Taxes and the wealth gap. Two incredibly challenging conversations to have in modern-day America. Nobody seems to agree on the amount of money that should be taxed to Americans, who should have to pay it, or what the tax money should ultimately go to. It makes for a contentious atmosphere on Capitol Hill, with some lawmakers wanting to cut taxes across the board and some wanting to make even more radical changes to the tax code.

Taxing the Wealthy

A facet of the conversation that is especially important, particularly in light of Gen Z coming of voting age, is taxing the wealthy and corporations. President Biden ran on billionaires paying their fair share in 2020, as well as reversing some of the tax cuts that were put into place by former president Trump for the wealthy and corporations.

This is an issues that is deeply divisive between the political parties. While there are some Democrats who want to leave the tax issue alone, many of them are in line with their constituents in the opinion that the wealthy pay far less than their fair share of taxes.

An Old Issue

This is a problem that stretches back decades. Some of the most famous actions regarding taxes, corporations, and the super wealthy came from the Republican darling, Ronald Reagan. Reaganomics was a series of policy changes that were put into place by the Republican that were intended to stimulate the economy by charging corporations and billionaires less in taxes.

The reasoning behind these policy changes is trickle down economics. Simply put, this is the idea that if corporations are less regulated and have to pay a lower percentage of profit in taxes, they’ll turn around and use the newly gained profit to invest back into their employees and companies, and generally spread the wealth.

Trickle Down Economics Doesn’t Work

While this is a noble thought and aspiration, it’s flawed. In practice, neither corporations or billionaires are the type to do the right thing unless they’re obligated to. This has led to billionaires getting exponentially richer by the year, and corporations reporting larger and larger profits for the benefit of their shareholders.

Unfortunately for Americans, and Congress, this wealth has not settled into the lower classes. The wealth gap in America is higher than ever, and as Congress has spent more and more money over the years, the lack of tax revenue has resulted in the government deficit ballooning to astronomical proportions.

Republicans Complain, But Don’t Work

Despite the fact that many conservatives have campaigned against government spending and used the increasing deficit as a political argument, none of them have ever offered real solutions for cutting the deficit, beyond cutting entitlement programs. Medicaid and social security are always the first on the chopping block when it comes to the yearly budget, despite the fact that these programs significantly improve the lives of Americans.

Conservatives have also run on cutting taxes even more, selling taxes as one of the greatest evils that is impacting the middle class in modern America. In 2017, Donald Trump signed into law one of the most significant tax cuts in modern history, but unfortunately, the Tax and Jobs Act only benefited corporations and the super wealthy.

Democrats Raising Awareness

In the years since Donald Trump left office, Democrats have been running a campaign to bring awareness to the lack of equality as far as taxes and wealth. This is in an effort to appeal to the youngest generation of voters, who will be the second-largest voting bloc in the 2024 election.

Billionaires and corporations paying their fair share is an issue that is deeply important to younger Millennials and Gen Z, and it’s understandable why. With rising costs of living and stagnated wages, many younger Americans see wealth inequality in America as a significant detriment to their happiness, and believe that closing the wealth gap will improve quality of life for millions of people.

Other First World Countries Can Do It

The data backs up this theory as well. Other first-world countries with higher levels of happiness among their citizens show that citizens who can pay for their bills are significantly happier. Countries like Canada have a yearly cost-of-living adjustment that is in line with inflation, and many Canadians report happier, more stable lives than Americans do.

The data supporting it, as well as the needs of their constituents, has led to a group of Democratic lawmakers proposing a new law, which would raise taxes on the wealthiest ASmericans and generate trillions of dollars. Most of this money would go towards the deficit and funding national programs such as Medicare and Social Security.

Explaining the Bill

The proposal would implement a 2% tax on households worth $50 million to $1 billion, and a 3% tax on households worth more than $1 billion. It would affect the wealthiest 100,000 households in the country, which is approximately 0.05% of the population.

