Amid California’s ongoing insurance crisis, the state’s troubled home insurance market is bracing for another setback. In a recent development, Tokio Marine America Insurance and Trans-Pacific Insurance have declared their intentions to cease renewing home insurance policies for their customers in California.

This latest development intensifies concerns already hanging over the state’s insurance landscape, with customers scheduled to receive non-renewal notices during the summer months. The confirmation of this withdrawal comes from the California Department of Insurance, further highlighting the urgency of the situation and the challenges faced by homeowners across the state.

Insurance Giants Exit, Leaving Thousands of Policies and Millions in Premiums Uncertain

In filings to the Department of Insurance, the companies revealed plans to withdraw from California by July.

The California Department of Insurance stated that this decision will impact 12,556 policies and premiums totaling $11.3 million, with Tokio Marine holding 2,732 personal umbrella policies for liability valued at approximately $400,000.

California Department of Insurance Downplays Concerns, Assures Consumers of Ample Alternatives

In an email to KQED, the California Department of Insurance stated that customers should not be overly worried due to the low market share of these two companies.

Jazmín Ortega, deputy press secretary for the state’s insurance department, mentioned, “Given the companies’ minimal market share, we do not expect this to affect the California market as consumers have other options.”

California Grapples with Deepening Insurance Crisis as Major Players Halt Renewals

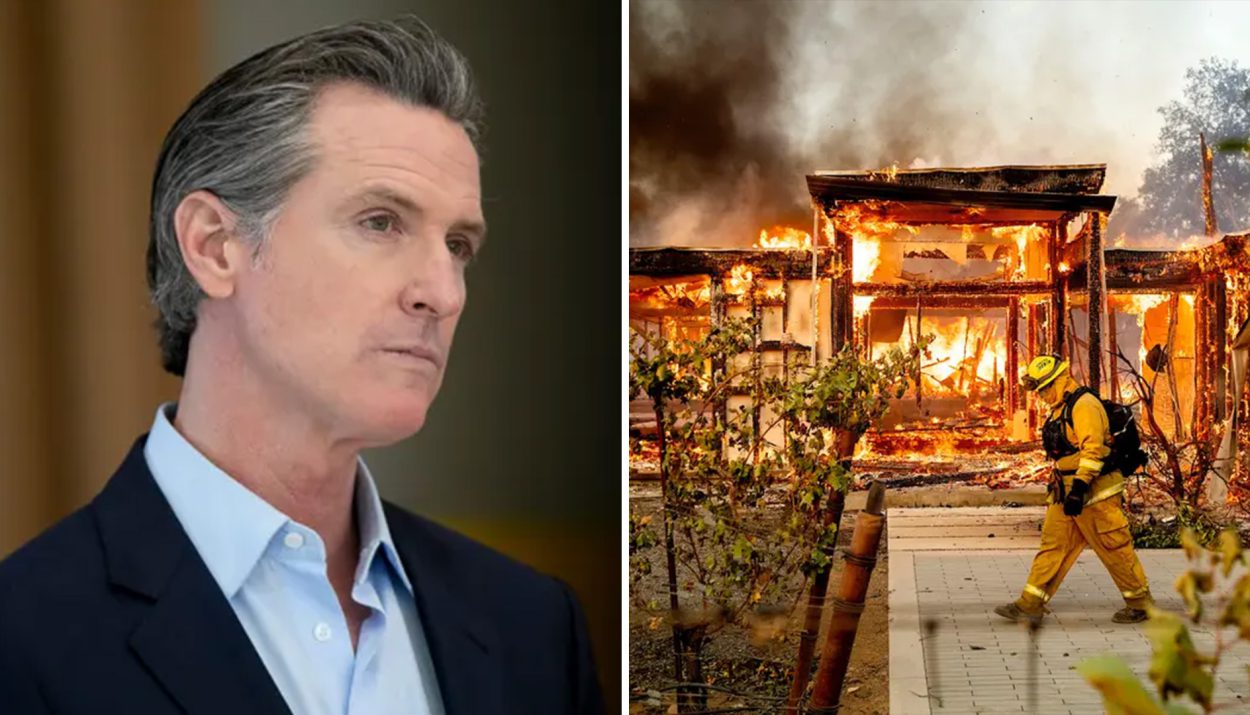

The insurers did not provide a reason for their departure in the filings, but their sudden exit coincides with a state insurance crisis, with major industry players halting policy renewals in California.

As reported by KQED, 70% of insurers listed on the California Department of Insurance’s Home Insurance Finder tool are presently not providing new home insurance plans. Furthermore, 90% of companies within the insurance market either refrain from offering new property insurance or have implemented stringent limitations on existing policies.

Insurance Exodus Continues as State Farm Announces Massive Policy Cuts, Adding to Industry Turmoil

It appears that a continuous stream of both major and minor insurers has been announcing their departure in recent months.

State Farm recently declared its intention to terminate 72,000 policies in California by July, following a decision made nine months ago to cease offering new coverage entirely.

Escalating Climate Disasters Drive Insurers Away from California, Experts Warn of Increasing Risk

A surge in the frequency and severity of property-damaging events such as wildfires, floods, storms, and other climate-related disasters has rendered writing policies in the state more risky than rewarding.

Jeremy Porter, head of climate implications research at First Street Foundation stated “They know the risk is just too high to be actuarially sound for their business.”

California Assemblymember Warns State’s Financial Stability Hangs by a Thread Amidst Looming Fire Season Peril

In March, a Democratic Assemblymember emphasized the state’s precarious financial situation, warning of potential ruin if a particularly severe disaster strikes California.

We’re one bad fire season away from complete insolvency – it feels like a big gamble,” remarked Assemblymember Jim Wood, a Democrat representing Sonoma County, expressing concerns akin to those of financial markets. He also stated, ” If this were on Wall Street, I’m not sure you’d be able to get away with this.”

