made it to the president’s desk for signing, but that doesn’t mean that they haven’t been there.

Potential Cuts Ahead

A second Trump presidency could see a solidification of these goals to cut these programs. Any Republican presidency could see cuts to these programs. Nikki Haley, a Republican running in the primaries for the RNC presidential nomination, has stated that she believes that the retirement age should be raised in order to preserve the social security program, from 65 to 70.

Haley is relatively moderate, and it isn’t a stretch to wonder whether Trump would go further with these goals if he were to make it back to the White House. Republicans claim that they’re the party of the working class American, but their actions towards the middle class and elderly Americans prove that these talking points are nothing more than lip service.

Looking Forward

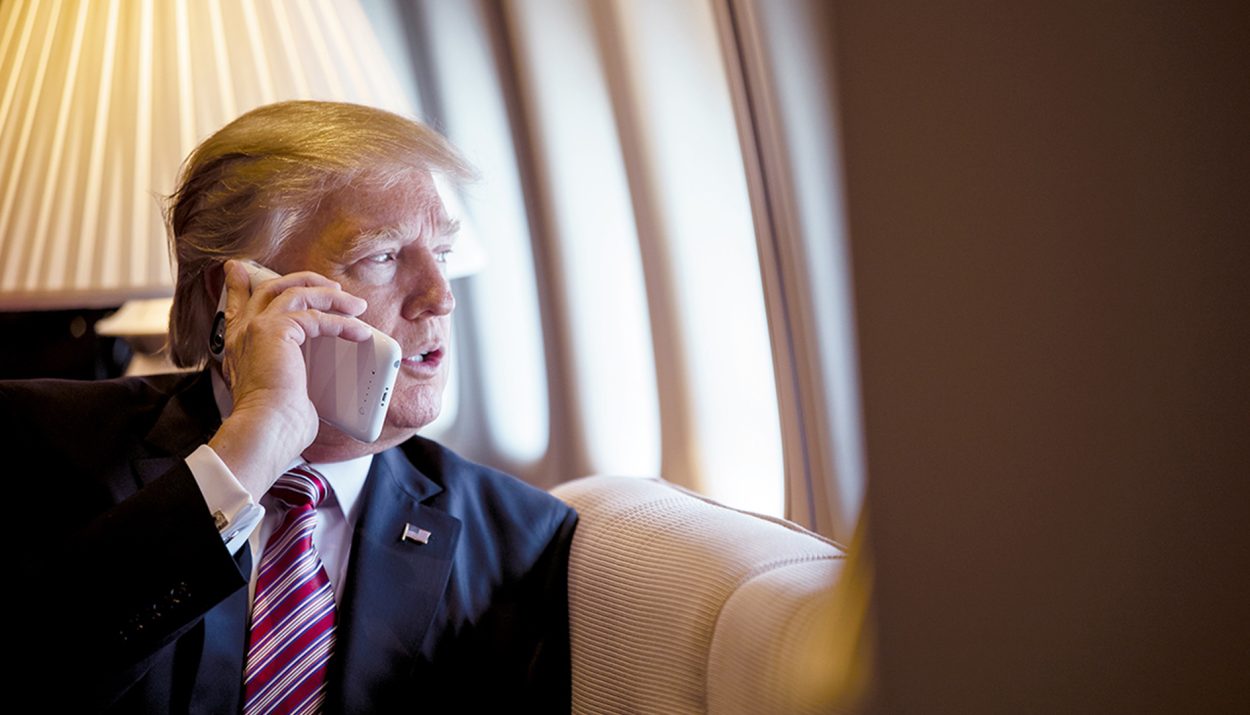

Trump has yet to gain the nomination for president from the RNC, though it appears clear that he is the likely candidate for the party. He’s been trying the same tactics that won him the White House in 2016 to appeal to blue-collar workers and older Americans, with mixed results.

Older Americans should be on alert for the potential ramifications from a second Trump presidency, though. Not only is the state of the social security program at risk, but more aggressive tax forms could have unforeseen consequences to some of the most vulnerable Americans, and the only thing standing between Trump and making those changes is the ballot box.