Banks are supposed to be safe places to keep our money. When one bank fails, it can be alarming. When several do, it’s likely to lead to panic. Recent remarks by Federal Reserve chairman Jerome Powell have caused real concern.

What Is A Bank Failure?

You might be wondering what it means when a bank fails. The simple explanation is that a failure means that a bank can’t meet its obligations. Account holders (depositors) and borrowers may be left hanging without a way to get their money.

If you’ve seen the classic Christmas film It’s a Wonderful Life, you’ve seen an example of what can happen when a bank is at risk of failure. If everyone wants their money at once, it can quickly turn into a crisis.

Famous Bank Failures In History

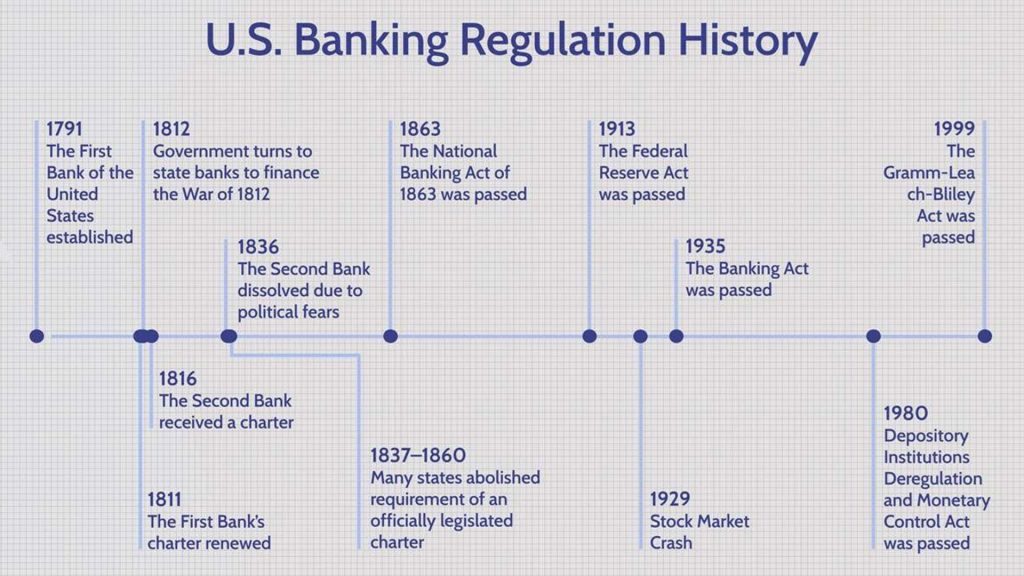

The most famous collection of bank failures in history happened in the 1920s. There was a massive crash on Wall Street. With stock prices tumbling, the situation rapidly turned into a run on some of the country’s biggest banks.

The explanation of what happened is that the so-called Roaring 20s were a period of speculation. Everybody was riding a stock market high with a strong economy. When prices fell, people panicked and the country spiraled into The Great Depression.

What Happened With Silicon Valley Bank?

Silicon Valley Bank is a bank that caters to business start-ups. In other words, its clients were people who were comfortable with risk. SVB took some significant chances bankrolling these companies, including interest rate swaps, and it didn’t pay off.

In March of 2023, inspectors from the Fed and the FDIC showed up at SVB’s main office. Soon after, they issued a statement saying the bank had been placed into receivership. The reasons were cited as inadequate liquidity and insolvency.

What About Signature Bank?

Signature Bank was another significant bank failure in 2023. In fact, it was the third largest bank failure in US history. The Fed and FDIC said the bank’s failure was due to poor management. The failure happened just two days after SVB’s collapse.

Signature Bank was involved in some of the same speculation as SVB. There was a run on the bank after SVB’s failure. Like SVB, Signature Bank was put into receivership and later rescued by the federal government in a bailout.

How Many Banks Have Failed In The Past Decade?

You might be wondering just how many banks have failed in recent years. Bank failures happen more often than you might think. They usually occur at times when the economy is struggling or the stock market is falling and investments are losing value.

The surprising truth is that a total of 34 banks in the United States have failed since 2015. That’s according to the FDIC, which insures deposits. Most individuals who have accounts at failed banks are protected by the FDIC.

Jerome Powell On Banks’ Vulnerability

On Thursday, Jerome Powell, who is the Chairperson of the Federal Reserve, said that small and medium-sized banks were most at risk. He said, “It’s not a first-order issue for any of the very large banks. We’re working with them.”

Powell went on to say that this is a “problem we’ll be working on for years more.” He also said that he believes that the issues, troubling as they are, are still manageable. It’s for that reason he wants to get out ahead of the problem.

What Does Real Estate Have To Do With Bank Failure?

One of the most significant problems Powell pointed out is that companies have over-invested in commercial real estate. This is an issue that was compounded by the COVID-19 pandemic. Some businesses are on the hook for monthly rent for buildings they aren’t using.

Powell cited falling office space and retail assets that aren’t being used. He pointed out that the big banks that were designated as “systemically important” back in 2008 are not struggling. That’s despite the fact that the 2007-2008 crisis was triggered by bad real estate investments.

Real Estate Investments Are Struggling

While Powell’s comments focused largely on commercial real estate, the truth is that real estatement investments across the board are struggling. Real Estate Investment Trusts, or REITs, are among those at risk. REITs are commonly included in investors’ portfolios.

Some of the REITs that have lost value since the beginning of 2024 include Boston Properties, Alexandria Real Estate Equities, Vornado Realty Trust, and Kilroy Realty Corp. Their losses are a troubling piece of the puzzle that could lead to bank failures.

Remote Work And Banks

If you’re one of the workers who began working remotely at the outset of the COVID-19 pandemic, you might be curious about whether remote work has played a role in the current crisis. The short answer is yes, although that’s not the fault of workers.

Commercial real estate leases are often multi-year contracts. Some companies sign leases for five or ten years. The pandemic meant they were paying for office space they weren’t using and those costs have added up in the four years since.

What Can The Fed Do To Prevent Failure?

Powell said that the Fed is in dialogue with banks. They’re asking questions like, “Do you have enough capital? Do you have enough liquidity? Do you have a plan?” These are all essential questions that banks should be asking themselves.

One of the most important issues Powell raised is about banks’ truthfulness. He said, “You’re going to take losses here – are you being truthful with yourself and with your owners?” Some banks may be tempted to hide losses out of fear.

Is More Regulation Needed?

Powell confirmed that declining commercial real estate values could cause bank failures in the coming months and years, he still felt confident that the Fed could find ways to limit the impact on the economy as a whole.

The central belief that Powell expressed is that regulation could prevent at least some of the potential failures from happening. That’s positive but also presents a potential problem. There’s a political divide in the US about regulation and when it’s necessary.

Regulation And The Upcoming Presidential Election

Speaking of politics, let’s talk about that divide. The bottom line is that the Democratic Party tends to be in favor of regulation. They understand that banks (and businesses in general) are unlikely to regulate themselves when there’s money to be made.

By contrast, the Republican Party frowns on regulation and has often taken action to remove it. A classic example is that deregulation in the early 2000s led to loose lending practices and was a direct cause of the 2007-2008 housing crisis.

Should You Be Worried About Your Bank?

It’s natural to be worried that your bank might be at risk. Even if you don’t have a lot of money in your account, losing it is a frightening thought. So, should you be worried about your bank? And if so, what can you do to protect yourself?

As long as your bank is FDIC insured, your deposits are insured up to $250,000. You’re likely very safe if you keep your money with a large bank such as Wells Fargo or Bank of America. Even smaller banks and credit unions are insured, so you probably don’t need to be concerned.