Insurers Warn of Escalating Climate Risks Nationwide as California Bears Brunt of Economic Losses

California isn’t alone in grappling with insurers reluctant to underwrite policies, but it leads to economic losses from climate-related disasters.

Sean Kevelighan, president and CEO of the Insurance Information Institute, an industry association stated “Losses are increasingly related to climate risk,” also noted that “As that risk increases, so does the cost of insuring those assets that people have on hand.”

Insurance Commissioner Proposes Price Hike in Ambitious Plan to Tackle Crisis

Fixing an insurance crisis presents a complex challenge with no easy remedy. In December, California Insurance Commissioner Ricardo Lara introduced a stabilization plan to legislators, which would entail increasing prices for customers.

Finding a solution that satisfies both customers and insurers proves daunting, especially as the issue is worsened by natural disasters beyond human control.

California’s Risky Homeowners Seek Shelter in FAIR Plan Amidst Insurance Exodus, Threatening Funding Shortfall

In California, homeowners deemed too risky for private insurance have recourse through the California Fair Access to Insurance Requirements (FAIR) plan, which is sustained by mandatory contributions from insurance companies operating in the state.

Consequently, as companies exit the state entirely, not only does the private market see a decrease in policies, but the FAIR plan also faces dwindling insurance funding.

California’s FAIR Plan Struggles to Cope with Soaring $311 Billion Losses Amidst Disaster Threat

In March, California’s state-chartered insurer, established under the FAIR Plan, informed lawmakers of its financial inadequacy to handle the expenses of a significant disaster in the state.

The FAIR plan now confronts potential losses totaling $311 billion, a drastic increase from the $50 billion figure six years prior.

Department of Insurance Convenes to Tackle Crisis Through Catastrophe Modeling

The California Department of Insurance has scheduled a meeting on April 23 to explore strategies addressing the insurance crisis through “catastrophe modeling.”

Dependence on the FAIR plan for interim coverage presents difficulties, despite its costly nature and inadequate coverage, as many individuals have no other option, highlighted by broker and insurance expert Karl Susman’s remark: “The FAIR Plan is receiving a thousand applications per 24 hours, which is outrageous to even conceive of.”

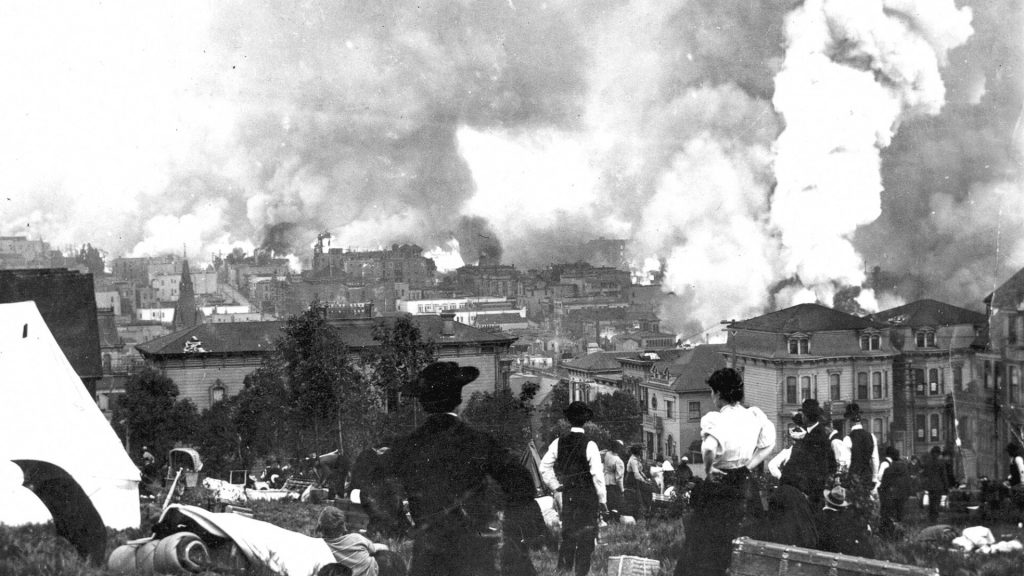

California’s Historical Disasters Shape Modern Insurance Challenges Amid Climate Uncertainty

Historical disasters like the 1906 San Francisco Earthquake and recent wildfires have left lasting impacts on California, affecting population centers, infrastructure, and the insurance sector.

Understanding these events helps contextualize the challenges faced by today’s insurance industry in the state, as insurers struggle to keep up with demand and provide adequate coverage amidst limited resources and time for preparation, influenced by climate change.

Advocates Emphasize Collaborative Risk Pooling

States like Florida and Louisiana, as noted by RSM, have faced comparable disruptions in their insurance markets due to natural disasters, leading to increased premiums and deductibles for homeowners, further worsening affordability challenges.

Paula Jarzabkowski, emphasizing the concept of “risk pooling” in addressing climate change impacts on insurance, highlights its collaborative nature involving financial institutions, governments, NGOs, and commercial bodies, aimed at spreading financial risk and reducing insurance premiums effectively.

Expert Urges Public-Private Collaboration to Combat Insurance Crisis

Jarzabkowski advocates for public-private partnerships to create effective risk pools, enabling the pooling of resources and expertise crucial for offering affordable and sustainable insurance solutions. These partnerships spread financial risk across multiple entities, stabilizing premium costs for consumers and reducing the burden on government services during disasters.

To tackle the persistent insurance crisis, homeowners and policymakers alike must proactively engage in decisive actions. This entails implementing policy adjustments and preparedness initiatives geared towards bolstering resilience and establishing sustainable insurance solutions that cater to the needs of all Californians.