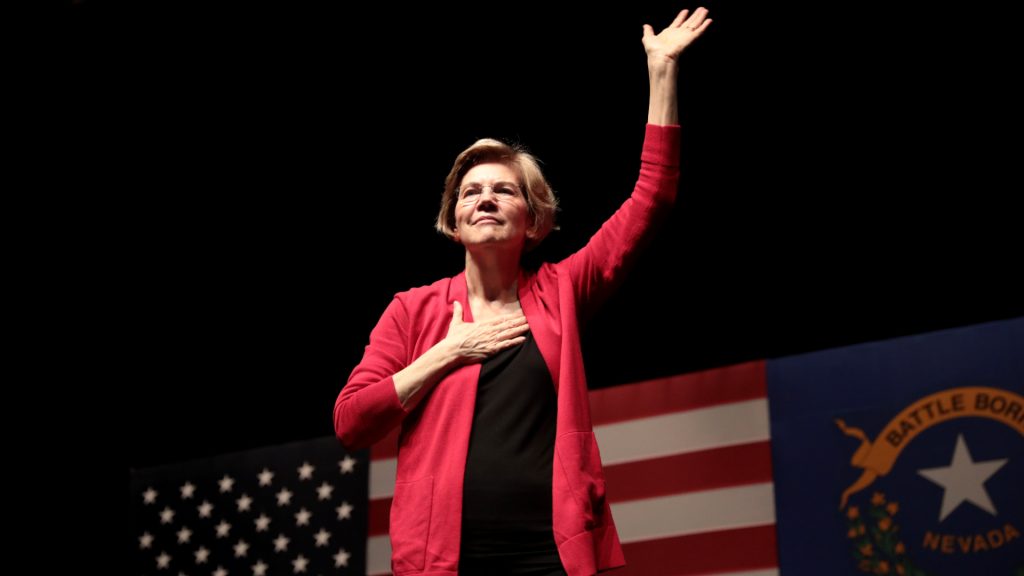

The bill is being sponsored by Democratic senator Elizabeth Warren, who has campaigned on wealth inequality in the past. The Wharton Budget Model at the University of Pennsylvania estimates that the proposal would generate $2.7 trillion over the next decade.

Addressing Tax Dodgers

The bill also addresses the significant problem of the super-wealthy dodging taxes. The Inflation Reduction Act included funds to expand and update the IRS, and this proposed bill does, too. It includes $100 billion to the IRS for auditing efforts, allowing them to invest more in the efforts that it takes to audit this large-income accounts.

Additionally, the bill contains a provision that would penalize individuals with a 40% “exit tax.” This would come into play if an American citizen attempted to cede their citizenship for another country’s in order to bail on taxes.

Supported in Both the House and Senate

The bill is supported by five other Democratic senators, 27 Democratic House lawmakers, and Senator Benier Sanders, who is an Independent Senator who caucuses with the Democrats. In the house, it’s led by Progressive Caucus Chair Pramilia Jayapal, and Brendan Boyle.

The bill addresses many of the issues that younger Americans have with the super wealthy and taxes. This past year, many middle-class and low-income individuals felt the pain of the adjusted tax code that went into effect from the 2017 cuts, and anger towards both the wealthy and the government has been high.

It Won’t Pass Mike Johnson

Unfortunately, the bill has little chance of passing the GOP-led House of Representatives. It does, however, reflect the Democrat’s persistent efforts to force wealthy to pay their fair share for government programs, and reduce the widening gap between the richest Americans and everybody else.

The issue is also important to President Biden. During his State of the Union address, he once again pledged to raise taxes on the wealthy and large companies. This is the same promise that he made to Americans when he was elected to office in 2020, and it is one that he has championed intensely during his years in the Oval Office.

Biden’s Budget Proposal

Biden’s own budget proposal, released earlier this month, included a 25% tax on the top 0.01% of Americans. This number covers those with wealth greater than $100 million. It also proposed to reverse the corporate tax rate cut that was put in place under Donald Trump, in addition to increasing the minimum tax on the largest corporations from 15% to 21%.

Warren used this support when discussing her bill. “As president Biden says: no one thinks it’s fair that Jeff Bezons gets enough tax loopholes that he pays at a lower rate than a public school teacher. All my bill is asking is that when you make it big, bigger than $40 million dollars, then on that next dollar, you pitch in two cents, so that everybody else can have a chance.”

A Bill Over the Years

The bill which has been dubbed the “Ultra Millionaire Tax Act” was first introduced in 2019, and was a part of Warren’s unsuccessful 2020 bid to be president. The idea was deeply popular; nearly 70% of likely voters said that they supported the bill, and 63% of all Americans said that they approved the idea in a 2019 survey from the New York Times.

Biden has proposed multiple changes to the tax code that would be closer in line with the bill that Warren has proposed, but Republicans have shot down the proposals every time. They argue that increased tax burdens on businesses would hurt the economy, and by extension, average Americans.

Discussing Wealth and Inequality in an Election Year

The progressive proposals regarding the tax code have provided a backdrop to conversations about wealth and inequality, especially ahead of the 2024 Biden and Trump rematch. Many of the tax cuts that were passed by Trump in 2017 are set to expire in 2025, meaning that a new bill addressing the tax code is in the near future.

This, among other issues, is one that younger Americans care deeply about, and could either help, or hurt Biden deeply depending on how he addresses the problem. Assuring Americans that he hears them and wants to make changes is the first step, but words are cheap, and actions are going to be more and more important as November draws near.