Imagine the horror of being involved in a car accident, only to discover that the other driver doesn’t have insurance. This nightmare scenario is becoming increasingly common across the United States, with some states experiencing a staggering rise in uninsured drivers. In this article, we’ll explore the top 10 states where this problem is most prevalent and the consequences for both insured and uninsured motorists.

The Shocking Statistics: States With the Highest Uninsured Driver Rates

According to a recent study by the Insurance Research Council, Mississippi tops the list with an astounding 29.4% of drivers lacking proper coverage. Michigan follows closely behind at 25.5%, while Tennessee, New Mexico, and Washington round out the top five, each with over 20% of drivers uninsured. These numbers highlight the severity of the issue and the urgent need for action.

Florida, Alabama, Arkansas, the District of Columbia, and California also make the list, with uninsured driver rates ranging from 16.6% to 20.4%. The high cost of insurance premiums in some of these states may be a contributing factor, but the consequences of driving without coverage are far more severe.

The Alarming Trend: Uninsured Drivers on the Rise

Recent data from J.D. Power reveals a disturbing trend: the number of uninsured drivers is skyrocketing in several states. South Dakota saw a staggering 106% increase in uninsured drivers from the second half of 2022 to the first half of 2023. New Hampshire, West Virginia, Oregon, and Indiana also experienced significant increases of 36% or more during the same period.

This growing problem not only puts uninsured drivers at risk but also poses a threat to insured motorists who may find themselves in an accident with someone who can’t cover the damages. The financial and legal ramifications can be devastating for all parties involved.

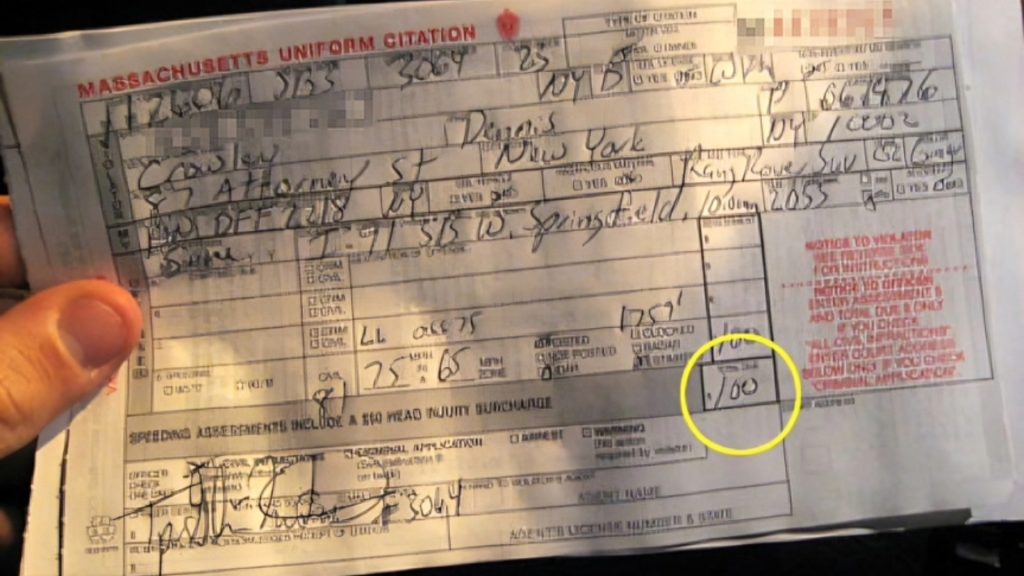

The Consequences: Fines, Suspensions, and Financial Ruin

For uninsured drivers, the consequences of getting caught can be severe. Most states impose hefty fines, suspend licenses, and even jail offenders. Moreover, when these drivers eventually seek coverage, they face significantly higher premiums due to their history of driving without insurance.

In the event of an accident, uninsured drivers are personally liable for any damages they cause. This could result in tens or hundreds of thousands of dollars in bills, potentially leading to financial ruin. The short-term savings of skipping insurance premiums pale in comparison to the long-term risks.

The Impact on Insured Drivers: Uninsured Motorist Coverage

Even responsible, insured drivers are not immune to the dangers posed by uninsured motorists. Most states’ minimum coverage requirements do not protect drivers if they are hit by someone without insurance. To safeguard themselves, drivers must invest in uninsured and underinsured motorist coverage.

