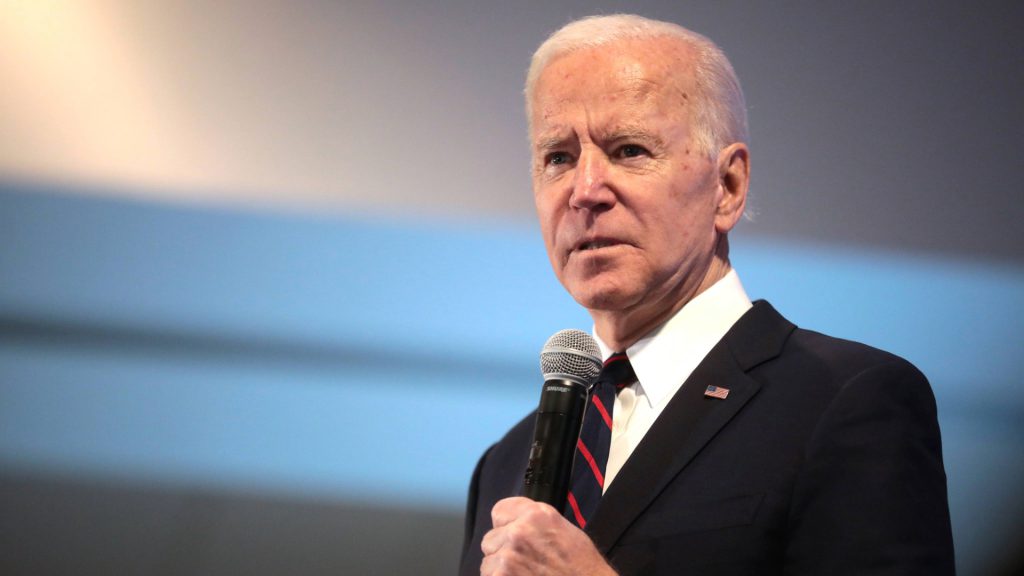

President Biden remains committed to canceling student loans, but a recent study shows that his plan will burden taxpayers significantly. The president’s cancellation plans will relieve many Americans of their debts, however it is earning criticism from the opposite side of the political corridor. Let’s take a closer look.

Updated Plans

The most recent analysts from the University of Pennsylvania’s Penn Wharton Budget Model have revealed that the total taxpayer cost for President Biden’s cancellation plans could reach $559 billion.

Notably, households with annual incomes that exceed $300,000 stand to benefit the most from these plans.

SAVE

The SAVE (Saving on a Valuable Education) Plan was launched last summer in 2023. It’s an income-driven repayment scheme that allows many borrowers to qualify for $0 down payments if their earnings are below the poverty limit.

Since its inception, over 7.5 million borrowers have enrolled in this plan. Forgiveness was even granted to borrowers who’d been paying for at least 10 years with an original loan of $12,000 or less.

Billions Added

The Budget Model estimates indicate that by early April of 2024 it will cost well over $84 billion over the next ten years.

This amount is in addition to the $475 billion previously estimated for President Biden’s SAVE plan. The total of the new plans and SAVE plan amounts to $559 billion.

Assistance For High-Income Households

In addition to the new cost exceeding over $500 billion, the Budget Model analysis indicates that the latest plan will offer debt relief for approximately 750,000 households with an average income of over $312,000.

The study noted that the high average household income is partly due to the SAVE plan.

Older Than 20-Year-Old Debt Erased

In the latest plan, the Biden administration will cancel student loan debt without income limits for borrowers who only have undergraduate student debt and entered repayment 20 years ago.

This forgivness also extends to individuals with graduate student debt that entered repayment 25 or more years ago.

Significant Relief For Average Debt

Households earning over $312,000 annually, with 20 years repayment, will experience an average debt relief of $25,541.39 under the new plan. This amount significantly surpasses the average student debt relief of $4,899.26.

Furthermore, it’s important to note that the Budget Model does not include Biden’s April 12th announcement to cancel $7.4 billion in student debt for an additional 277,000 borrowers.

Criticism From Republicans

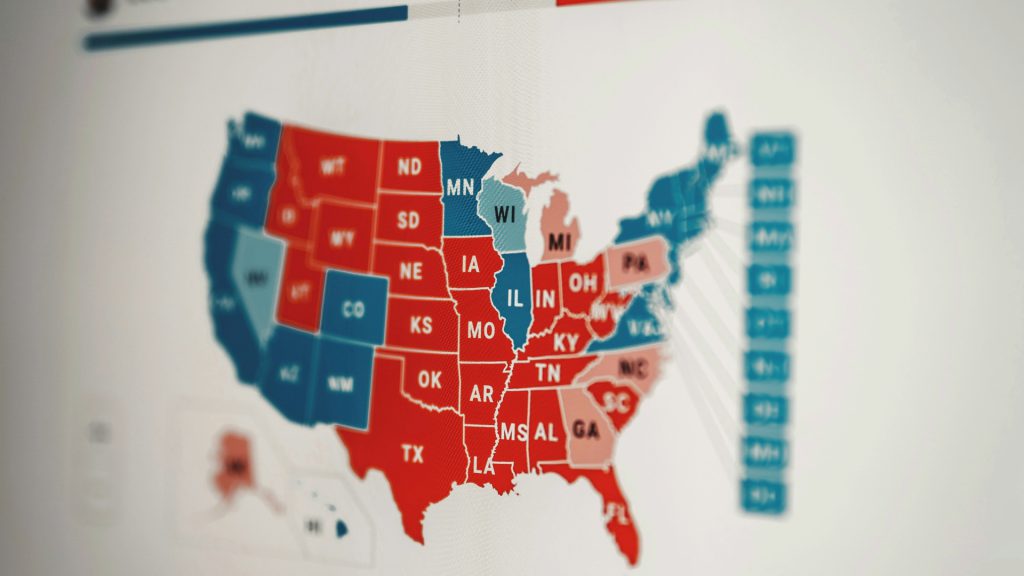

Amidst the heightened political tensions of an election year, the Penn Wharton Budget Model has provided Republicans with fuel to criticize the president.

House Budget Committee Chairmen Jodey Arrington (R-Texas) has already voiced his opposition, contending that the move is unconstitutional. Arrington also accused the move as the president of “quest to buy votes.”

Adding To American Debt

Arrington said in a statement, ”In reality, his plan will shift the responsibility of paying for loans owed by high-income earners who freely incurred them onto the backs of all taxpayers, many of whom do not even have a college degree.”

“[Biden’s] administration is dead set on circumventing the Supreme Court, defying Congress, and saddling our country with more debt,” he added.

Biden Administration Remains Unaffected

Despite all of this, the Biden administration remains unaffected, even by the lawsuit. Cardona has argued that the president’s policies are still sound and will “give hardworking Americans some breathing room.”

Cardona said the administration “will remain relentless in our pursuit to bring relief to millions across the country.”

11 States Vs. Biden

Just weeks after the Supreme Court rejected another student loan cancellation plan proposed by President Biden, his SAVE plan was initiated. That earlier plan, announced in June 2023, aimed to eliminate $430 billion in debt for more than 40 million borrowers.

In response to the SAVE plan, 11 states led by Republican leaders filed lawsuits against the president and Education Secretary Miguel Cardona.

Relief For Many Borrowers

The borrowers certainly have no complaints. The 10% who’ve been granted debt relief under Biden’s many student loan cancellation programs are grateful.

Lauran Michael, an interior designer in Raleigh, North Carolina said, “We don’t want our loans dictating our life choices, and us not being able to do other things because we’re paying so much money. The SAVE plan is definitely a game changer for us.”