Finance expert John Williams recently did an evaluation on California’s new tax policies, which included the introduction of a wealth tax that is targeted towards the more affluent residents and a new tax that will be implemented for residents that are relocating out of state. This is part of California’s effort to rectify its budget deficit, which has reached an all time high of $68 billion. The state’s approach to increasing revenue involves direct taxation on the assets of the wealthy, with additional scrutiny on asset reporting.

Tackling The Budget Deficit

John Williams underscores California’s significant budget deficit of $68 billion. In response to this matter the state has decided to implement a wealth tax, which involves annual taxation of the rich based on their assets.

This initiative is part of the bigger strategy to increase the state’s revenue, which involves attorneys to look into and possibly litigate against affluent individuals for underreporting their wealth.

Tax Rates And Consequences For The Wealthy

Beginning in 2024, the proposed tax rate will be 1.5% for net worths that exceed $1 billion. From 2026, the rate would adjust to 1% for net worths over $50 million.

This tax is meant to apply to California’s full-time, part-year, and temporary residents, with specific provisions for apportionment. The exit tax mechanism is structured to allow taxation for several years after a taxpayer leaves California, classifying them as a “Wealth Tax Resident.”

Exit Tax Explained

The suggested wealth tax in California introduces the possibility of an exit tax for people and businesses that make the decision to move out of the state.

Though not explicitly termed as an exit tax, the legislation could impose a significant financial burden on those choosing to relocate to areas with lower tax rates.

Exemptions

This wealth tax is designed to not have an impact on California residents with a net worth that is below $50 million.

The exit tax would solely be imposed on individuals that are already subjected to the wealth tax, upon choosing to relocate from the state.

Legal And Constitutional Issues

Critics have voiced doubts about the legality of the proposed wealth and exit taxes, raising concern about its constitutionality.

There are uncertainties about the potential breach of the Due Process or Commerce Clauses of the Constitution, particularly whether taxing individuals no longer residing in California or discriminating against interstate commerce is lawful.

Possibly Spreading To Other States

Williams cautions that California’s tax initiatives could set a precedent for other states that are dealing with financial issues.

There are concerns that cities such as Philadelphia, Boston, Atlanta, and Chicago might decide to adopt similar tax policies. This speculation suggests a possible trend of increased taxation targeting the wealthy across different states.

Consequences For California Residents

Williams goes over the real-life impacts of these tax policies, highlighting the challenges that individuals that are significantly invested in California’s real estate market.

The declining property values, combined with increasing taxes, pose significant financial risks.

Public Outcry And Constitutional Debates

The public has expressed strong opinions in opposition of the exit tax, with many stating that it violates constitutional rights.

Comments like, “Taxing people for leaving CA? That is unconstitutional,” and “How is this even legal???”

Summary Of California’s Wealth Tax Legislation

California’s proposed wealth tax encompasses a broad net that targets not just full-time residents but also those that live there part time. The tax is determined by the proportion of an individual’s wealth, calculated based on the days spent in California each year.

Even after leaving the state, former residents may find themselves obligated to pay the wealth tax, highlighting the state’s intent to secure revenue from a broad base of wealth holders.