This additional coverage helps pay for medical expenses and vehicle repairs if an insured driver is involved in an accident with an uninsured or underinsured motorist. While it may increase policy premiums, the added protection is crucial in states with high rates of uninsured drivers.

The High Cost of Insurance: A Contributing Factor

One of the primary reasons drivers choose to forgo insurance is the high cost of premiums. In states like Michigan, where car insurance rates are among the highest in the nation, many drivers find it challenging to afford the required coverage. This leads to a vicious cycle, as the presence of uninsured drivers drives up premiums for everyone else.

While some states have taken steps to address the issue of affordability, such as implementing no-fault insurance systems or allowing for low-cost, basic coverage options, the problem persists. Policymakers and insurance companies must work together to find solutions that balance the need for affordable coverage with the necessity of protecting all drivers on the road.

The Role of Law Enforcement: Cracking Down on Uninsured Drivers

To combat the rising number of uninsured drivers, many states have increased their efforts to identify and penalize those who drive without proper coverage. Police departments are using advanced technology, such as automatic license plate readers, to quickly identify uninsured vehicles on the road.

In addition to increased enforcement, some states have implemented programs that require drivers to provide proof of insurance when registering their vehicles or renewing their licenses. These measures, combined with stricter penalties for offenders, aim to deter drivers from taking the risk of driving without insurance.

Protecting Yourself: Shopping for Uninsured Motorist Coverage

To ensure adequate protection, drivers should consider adding uninsured/underinsured motorist coverage to their auto insurance policies. The amount of coverage required varies by state, with some mandating that it match the driver’s liability coverage limits and others allowing policyholders to choose their desired level of protection.

When shopping for this coverage, compare quotes from multiple providers to find the best rates. If the added cost is a concern, consider raising your deductible to lower your premiums. Taking a few minutes to research and compare options can provide invaluable peace of mind in the event of an accident with an uninsured driver.

The Ripple Effect: How Uninsured Drivers Impact the Economy

The prevalence of uninsured drivers has far-reaching consequences beyond the individuals directly involved in accidents. When uninsured drivers cause accidents, the costs are often passed on to insured drivers through higher premiums. This, in turn, can lead to more people choosing to forgo insurance, creating a downward spiral.

Moreover, the financial burden of uninsured accidents can strain the healthcare system and public resources, as injured parties may rely on government assistance or emergency services for treatment. Addressing the issue of uninsured drivers is not only a matter of personal responsibility but also of economic stability and public welfare.

The Need for Education: Promoting Responsible Driving

In addition to enforcement and policy changes, education plays a crucial role in reducing the number of uninsured drivers on the road. Many drivers, especially young and inexperienced ones, may not fully understand the importance of car insurance or the potential consequences of driving without it.

By incorporating insurance education into driver’s education courses and public awareness campaigns, states can help foster a culture of responsible driving. Emphasizing the legal requirements, financial risks, and moral obligations associated with driving can encourage more people to prioritize obtaining and maintaining proper insurance coverage.

The Future of Car Insurance: Innovative Solutions

As the problem of uninsured drivers persists, the insurance industry is exploring new ways to address the issue. Some companies are experimenting with usage-based insurance programs, which base premiums on a driver’s actual behavior behind the wheel rather than broad categories like age or location.

Other innovations, such as pay-per-mile insurance or peer-to-peer coverage, aim to make insurance more accessible and affordable for a wider range of drivers. By embracing technology and new business models, the insurance industry can adapt to the changing needs of drivers and help reduce the number of uninsured motorists on the road.

The Bottom Line: Uninsured Drivers Pose a Serious Threat

The rising number of uninsured drivers across the United States is a serious problem that affects everyone on the road. From the top 10 states with the highest rates of uninsured motorists to the alarming increases seen in several other states, this issue demands attention and action.

For uninsured drivers, the risks of fines, license suspensions, and financial devastation far outweigh any short-term savings on premiums. Insured drivers must also take steps to protect themselves by considering uninsured/underinsured motorist coverage. By working together to address this problem through enforcement, education, and innovation, we can create safer roads and a more stable insurance market for all.