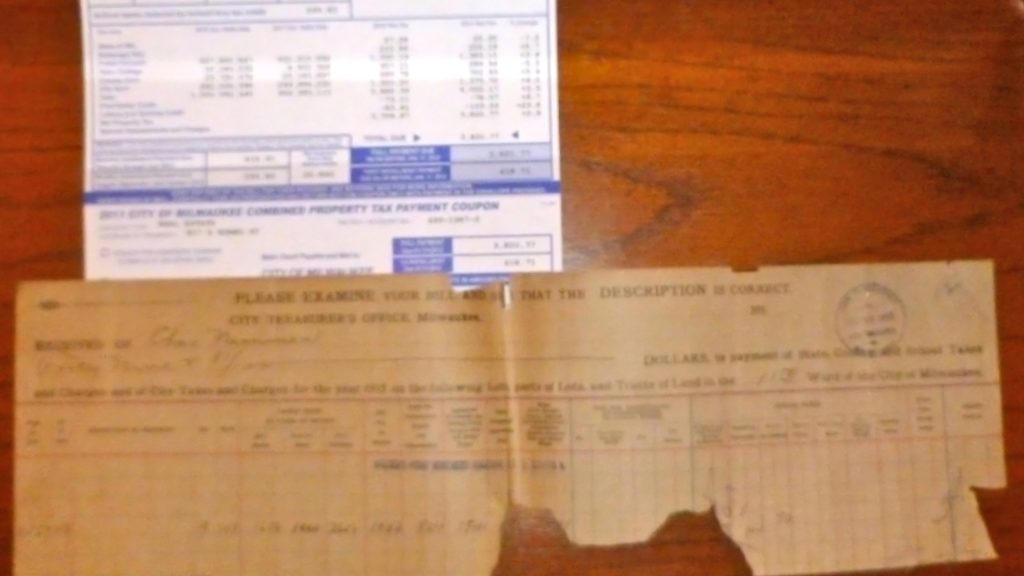

Property taxes are a way for the government to upkeep local communities using payments from the people who live there. Unfortunately, there’s no tax cap, and this Ohio neighborhood has seen their taxes on their real estate and homes double in six months, leading some of them to face losing their homes. Let’s take a closer look.

The US Is Seeing Massive Homeowner Tax Increases

According to some reports, property taxes have increased by over 500% in some locales in the US. This increase in property taxes is directly linked to the increase in the cost of houses. As house prices go up, property prices increase to match.

Unfortunately, that also means that homeowners will be stuck trying to make those property tax payments. If they default on the payments, they might even lose their homes. That’s a reality that no homeowner wants to consider.

Hamilton County Sees Property Tax Double

Hamilton County in Ohio has seen its property tax rapidly rise over the last six months, with many homeowners complaining. The deadline for paying this increased tax is February 5th, and the increased rates make many homeowners worry they won’t make the payment.

Without aid from the State, these homeowners might not be able to pay their property taxes and could potentially lose their homes. Some homeowners worry that their kids may be unable to pay taxes if they keep going up so much.

The Entire State Is Seeing Massive Property Tax Rates

It’s not just Hamilton County dealing with this property tax problem, either. By the end of last year, residents of Ohio were all grappling with huge property tax increases. This is due to a scheduled assessment.

The state requires property tax assessments to occur every six years. The assessment determines whether the rates paid are in line with the property market and, if not, adjusts it to suit the increased housing prices.

Reappraisals And Skyrocketing Valuations

Property valuations are an estimate of the fair market value of a property. In Ohio, the assessment considers these valuations to determine what the tax increases ought to be.

Residential property in many parts of Ohio experienced a jump in valuation. Valuators from Summit, Richland, Ashland, Geauga, and Ashtabula have seen residential home prices increase by 30% after these appraisals.

Property Tax Payments More Than Mortgages

Ideally, property taxes should be a minimal payment on a real estate investment of a home. However, because of how these taxes are calculated, many homeowners have to pay as much as one installment of their mortgages in property taxes.

Commissioner of Hamilton County, Alicia Reece, is unhappy with the unfair burden that homeowners have to shoulder because of the unfair tax increase calculations. She is looking at temporary solutions to relieve the burden on homeowners.

Rolling Assessments Yet To Come

Ohio’s property owners outside these communities are bracing for more of these assessments since the state is scheduled to continue updating its valuations in other communities.

This year, counties such as Stark, Portage, Lorraine, and a slew of others are scheduled to have their assessment rolls (and their tax payments) adjusted to keep with the fair market value. The tax calculation formula may need to be adjusted to avoid similar outcomes.

Commissioner Seeking Remedies

Commissioner Reece is not happy with the current tax adjustment formula, but she also knows it will take a lot of effort to create an equitable solution. The commissioner has to walk a fine line to get value without causing harm to homeowners.

Ohio Legislators are looking at a solution through House Bill 187, which aims to address this issue. The bill uses an aggregate value over three years instead of the last year to calculate the property tax value.

Will This Make a Difference?

House Bill 187 aims to be a more equitable solution to taxation, but is it actually likely to make a dent in the tax rates homeowners have to pay? With house prices going up year after year, it’s uncertain whether this will actually bring any relief.

House prices across the US continue to rise because of a lack of supply. Home construction has been sporadic after the pandemic, and the low supply means that houses on the market are valued a lot higher than they were a few years ago.

County Auditors and Treasurers Complain

While the Ohio House is trying to bring about some relief to homeowners, auditors and treasurers are up in arms about its measures. If the bill passes the state Senate, it will be valid for three years until the legislature can change or adapt it.

Auditors argue that the bill would significantly disrupt tax collection across the state. What’s more, both auditors and treasurers would have to conduct assessments all over again for places they have already covered, increasing the time before homeowners know how much they have to pay.

Higher Taxes Mean Higher Home Equity

One of the upsides of having more expensive homes is a higher equity value on the property. Some financial advisors suggest that this may be a good thing, as it helps families to leverage their equity into a line of credit.

Property taxes in other areas of Ohio show no signs of letting up. Walnut Hills has seen increases of over 500%, and Butler County braces for a 40% hike in rates. These rates are indicative of a housing market that will continue to rise.

Ohio Homeowners Hang in the Balance

Homeowners in Ohio will have to bite the bullet as the February 5th deadline for property tax payments looms closer. Commissioner Reece wants to help these homeowners, but she’s unable to do so at this point.

While the legislators understand the situation and try to bring relief, the auditors and treasurers of several districts are unhappy about the solution proposed by lawmakers. Until this is sorted out, Ohio’s homeowners will continue to hang in the balance, waiting to see if their inability to make payments will affect their living situation.