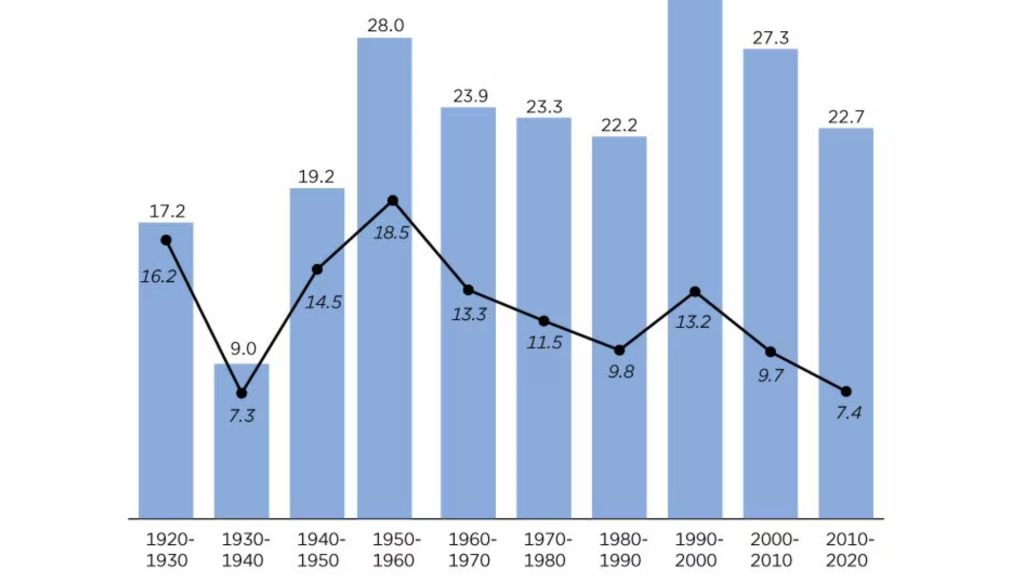

California’s Decreasing Population

The decrease in California’s population would have an impact on the success of the wealth tax. California went through a significant decrease in population in 2023.

Based on projections from the United States Census Bureau the state had a decrease in population by approximately 75,400 in a 12 month span of time.

Financial Consequences Of The Wealth Tax

It is estimated that the wealth tax will raise about $21.6 billion annually, assuming there aren’t any significant decrease in wealthy people from the state.

Nonetheless, this amount may still be short of covering the deficit in California, causing an increase in Medicaid costs.

Wealthy Californians Are Leaving

A significant amount of people leaving California are some of the states wealthiest.

This migration could put California’s tax revenue at serious risk, especially because 40% of the state’s tax income comes from earners in the top 1%. The migration could have serious implications for the state’s financial stability.

Decline In Tax Returns

In a report from Fox Business the IRS migration data showed over 399,400 tax returns leave the state, with only 241,200 coming in during 2020-2021.

This caused a net loss of about 158,200 returns. For individuals, the net loss exceeded 331,700 people within the same timeframe, indicating a significant outflow of residents.

Migration Data Raises Concerns

Tax Foundation Vice President of State Projects, Jared Walczak underscored the challenge in an interview with Fox Business, detailing California’s exodus numbers as “even more stark” than the population figures.

The relocation of these taxpayers is a significant concern for the state’s economic well being, as it faces challenges in maintaining its tax revenue levels.

Economic Pressure On California

California’s economic difficulties are underscored by its dependence on a small percentage of high earners for a substantial portion of its tax revenue.

The state’s budget is particularly vulnerable to fluctuations in the stock market and the economic choices of the wealthiest Californians. With the departure of these individuals, the possibility for a significant reduction in tax revenue gets bigger, causing a serious risk for stability and sustainability of public funding and services.

Difficulty Retaining Population

California’s grappling with a multitude of challenges, including a very high cost of living, housing market difficulties, and the rise of remote work, according to a report from the Los Angeles Times.

All of this combined with the high taxes in the state, is causing residents to relocate.

Governor’s Optimism

Despite decline in the population and the concern of the budget deficit, Governor Gavin Newsom remains optimistic about California’s future.

During an interview on “Hannity,” Newsom gave insight on the recent decline in the population and the state’s financial struggles in comparison to Floridia. He emphasized an interesting statistic to counter concerns: “Per capita, more Floridians move to California than California is moving to Florida.”

Tackling The Budget Deficit

To deal with the $68 billion budget deficit, it is possible that California might need to utilize its $24 billion in reserves and consider reducing its spending in specific areas, this includes Proposition 98 spending.

These moves are part of possible solutions being looked into to help manage the financial crisis.

Financial Consequences Of Population Decline

The decrease in the population in California combined with the exit of high net worth individuals is affecting the state’s economic framework.

These changes jeopardize the long-term funding of California programs, which are dependent on continued population growth and high earnings.

Bigger Patterns Of Population Decline

While California’s situation is worth noting, it is by no means unique.

Seven other states saw a population decrease in 2023, showing the larger demographic trend in that multiple states in the U.S. are navigating.

Concerns For Future Financial Sustainability

The implementation of the wealth and exit taxes in California brings up questions about the state’s financial sustainability and its impact on resident taxpayers, including those not directly affected by the wealth tax.

There is mounting concern that, over time, the financial strain could extend past the wealthy, and possibly affect the middle class and change the state’s economic environment.

Population Growth Nationally

Regardless of the challenges that California and other states face, the United States as a whole continues to grow.

The population nationally has reached 334.9 million in 2023, that’s a growth of 1.6 million people in 12 months.